How to Boost Payment Page Conversion: Boxopay’s Best Practices

29 December, 2023 13 min read

- Defining a high-quality payment page

- Ways to boost the trustworthiness of the payment page

- Ways to make the payment page highly functional: best practices from Boxopay

- Schedule a Boxopay payment page demo

Table of contents:

The payment page for any e-commerce business is the final link in its sales funnel. When a user sees a form with fields for entering credit card information on their screen, it means they have seen your advertisement, visited the website, liked your offer, and are ready to make a payment. Congratulations, you are the winner! But what if there are any bugs on the payment page or if something confuses the user? They might abandon the purchase, and all your efforts will go to waste! In this article, the Boxopay team shares the best practices for creating payment pages that we have developed over 13 years of successful work in the fintech niche.

Defining a high-quality payment page

In a global context, we can identify two key characteristics of a high-quality payment page:

- Trustworthiness.

- Functionality.

The trustworthiness of a payment page is a crucial psychological aspect that should not be underestimated. The payment page must evoke trust in the user. The less trustworthy your payment page appears, the higher the risk of users refraining from completing the payment. This is where we began – conversion can slip away at the last moment, even if the user is willing to part with their money.

As for functionality, it’s an entire universe. You might be surprised by the multitude of technical features that can be behind a seemingly simple web form consisting of 4-5 fields!

The payment page should be functional for both user convenience and merchant ease. Perhaps, the user finds it more convenient to pay using Apple Pay, and we should provide them with that option. On the merchant side, there might be a need to include a checkbox for agreement to terms and conditions during the payment process. Therefore, the payment page settings should accommodate these considerations.

So, let’s finally delve into Boxopay’s best practices for ensuring trustworthiness and functionality on payment pages for e-commerce!

Ways to boost the trustworthiness of the payment page

The payment page is a part of the user’s purchase journey and should be visually perceived as such. Users are much more likely to enter their card details and complete the purchase without hesitation if the payment form is seamlessly integrated into the design of your website. If the payment page is on a separate platform, its design should be aligned with the overall design of your store. This visual consistency fosters a sense of continuity and trust, making the user feel more secure in providing their payment information.

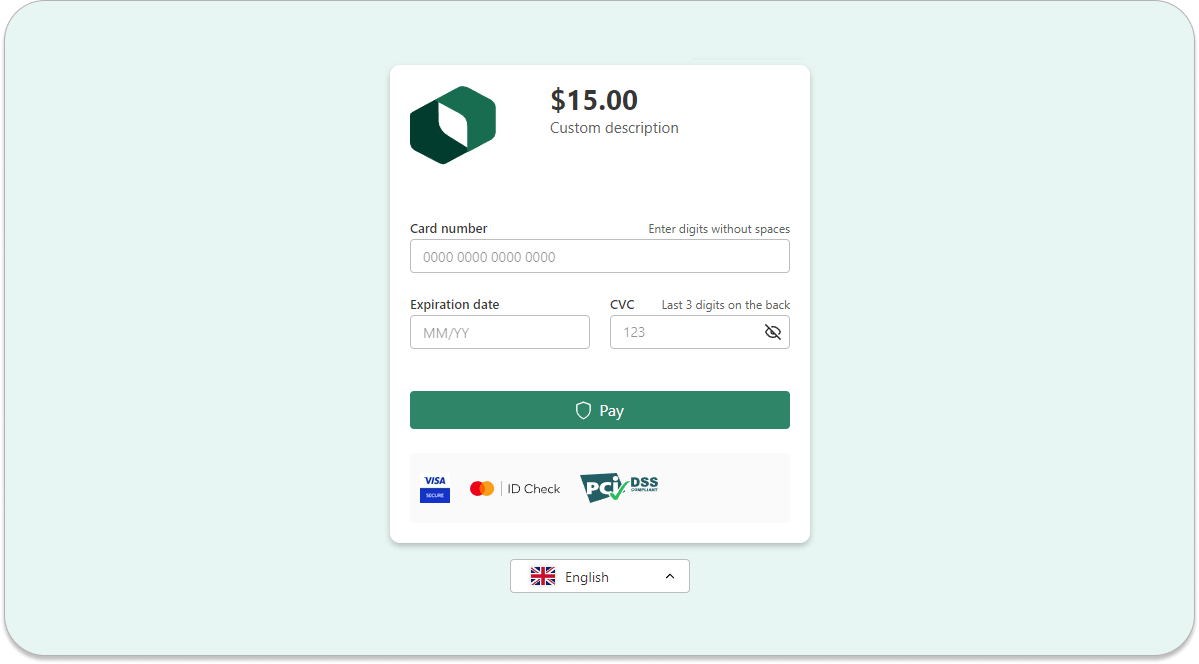

Accordingly, the first crucial aspect for the trustworthiness of the payment page is the ability for merchants to brand it. Recognizing this, at Boxopay, we empower merchants by providing the option to independently customize the layout of their payment pages.

During customization, merchants can:

- Adjust the color scheme.

- Incorporate custom images.

- Embed their logo.

This flexibility allows merchants to tailor the payment page to align seamlessly with their brand identity, contributing to a more trustworthy and recognizable transaction environment.

The second significant factor influencing trustworthiness is the traditional appearance of a payment page. You shouldn’t unsettle the user with an unusual design for entering their credit card information.

Defining the traditional appearance of a payment page is something our experience tells us is best understood by the merchant. Depending on the region, market segment, and other factors, users may have slightly different habits and expectations regarding what a payment page they are willing to trust should look like.

Globally, there are two approaches to the appearance of a payment page:

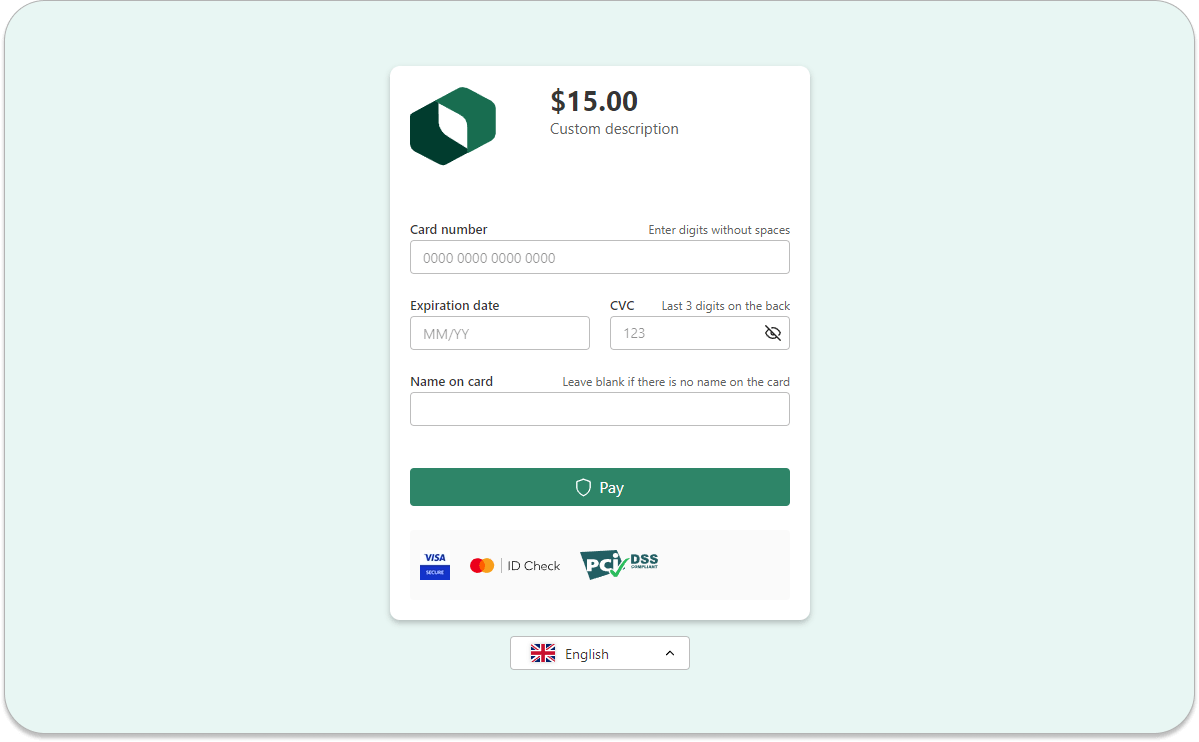

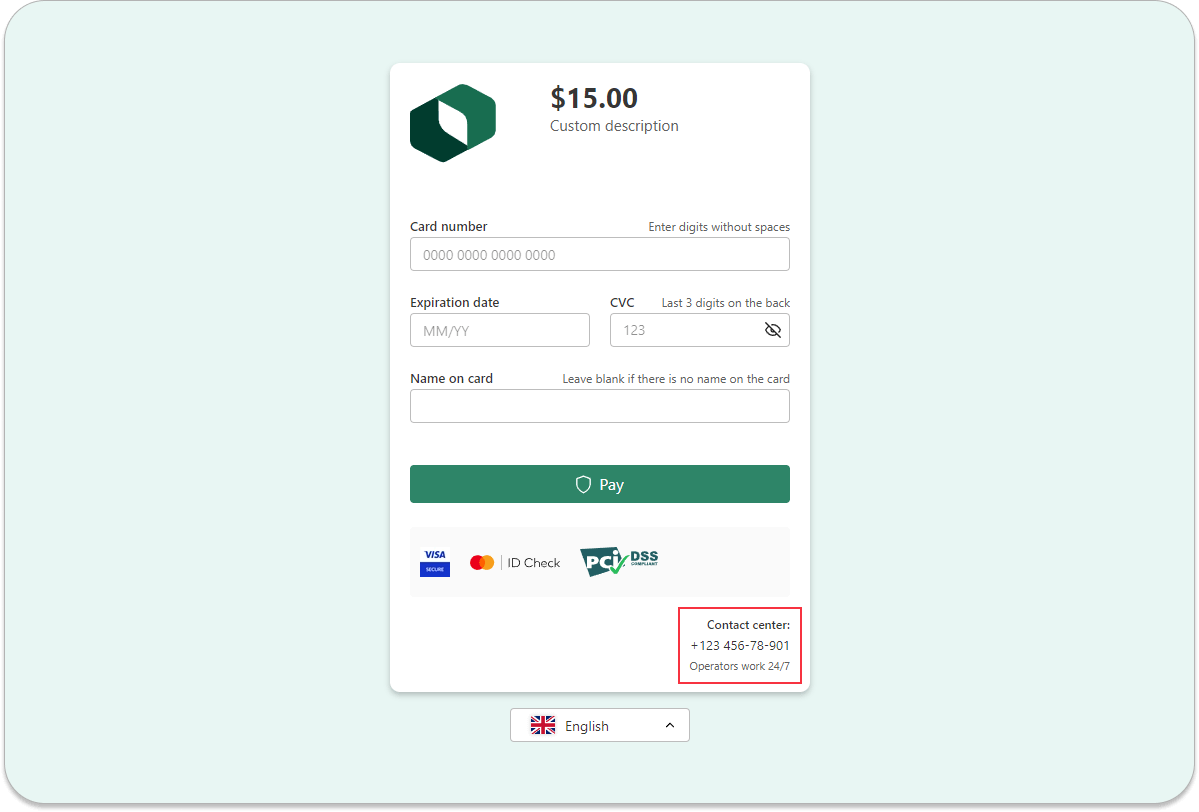

- Regular web form with card data input fields. This form is fundamentally no different from any other web form, such as the contact form in the feedback section.

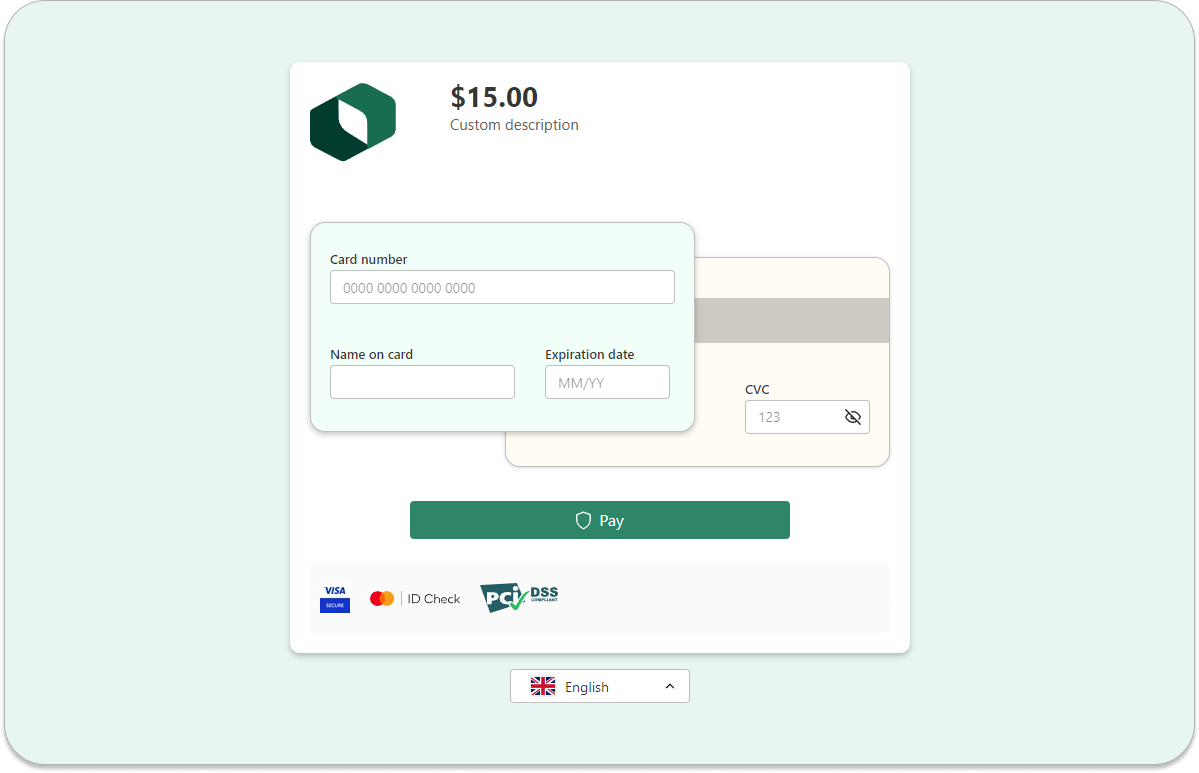

- Card-shaped form with front and back of the credit card. In this approach, the fields for card details are positioned approximately where they are located on a physical card: card number, expiration date, cardholder name, and the verification code CVV/CVC.

If you are already using a payment page from a certain provider but plan to integrate another solution, your users have likely formed an expectation regarding the appearance of the payment form on your site. It is crucial that when switching solutions, the design of the payment page does not undergo radical changes.

Understanding all of the above, at Boxopay, we offer merchants maximum flexibility in customizing the appearance of the payment page. This allows them to present users with a familiar form, ultimately reducing the percentage of payment refusals during the checkout process.

Ways to make the payment page highly functional: best practices from Boxopay

User functionality: smart form reduces payment decline rates

Form functionality is also about its trustworthiness. Below, we describe a multitude of features, the combination of which allows us to call our payment form smart. Practice shows that a user interacting with such a form is less likely to decline making a payment.

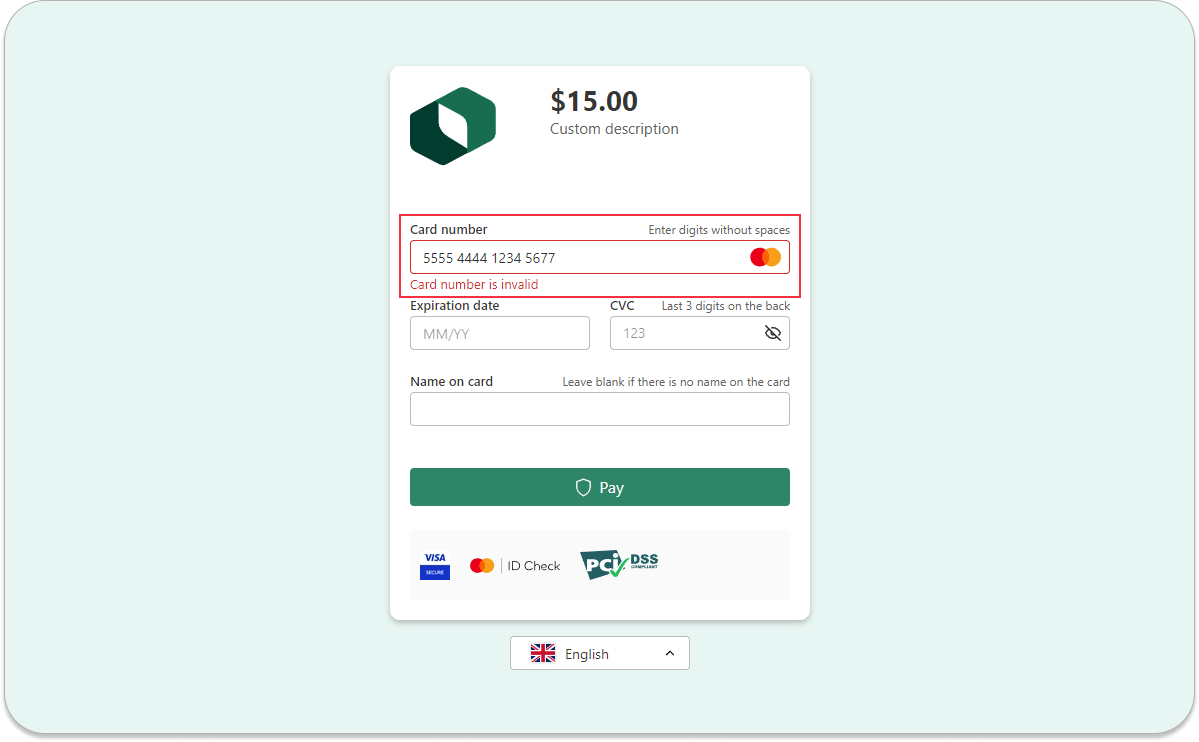

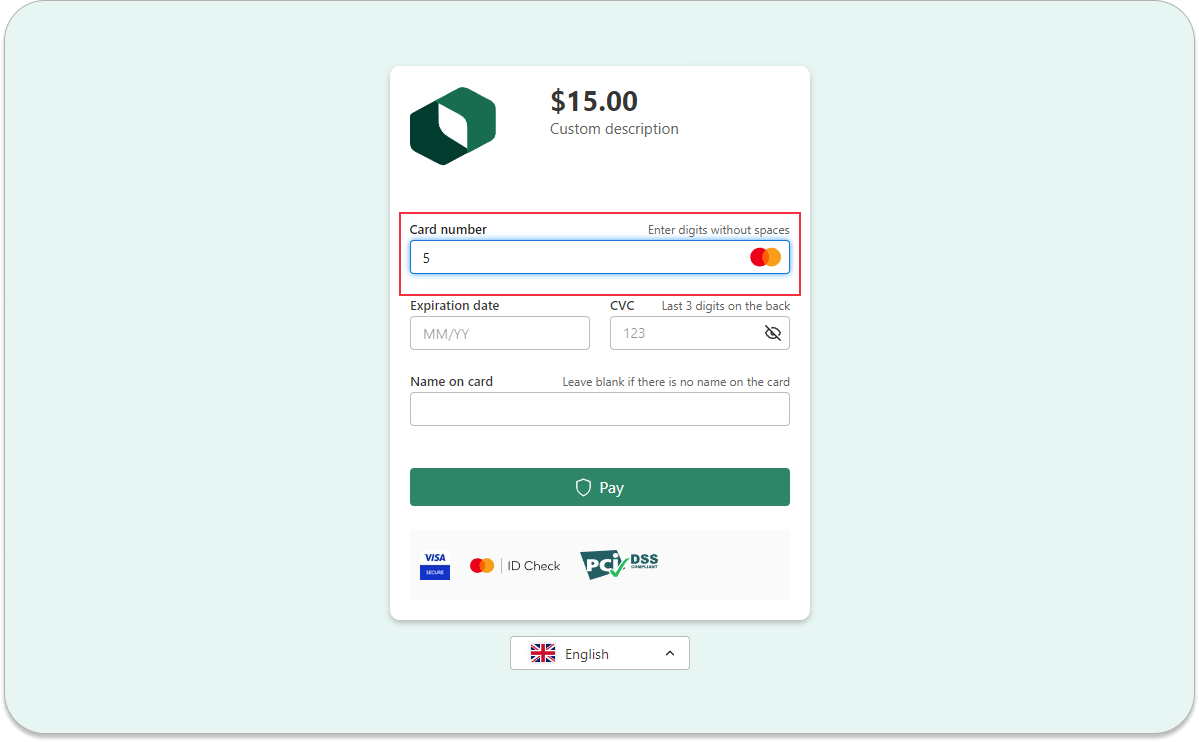

Instant card validation using the Luhn algorithm

An inconspicuous detail, but an incorrectly entered card number can lead to a user refusing to complete a purchase. After filling in the card details and entering just one digit incorrectly, the buyer clicks the payment button and only then receives an error message. Some users decline to re-enter the data and leave.

Boxopay’s smart form instantly checks the entered number on the user’s side and highlights incorrect numbers. The user can correct the error before pressing the payment button.

The secret is quite simple. The correctness of entering a credit card number is checked using the Luhn algorithm. The last digit in the number of any card is a check digit. It is calculated based on the previous digits. Therefore, we don’t need to send the card number to the bank to check it. A simple script right in the buyer’s browser handles this.

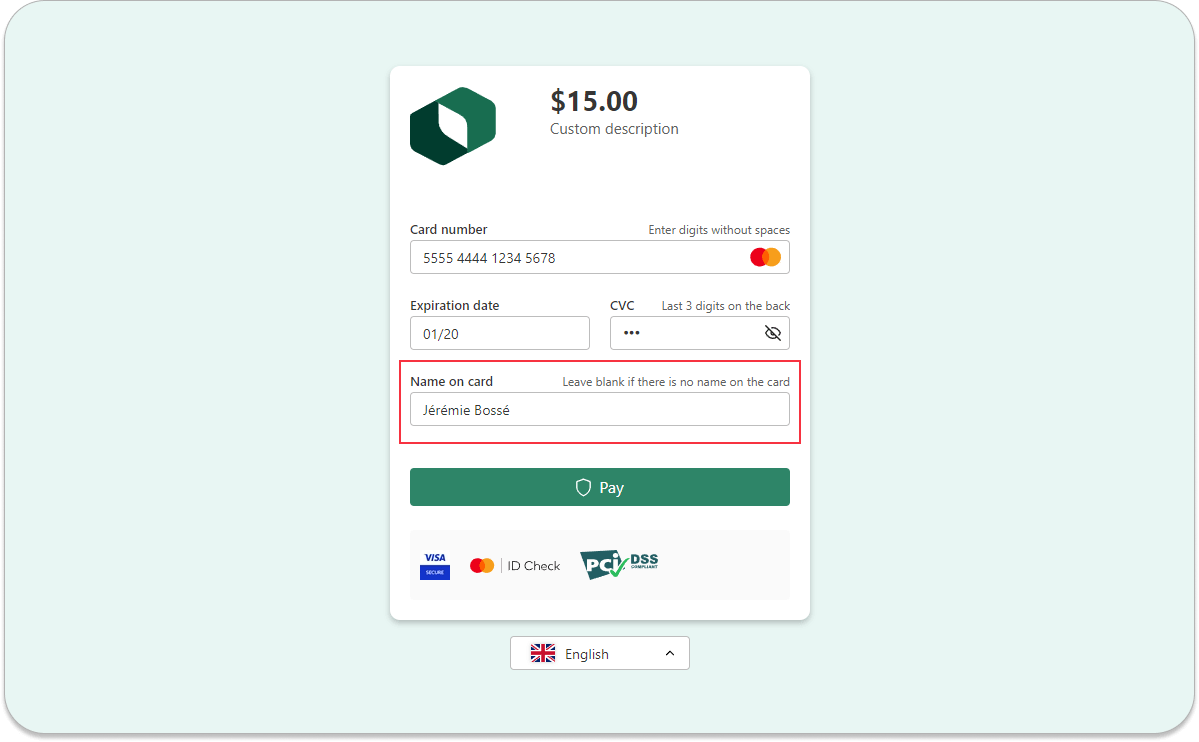

Highlighting the payment system when entering the card number

Determining the payment system that services a credit card (Visa, Mastercard, American Express, etc.) is relatively easy based on the first digits of the card number. It may seem like non-essential information for the merchant, but highlighting the payment system when entering the card number enhances the user’s trust in the payment page.

Support for non-standard cards

The standard card number format is 16 digits, adhered to by major payment systems like Visa, Mastercard, and UnionPay, which dominate the global market for bank cards.

However, a buyer’s card might be issued by a different payment system—such as Maestro, with card numbers consisting of 18 or even 19 digits. Or American Express with its 15-digit numbers. Naturally, the payment page should allow the user to input such a number into the appropriate field and validate it using the Luhn algorithm.

A less obvious detail is the behavior of the CVC/CVV input field. The card authentication code is called different names depending on the payment system – CVV for Visa, CVC for MasterCard, although essentially, they are the same. Usually, the CVC/CVV code consists of three digits, but for American Express cards, it’s four digits.

If a buyer enters an American Express card number, the CVC field on the Boxopay payment page adjusts to allow the input of four digits, even though the standard is typically three.

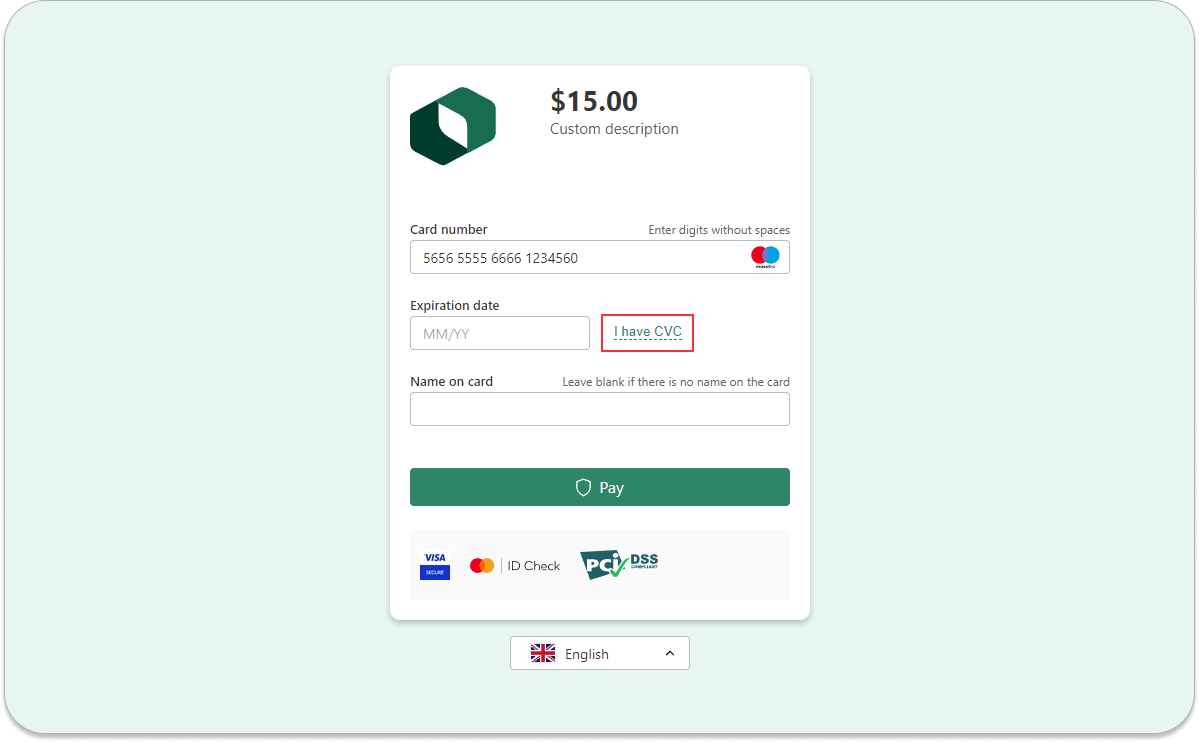

An even more interesting case is with Maestro debit cards, where CVC/CVV is not present at all. Due to this peculiarity, the internet is filled with user queries about what to enter in the CVV field when making a purchase.

Customers of merchants using the Boxopay payment page are not engaged in such discussions. We employ a straightforward approach – if a card does not have a CVC, such a field should automatically be hidden from the user. Our form behaves precisely like this as soon as it detects that the buyer is entering Maestro card details. In the event that the buyer’s card does contain a CVC, we have placed a link in place of this field saying “I have CVC.”

Support for expired cards

Before the COVID-19 pandemic, the card’s expiration date held significant importance. Payment systems would cease to service a card once the month indicated on its surface had passed.

During the lockdowns of 2020, payment systems allowed the use of expired cards. This was done to spare cardholders from having to go to the bank for a reissued card, risking their health. The decision of what to do with expired cards – whether to extend their validity or issue a new one as a replacement – was left to the discretion of the banks. This practice continues today.

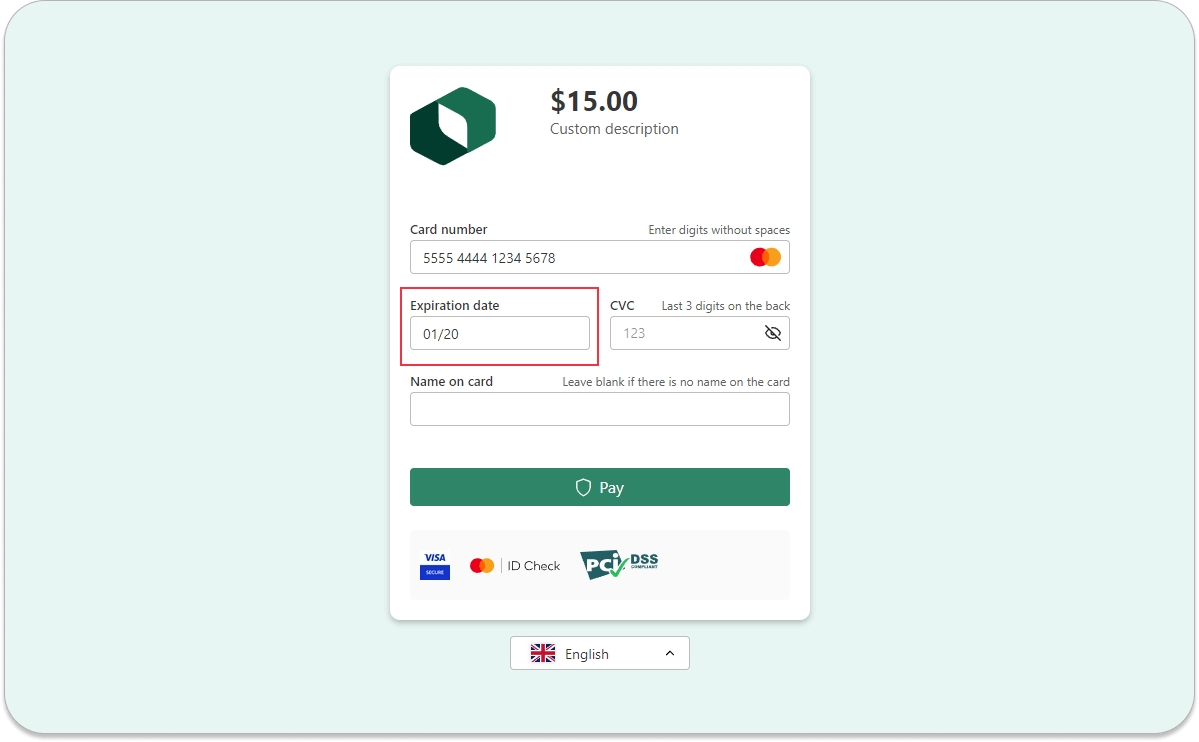

As, until 2020, the card expiration date was a strict requirement, many payment pages, including Boxopay’s solution, automatically validated it on the buyer’s side. If someone tried to enter a month and year that had already passed, the form either rejected it, displaying an error message, or did not allow the payment to proceed.

Contact our top experts

to pick products and services that fit your business needs

Schedule a meeting

Support for “expired” cards on Boxopay’s payment pages was introduced in the very first update released after payment systems allowed the acceptance of such cards.

When it comes to entering the card expiration date on the payment page, we can also share our vision of how it should be implemented from a UX/UI design perspective. Globally, there are two approaches: selecting the month and year from dropdown lists or manual input.

Previously, we favored the first option, where users choose the month and year from dropdown lists. However, based on one of our studies, we noticed that users can make mistakes during this stage of entering card information. The card’s expiration month is indicated as a number, while in the dropdown list, we presented the names of the months. Not all users remember the order of the months throughout the year. Buyers either made mistakes or spent additional time counting.

Additionally, we found cases where using a dropdown list is inconvenient for users. For instance, if a buyer is filling out a form on a mobile phone screen, and the expanded lists partially extend beyond the screen borders.

All of these factors led us to now favor the second approach in designing this field – manual input. It is more convenient for users whose flow simply involves using the keyboard to enter all the fields as they see them on the surface of the card. Following the card number, the buyer effortlessly enters the month and year without having to navigate dropdown lists.

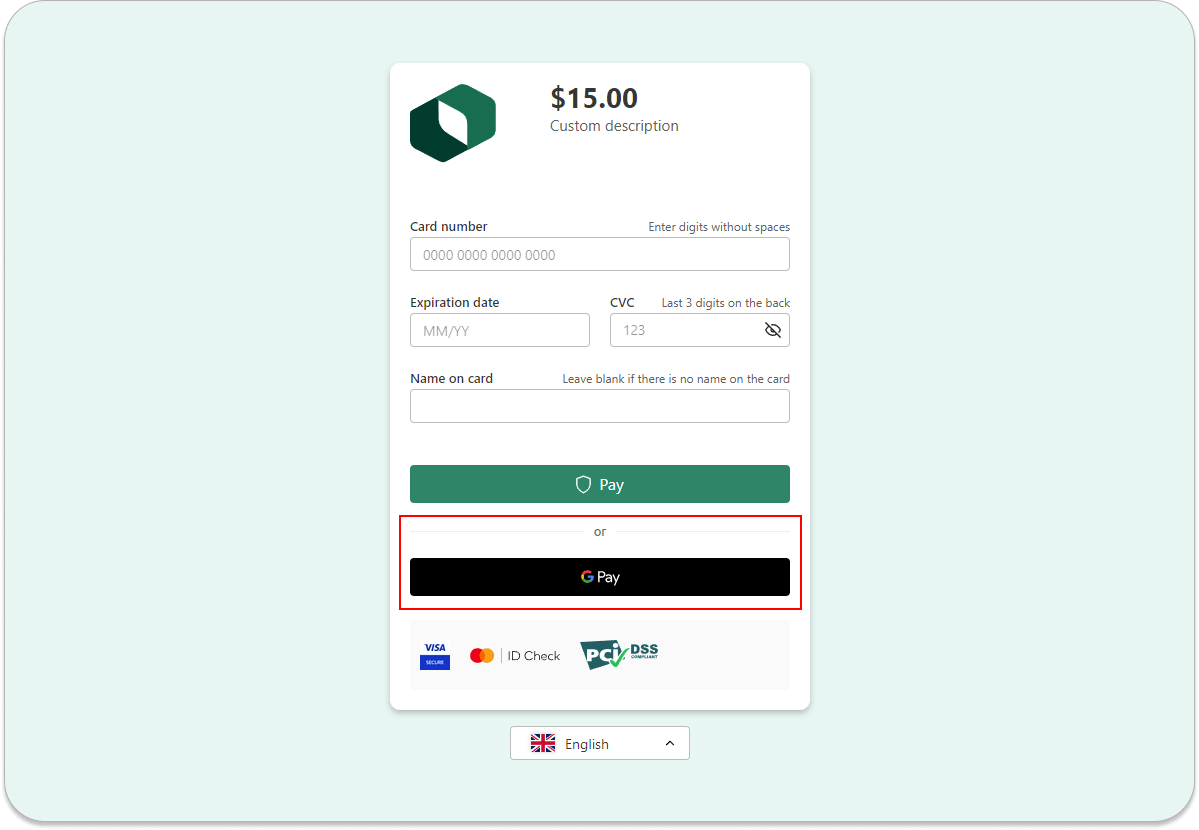

Support for additional payment methods

Today, relevant non-cash payment methods go beyond just credit cards, so a modern payment page should support other options that are secure and convenient for users.

The Boxopay payment page supports payment through electronic payment systems like Apple Pay and Google Pay. Merchants can also integrate open banking solutions, payments using QR codes (including cryptocurrency payments), and more.

We understand that new payment methods may emerge at any moment, so we closely monitor the market and are open to implementing new methods upon merchant request.

Contact our top experts

to pick products and services that fit your business needs

Schedule a meeting

Merchant functionality: add the elements you need

Customization options for the payment page should not be limited to branding and choosing between a standard form and a card-shaped form. Merchants may have a need for additional fields, and they should also have the ability to choose whether to include or exclude certain optional fields on the payment page.

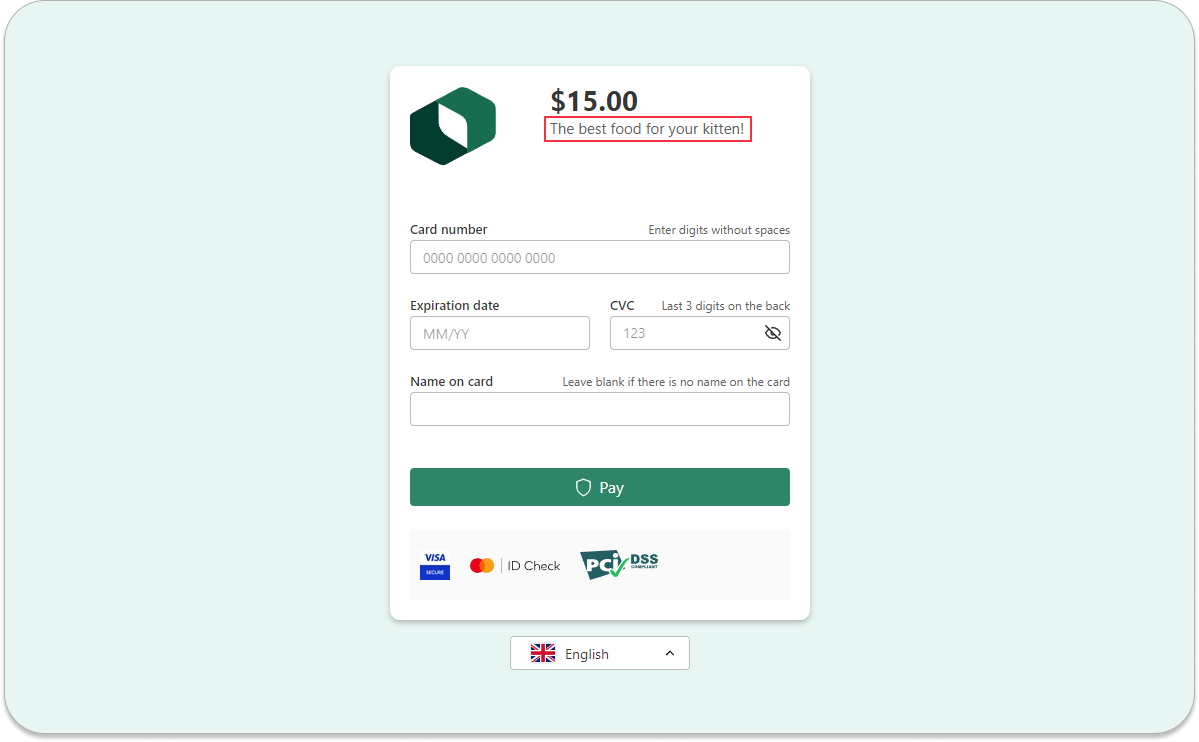

Editable payment descriptions

Boxopay’s solution allows merchants to use any payment description they prefer. For example: “Payment for Order #1 in the best online store” or “The best food for your kitten!”.

As a result, when a buyer opens the payment page, they can further confirm that they are paying for exactly what they intend to. With a savvy marketing approach, merchants can use the payment description field as another tool to enhance customer loyalty.

Disabling the “Cardholder name” field

The value of the “Cardholder Name” field never enters the processing. Typically, it is used for two main purposes: basic fraud protection and collecting customer data for the merchant’s CRM.

Banks sometimes issue anonymous plastic cards where the cardholder’s name is absent or replaced by a standard phrase specific to that bank. In the case of payment systems like Maestro, the user’s name is not indicated at all.

Based on the above, we believe it is correct to give the merchant the option to decide whether they want the “Cardholder Name” field on the payment page. If the answer is affirmative, we employ certain solutions to minimize the risk of the “Cardholder Name” field causing any confusion for the user and leading to payment refusal.

Firstly, the merchant can add an additional note next to this field: “Do not fill in if the name is not specified on the card.”

Secondly, we have implemented proper handling of any characters that a buyer may use when filling in the “Cardholder Name” field. This feature is especially useful in regions where local alphabets use diacritical marks. For example, a user’s name from France might look like Jérémie Bossé. On their card, it may be written as Jeremie Bosse. Our payment page will accept both variations.

Disabling the “CVV/CVC” field

The verification code, known as CVV or CVC, depending on the payment system, is something about which it’s important to know a few key points.

CVV/CVC cannot be stored by anyone other than the card issuer. Therefore, payment pages can only accept and transmit this code, and this requirement is strictly verified during software certification.

CVV/CVC is not mandatory from the perspective of the bank or the payment system. However, in about nine out of ten cases, acquirers require this field to be processed because CVV/CVC is a crucial mechanism for preventing fraud.

At the same time, acquirers can make exceptions for individual merchants. Large online platforms may store their customers’ card data with their permission for quick purchase transactions. Since CVV/CVC cannot be stored, this field is simply excluded from the required data.

If you are a merchant for whom the acquirer has made such an exception, you can disable CVV/CVC on your Boxopay payment page. The form settings allow you to do this.

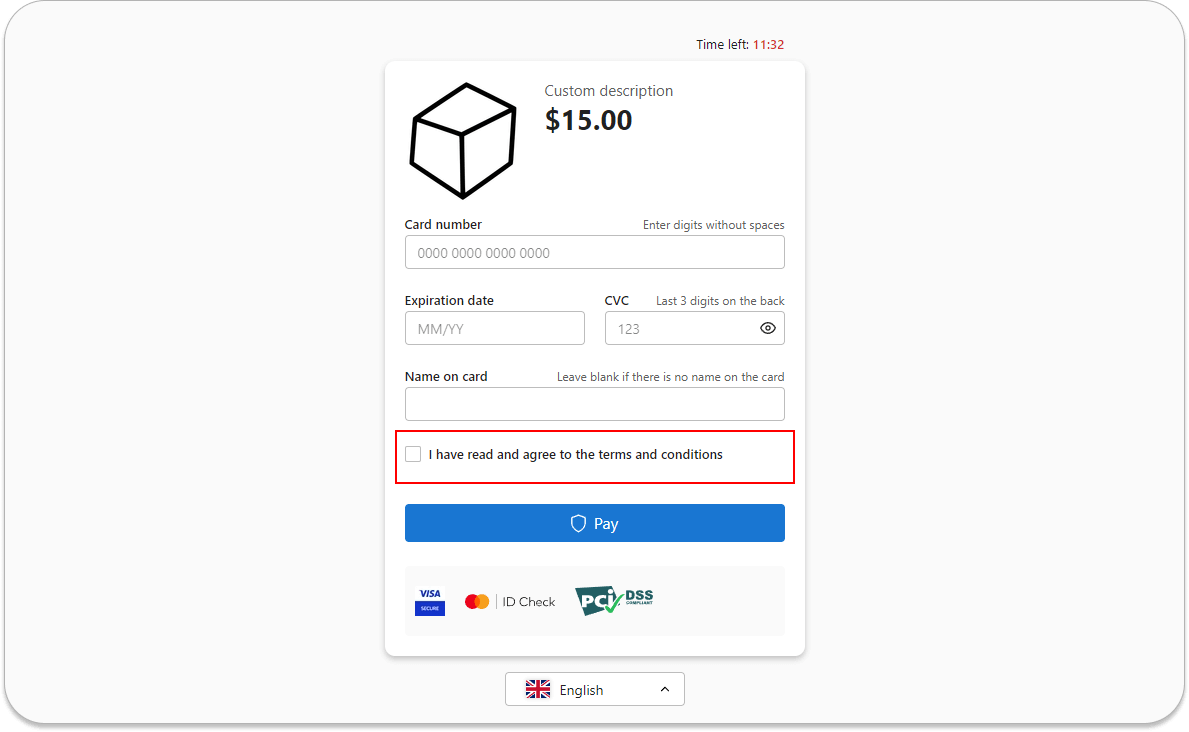

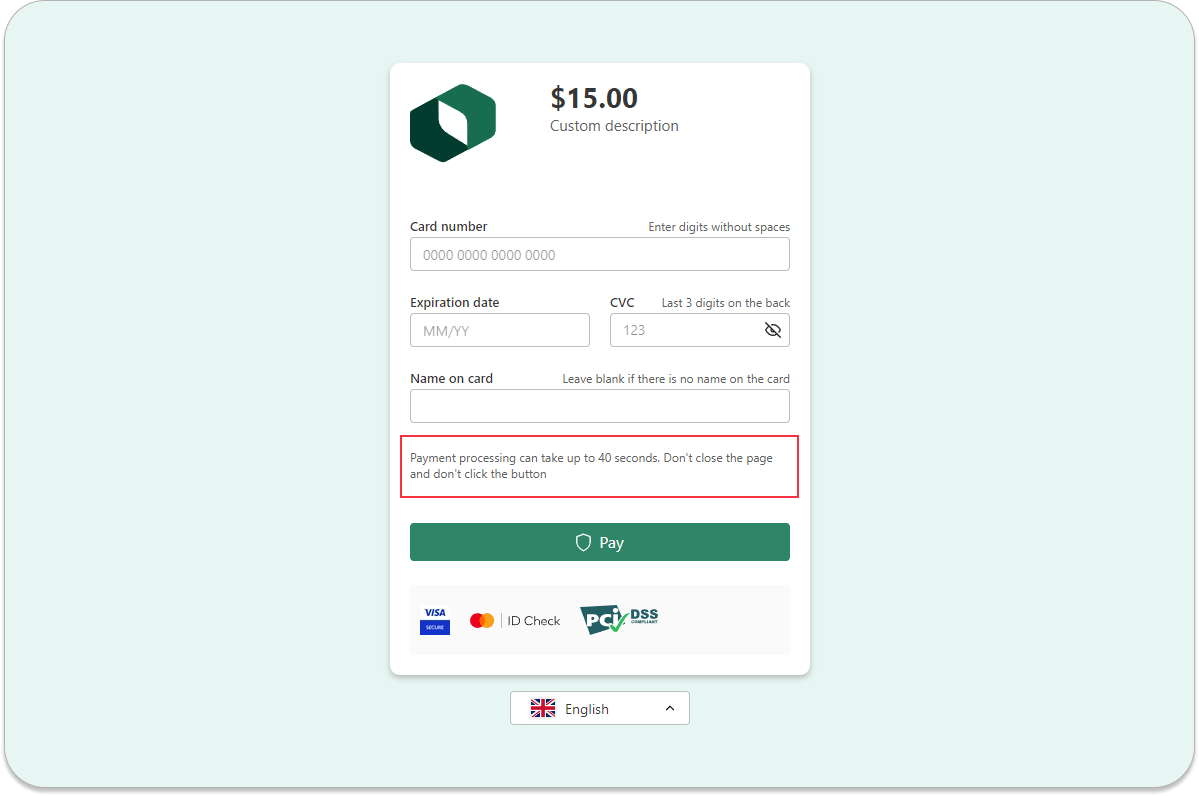

Additional payment form fields

Boxopay’s payment page allows you to add three types of additional fields that may be necessary for the merchant:

- Agreement with seller’s terms. Payment can only be processed if the user checks a box indicating agreement with the terms provided via a link.

- Disclaimer. Arbitrary text that the merchant can enter to warn users about specific details at the payment stage. For example, a notice that payment processing may take longer than usual if there is a stock verification.

- Contact information. Legal details of the seller, including address, phone number, etc.

Schedule a Boxopay payment page demo

If you’re eager to delve deeper into the details of the Boxopay payment page and discover how it can enhance the conversion rate at the final stage of your sales funnel, book a meeting with our experts!

Contact our top experts

to pick products and services that fit your business needs

Schedule a meeting