Automate KYC onboarding and free up to 60% of business costs

Focus your compliance team on the most demanding corporate or individual clients and provide an exceptional user experience with our omnichannel customer verification and onboarding automation solution.

Speed up

onboarding

Increase

onboarding rates

Minimize

manual errors

Free up to 70%

of human resources

Open new accounts in

15 minutes while carrying out security and AML compliance processes

Identity verification

5 minutesCombine world-class third-party tools for fast document, biometric, or other data verification. Choose the most convenient identification method for each client type.

Watchlist screening

8 minutesDetect high-risk clients to protect your business from fraud automatically. Build custom scoring methods and routes with different screening tools to maximize your protection.

Onboarding completing

2 minutesRequest specific data to create client profiles and automatically provide access to your unlimited selected digital products with login credentials.

Take advantage of a customer onboarding KYC solution that fits your specific business needs

For any business scale

Get a missing automation piece for your new fintech company, or transform business processes in an existing PSP, acquirer, or modern bank to earn more.

For any client type

Serve both individual and corporate clients, build custom segments, and provide them with unique onboarding scenarios and product access.

For any development case

Use our software as an end-to-end solution that’s integrated with your client management environment, or build your own frontend.

Bring your business to the next level with KYC automation

Make the customer experience significantly better

Ensure smooth and effortless digital customer onboarding to boost conversion rates, increase your revenue, and stand out from competitors with no risks for your business.

Stay completely flexible in KYC customer onboarding

Build custom routes for each client segment, and apply fully-automated, semi-automated, or manual-only checks to be sure of user compliance with your specific requirements.

Improve your risk management quality

Receive profound insights about your clients with external AI-powered screening tools, analyzing thousands of databases in several regions, in seconds. Stay compliant with local and global AML regulations.

Expand new markets and scale your business

Open up mass client segments like small merchants with fast onboarding capabilities and go to new markets, simply localizing user journeys with our KYC automation software.

Boost your operational efficiency

Reduce your business costs by minimizing manual workload and cutting out unnecessary time-consuming business routines. Build KYC workflows and manage all your customer data from a single window.

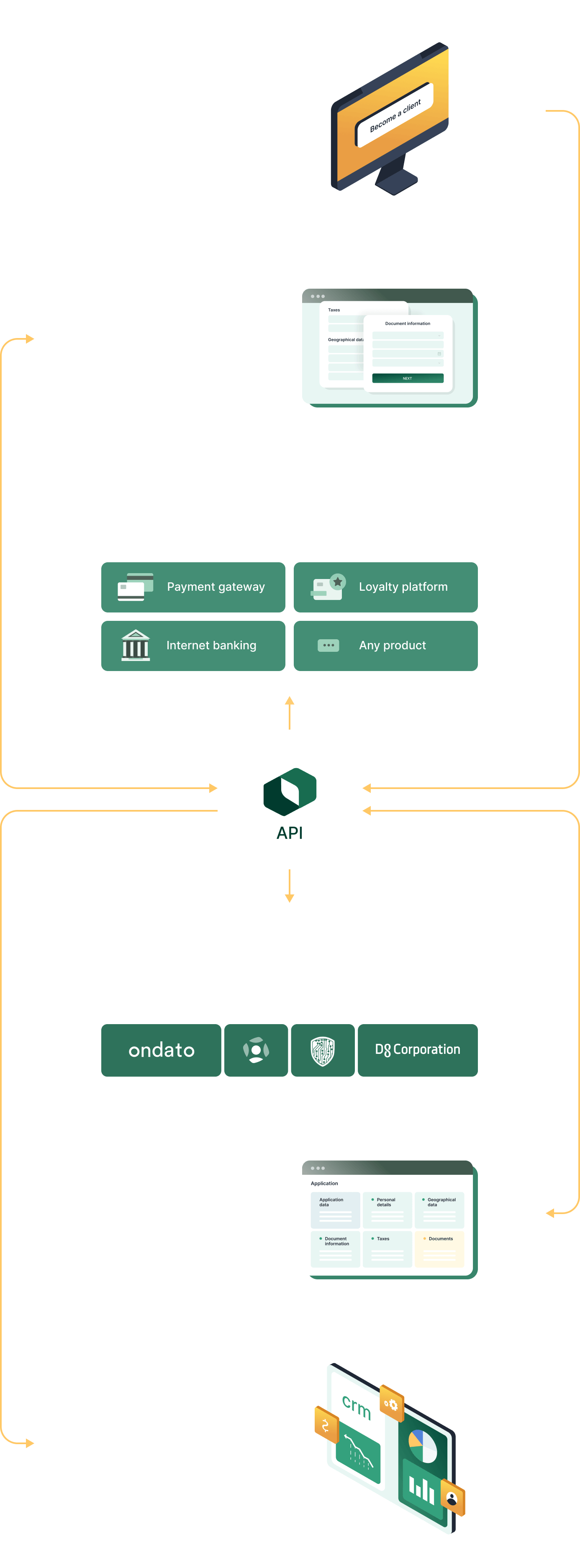

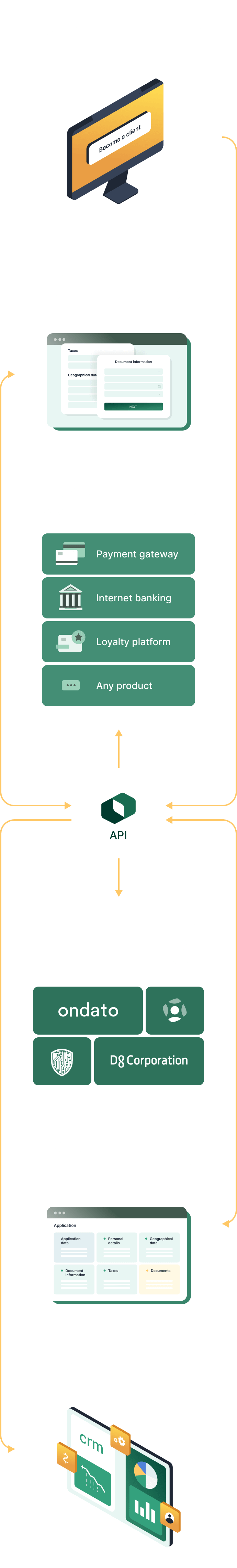

Build a fully-integrated

client management environment

with complex customer onboarding middleware connecting your website, client accounts, third-party tools, and CRM.

Create a unique stack from cutting-edge verification and screening tools

Build custom flows using different verification products for each segment and location, and combine cascading screening routes to maximize your security.

Provide client access for unlimited digital products

We integrate our omnichannel KYC automation tool with your site and all your apps for clients to generate access credentials for multiple products.

Use ready-made web interfaces or enhance your product

Use a wide range of API-first capabilities and SDKs to empower your existing environment or create a new one, connecting unlimited tools to our software.

Get full control over your client data with on-premises deployment

Overcome SaaS providers’ vendor lock and be completely flexible in your own onboarding solution configuration and data management.

Our onboarding automation solution is already integrated with all Boxopay products

Contact Experts

How automated KYC workflow performs for you and your clients

Simple ready-made web interfaces

Two-side in-built online chat for communication

Notifications about new actions in-site and by email

Сontine the onboarding process from any step after interruption

You can always use additional manual checks for any application as well as completely refuse third-party services

- Simply manage all new clients, confirm separate data, and accept, reject, or send applications to rework.

- Support your clients’ onboarding process via online chat for each application.