A white-label payment gateway to set up your own merchant acquiring service

Launch and take full control over your acquiring bank, PSP, or payment gateway functionality with a brandable on‑premises platform that covers all your and your merchants’ business needs.

A trustworthy software, proven by our clients’ practice

transactions processed

merchants serving

uptime

A white-label payment gateway solution that meets providers' sky-high expectations

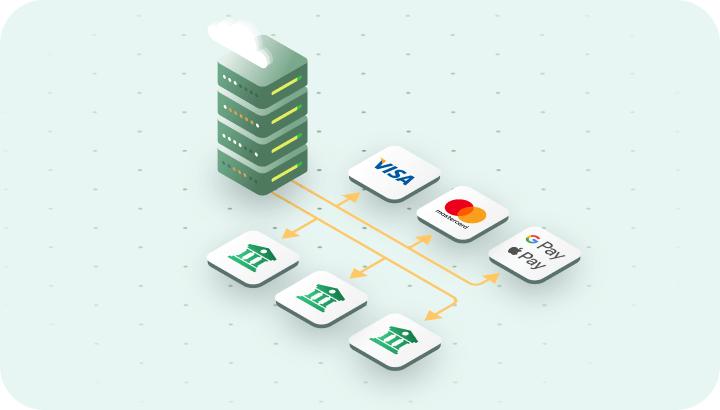

Acquirer bank

Out-of-the-box functionality, automating and gathering most of your business process management in a single window.

View more

PSP

A flexible merchant-oriented integrating solution that ensures your competitive edge and limitless capabilities for evolution.

View more

Traditional bank

Easy-to-embed software enhances your market opportunities and provides acquiring functionality for merchants and PSPs.

View moreBusiness support services

We lead you every step of the way to your first transactions and the next

Beginning with the proof of your market and tech fit, we go through resource assessment and realistic planning of your business development.

We provide integration, customization, and technical support services as well as help with licensing and certification. Benefit from our assistance for entering new markets and unique 10-year fintech expertise that ensures a turnkey new PSPs or acquirers launch.

View moreChoose a delivery model that fits your current priorities

You can change the model any time as your business grows

SaaS

An optimal option for a fast and cost-effective start. No development costs, infrastructure, or tech team hires are required. You also don’t need a PCI DSS certification.

On-premises

Host our payments processing software on‑premises or on your cloud infrastructure, get 100% control of your merchants’ and business data and product evolution capabilities.

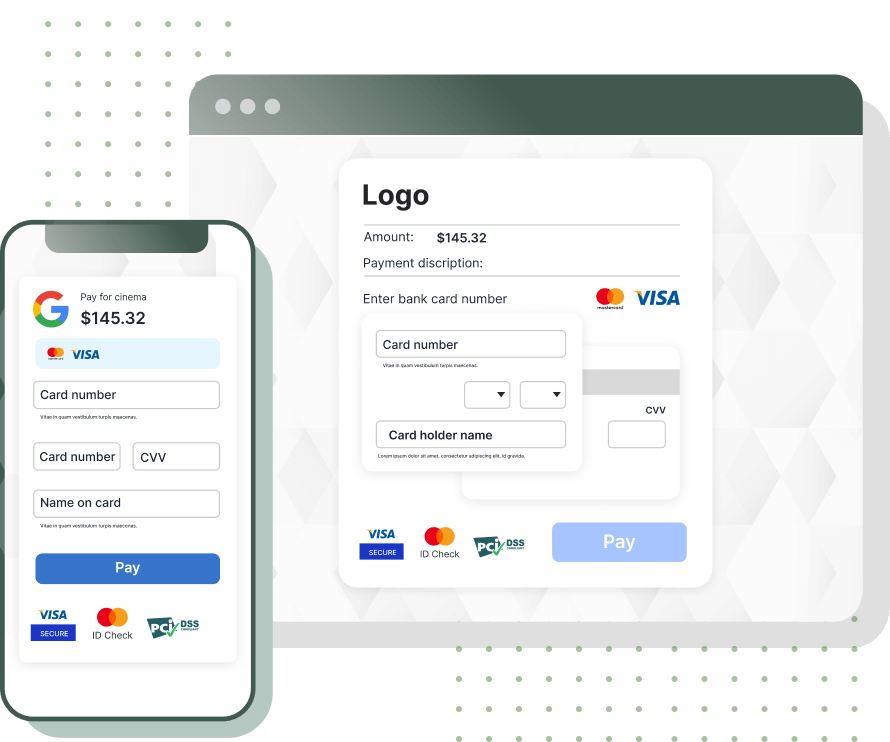

Boxopay’s white-label payment gateway software is ready for your and your merchants’ branding

We offer advanced features both for acquiring service providers and the merchants they serve

Enjoy a full-fledged white-label payment processing solution that allows you to deliver market-fit values for merchants and seamlessly run and scale your business.

For merchants

Maintain merchants of any size and any type globally

For small and medium merchants

E-invoicing and QR

Manual generation of payment links for sharing via email or in messengers.

Payments with or without 3-D Secure

DSRP payments (Apple Pay, Google Pay)

Customers can use Apple Pay or Google Pay instead of entering their card information on a hosted payment page. We also support tokenized DSRP payments with Apple Pay/Google Pay implemented on the merchant's side.

Alternative payment methods

Support for cryptocurrency payments, as well as using OpenBanking providers, Cash-In terminals, and similar methods.

Card tokenization with VTS

Visa Token Service (VTS) is a security feature from Visa. Once a customer makes their first payment on your website, it replaces their card number in our system with a unique identifier known as a token. For subsequent payments, the token is used instead of the actual card number.

Embeddable payment widget

Merchants which are not PCI DSS certified can place a JavaScript payment widget on their page. This widget is fully customizable and integrates smoothly into the checkout interface on the merchant's side.

Static payment link

Generating multiple-use links for payment on a fixed amount.

Customizable payment page

Merchant portal

Fast onboarding

All-in-one functionality for fast online merchant onboarding, data collecting, and generating access to the merchant portal.

For large merchants

Server-to-server integration

Embedding payment functionality into the website. PCI DSS Level 1 is required.

SMS and DMS transactions

Support of single message system (unified authorization and charge) or dual message system (separated authorization and charge).

Dynamic descriptor

Empowering merchants with the ability to dynamically create descriptors for each payment.

Account Verification Service (AVS)

Verifying card сredentials without blocking or charging funds.

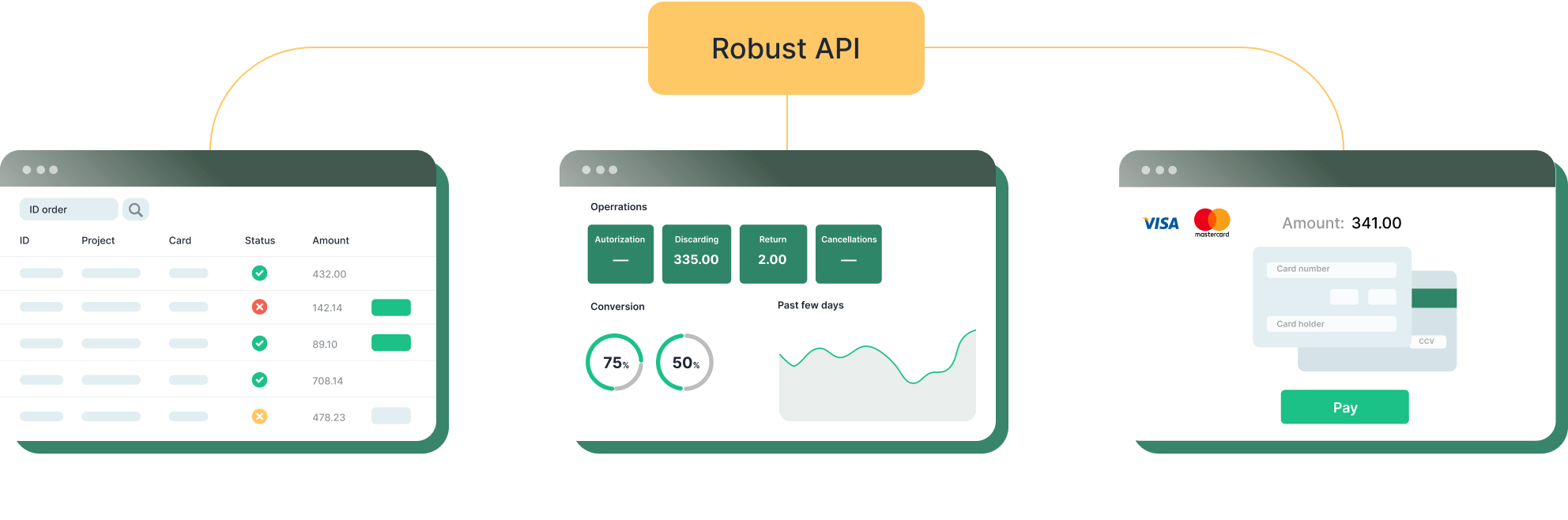

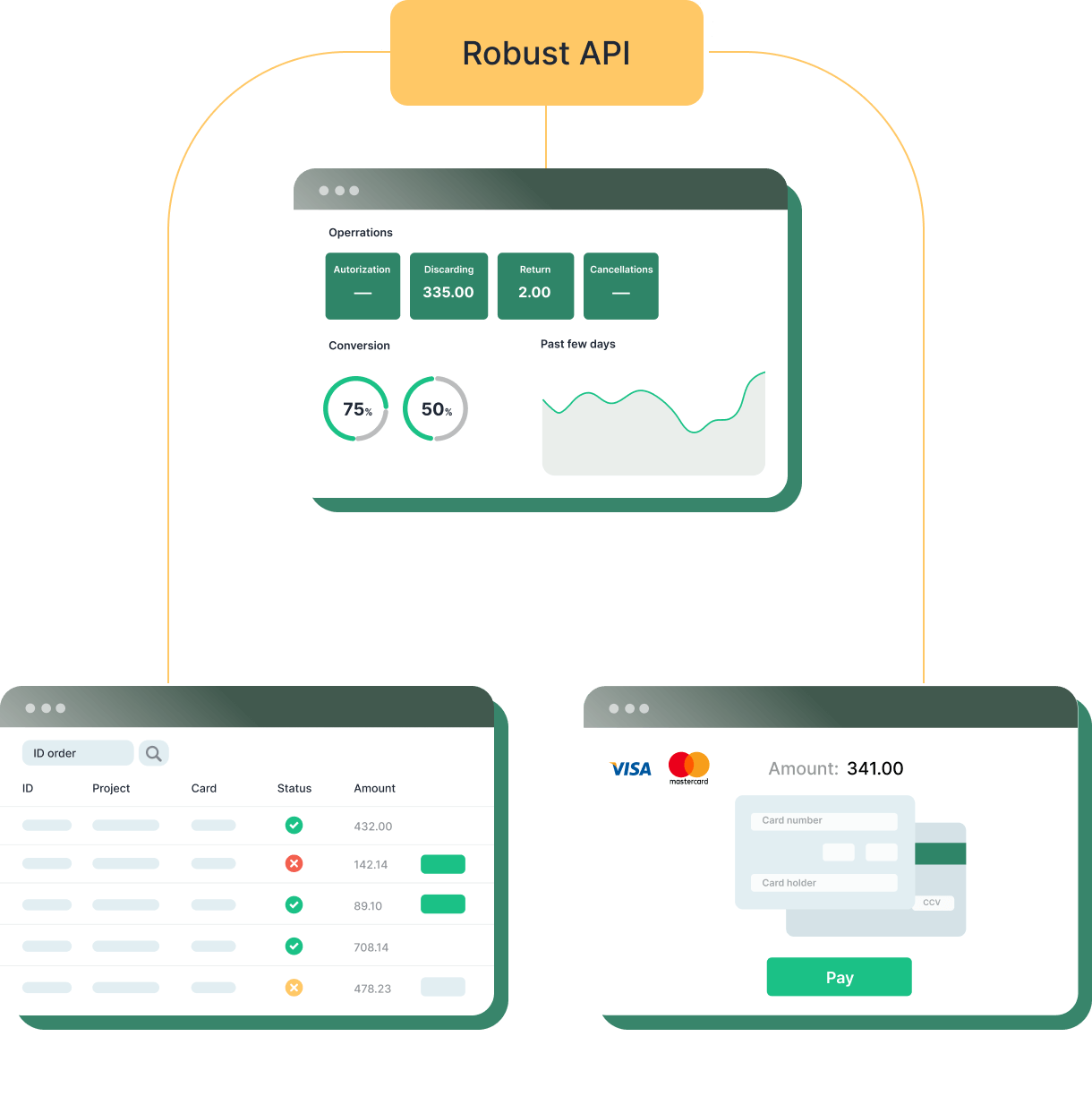

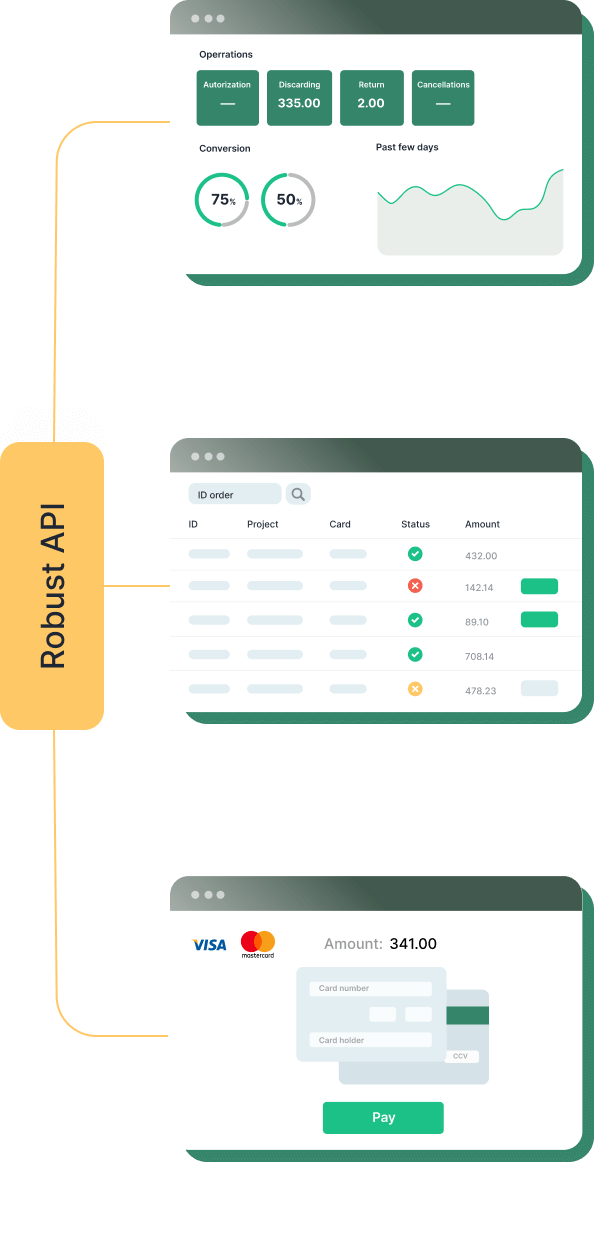

Robust API

For international brands

Multi-currency

Multi-language

Multi-tenancy

For digital platforms

Split payments

Payments distribution between sub-merchants for marketplaces.

Recurring payments

Сustomer initiated payments and Merchant initiated payments using Card-on-File.

One-click payments

Customers can save their card for faster future payments. For subsequent payments, only the CVV code will be requested from the customer.

High-risk (HR) identifiers

In some regions, payments associated with gambling, forex, crypto and similar purposes are allowed and should be marked for payment systems accordingly.

Payment facilitator

Payment facilitators, often referred to as "PF," simplify the process for small businesses to facilitate card payments. They act as intermediaries between businesses and acquirers, streamlining the setup to accept cards without significant complexity.

Marketplaces

Marketplaces may identify their transactions based on the region or product category of their sub-merchants according to the payment system requirements.

Secure card storage

A secure card vault that meets PCI DSS requirements. Saved cards can be used for embedded tokenization, one-click payments, MIT payments, and for processing refunds.

Non-CVV payments

The ability to conduct transactions in Cardholder Present (CIT) mode without requesting any card credentials from the cardholder.

OCT payouts

Original credit transactions. Payouts to cards according to P2P or A2C scenarios.

AFT payments

Let your merchants increase conversion with a fully-customizable payment page

Fully customizable

The payment page can be branded with the payment gateway’s style, alternatively each merchant can brand it according to their own preferences.

The best UX

Adaptive to all platforms, mobile and desktop. Smooth user experience which utilizes autofill and input features on all devices.

A/B testing functionality

Customization and analytics tools, allowing your merchants to increase their conversion rate on the payment page.

Demanded features

- Custom domain support

- Widget for embedding

- One-click payments with VTS

- Detailed reason for payment rejection

- Processing of non-standard cards and cards without CVV

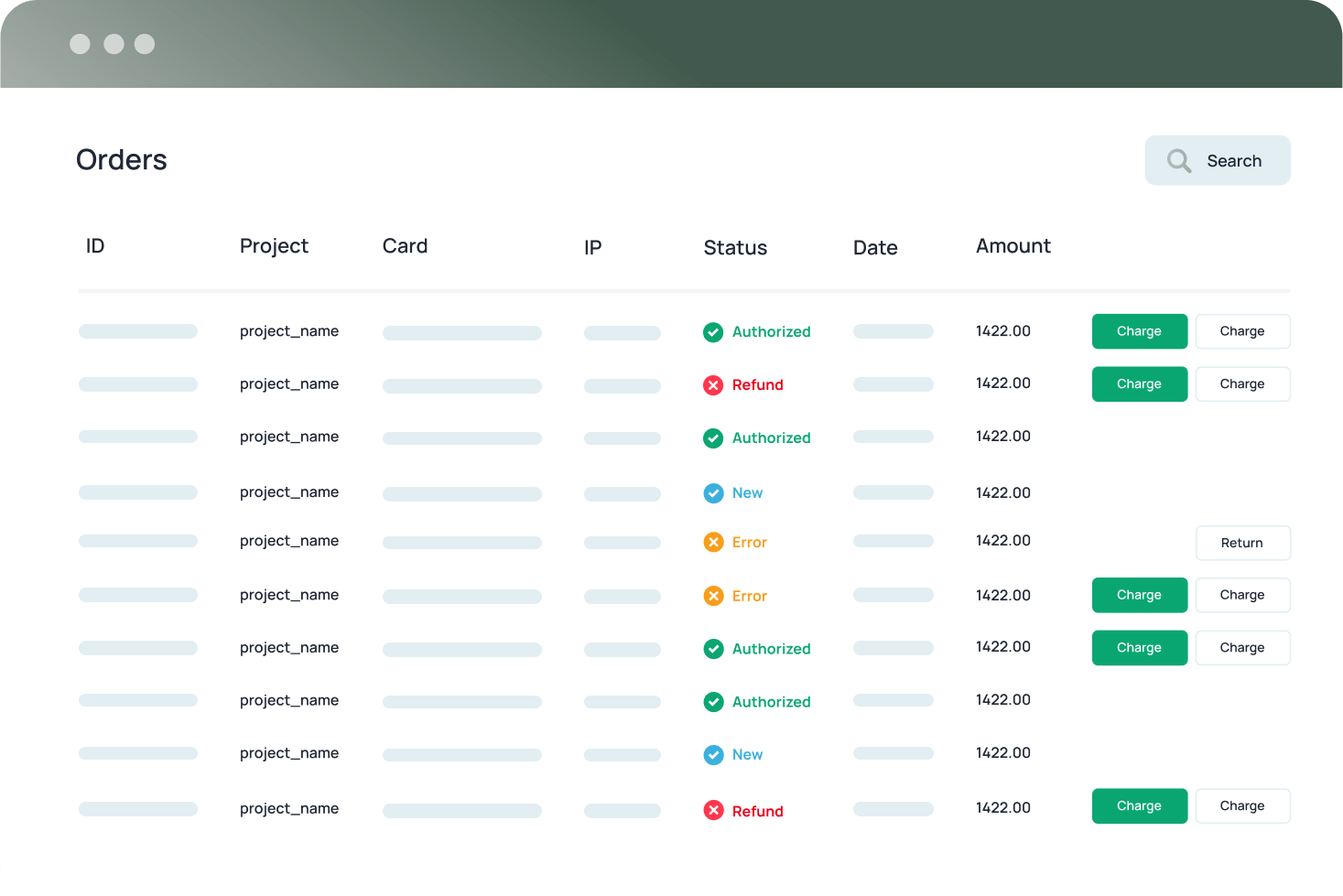

Simplify your merchants' routines with a plain and adjustable portal

Management

List of orders with details

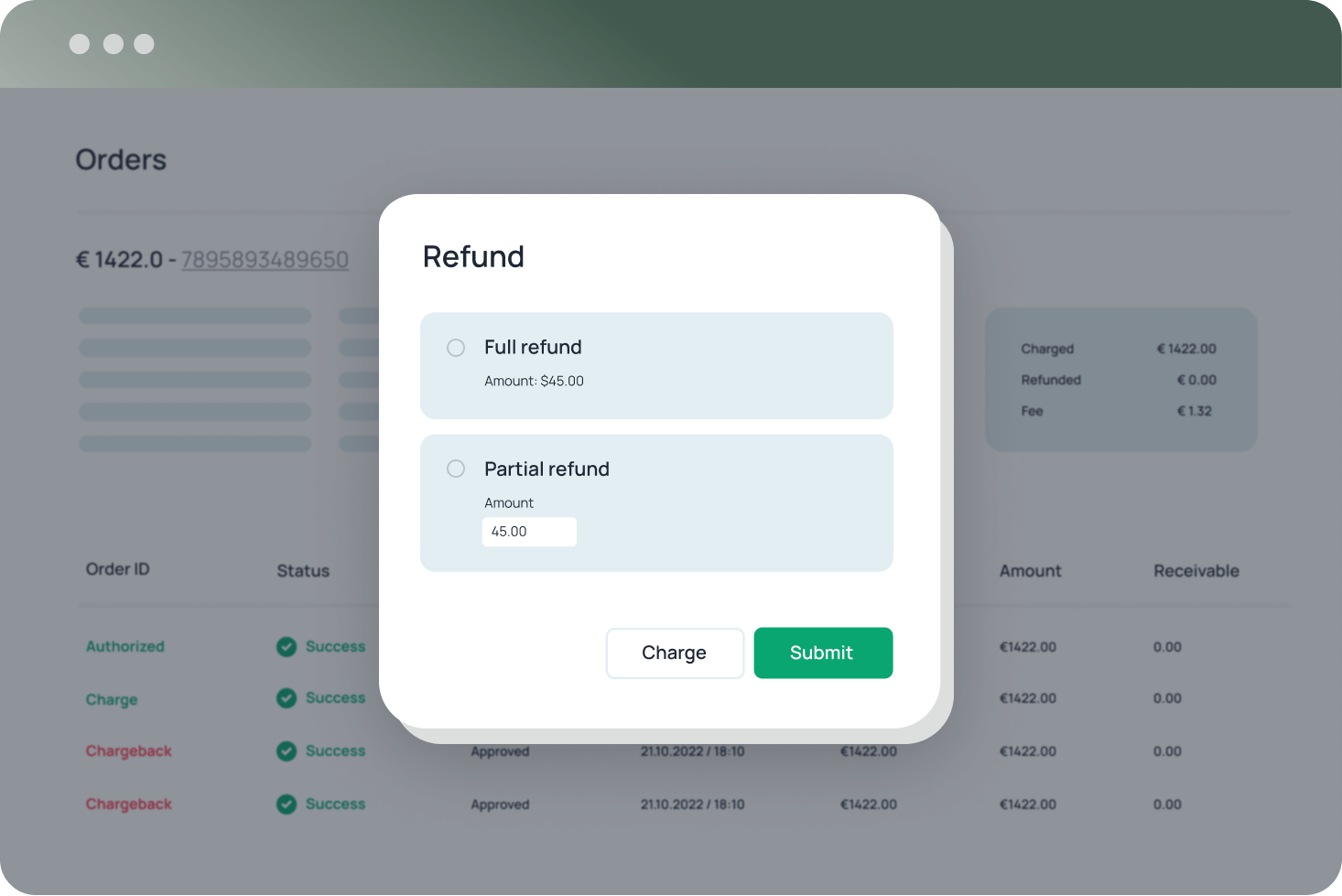

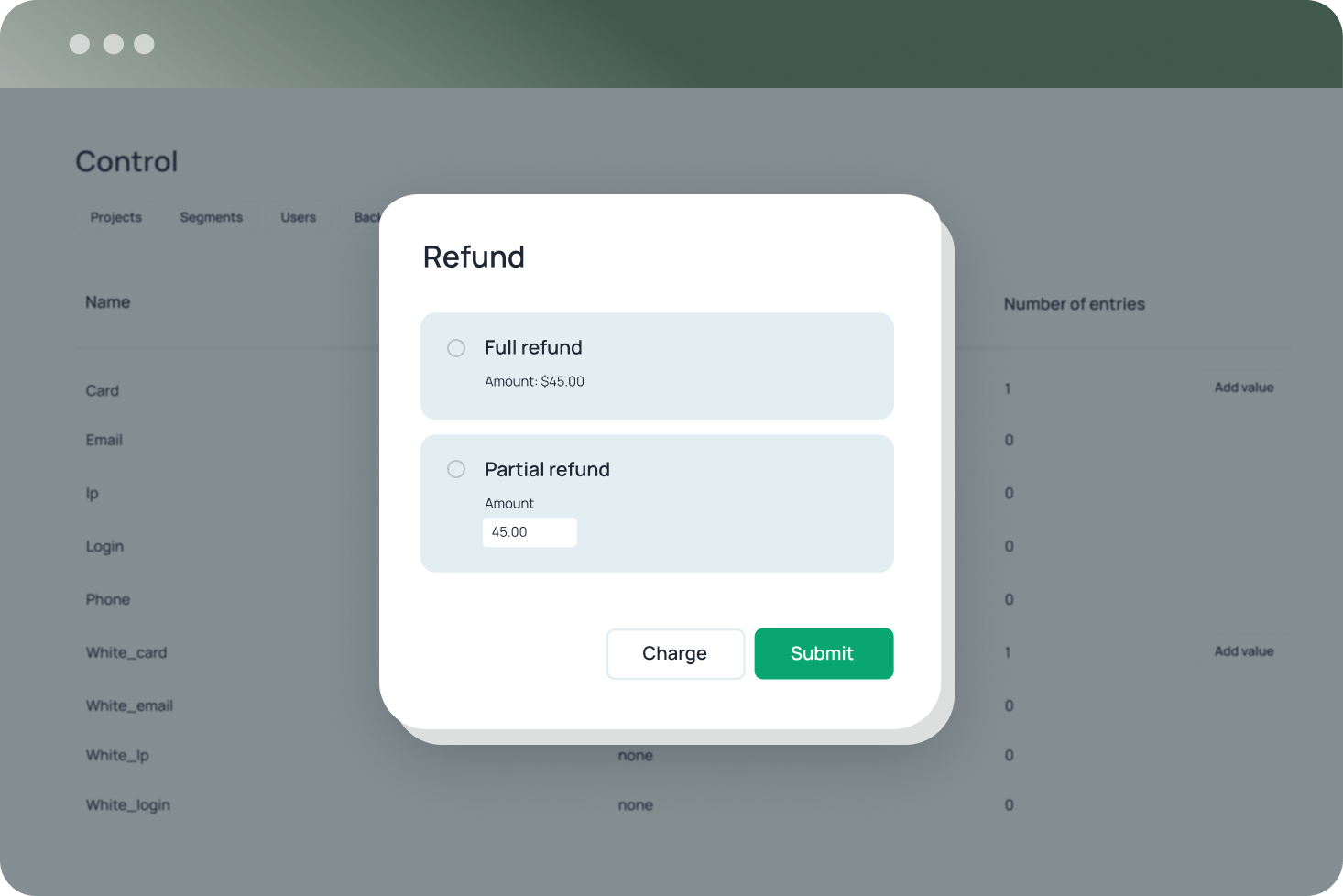

Full control over payments: charge confirmations, refunds, reversals

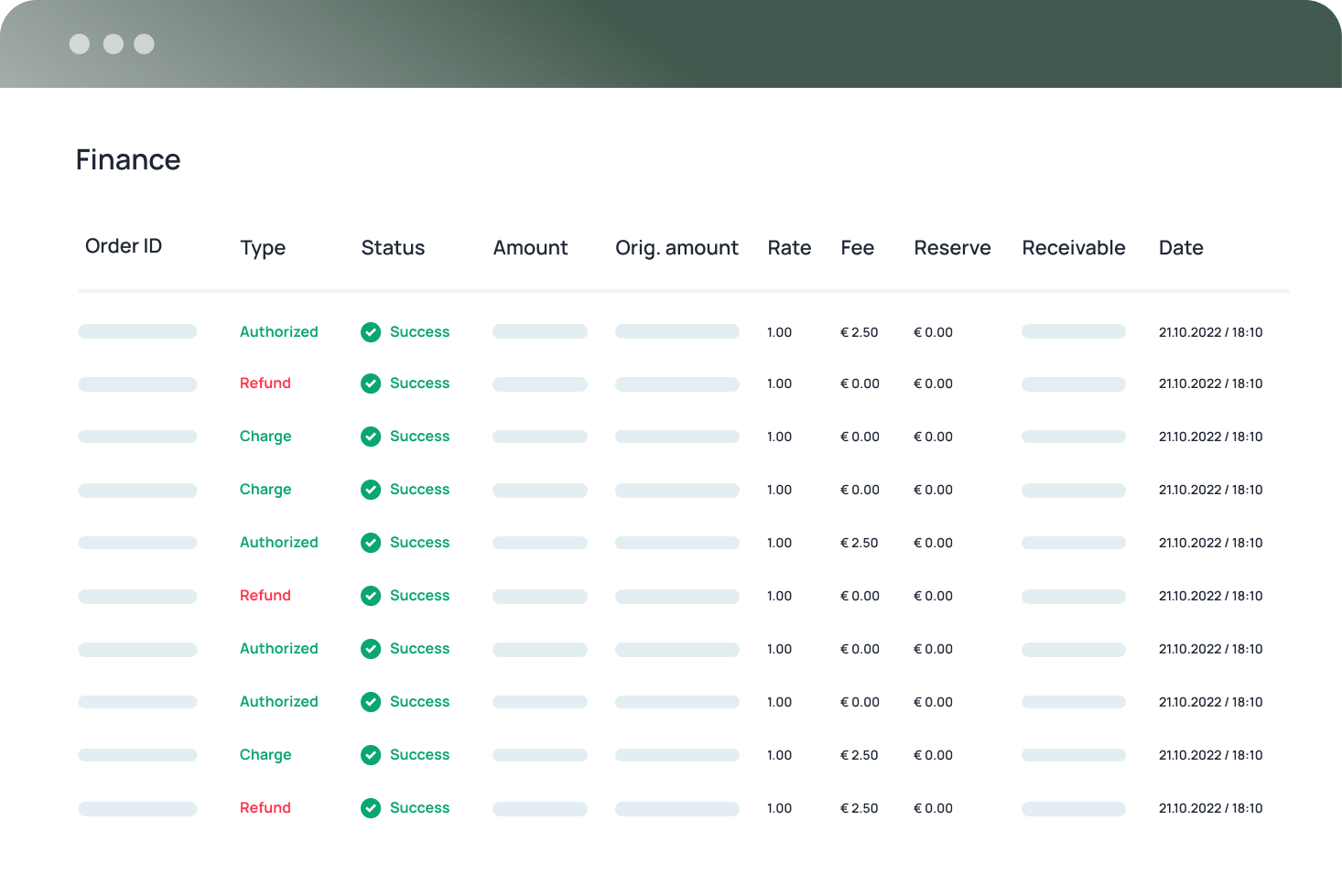

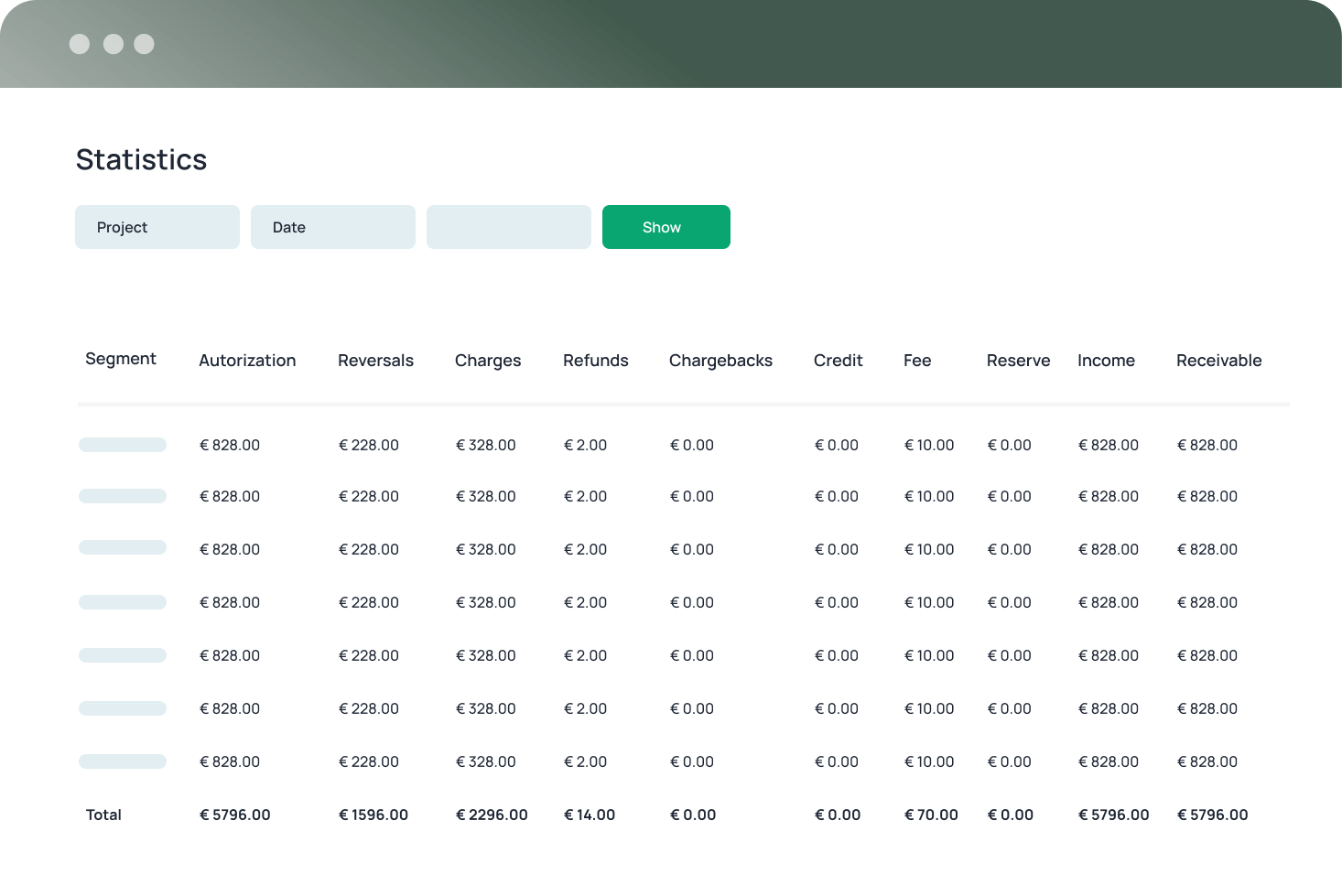

Per-transaction payout report with all involved commissions

Payments segmentation

Security

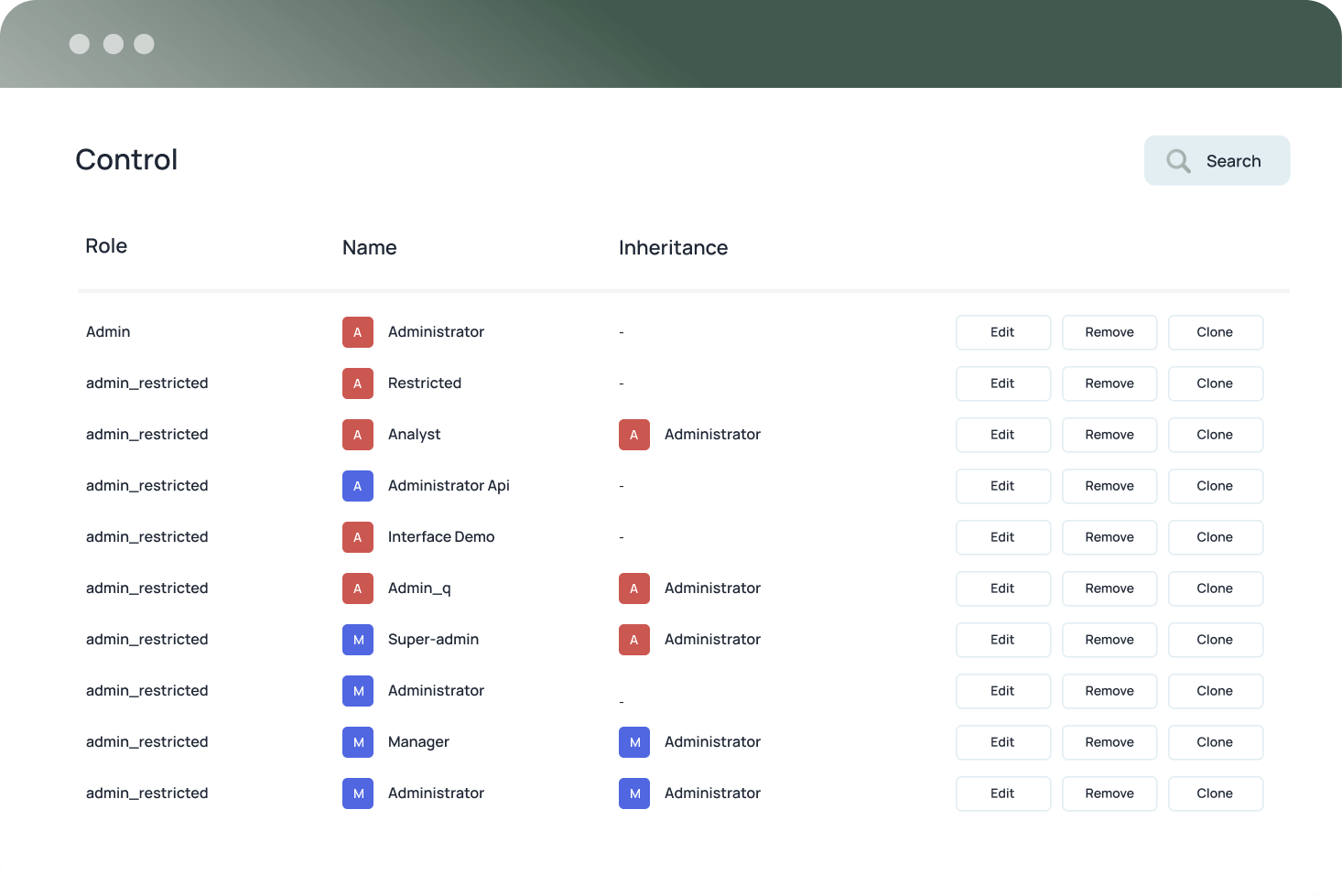

User access management

Blacklists of cards and customers

Data-driven decisions

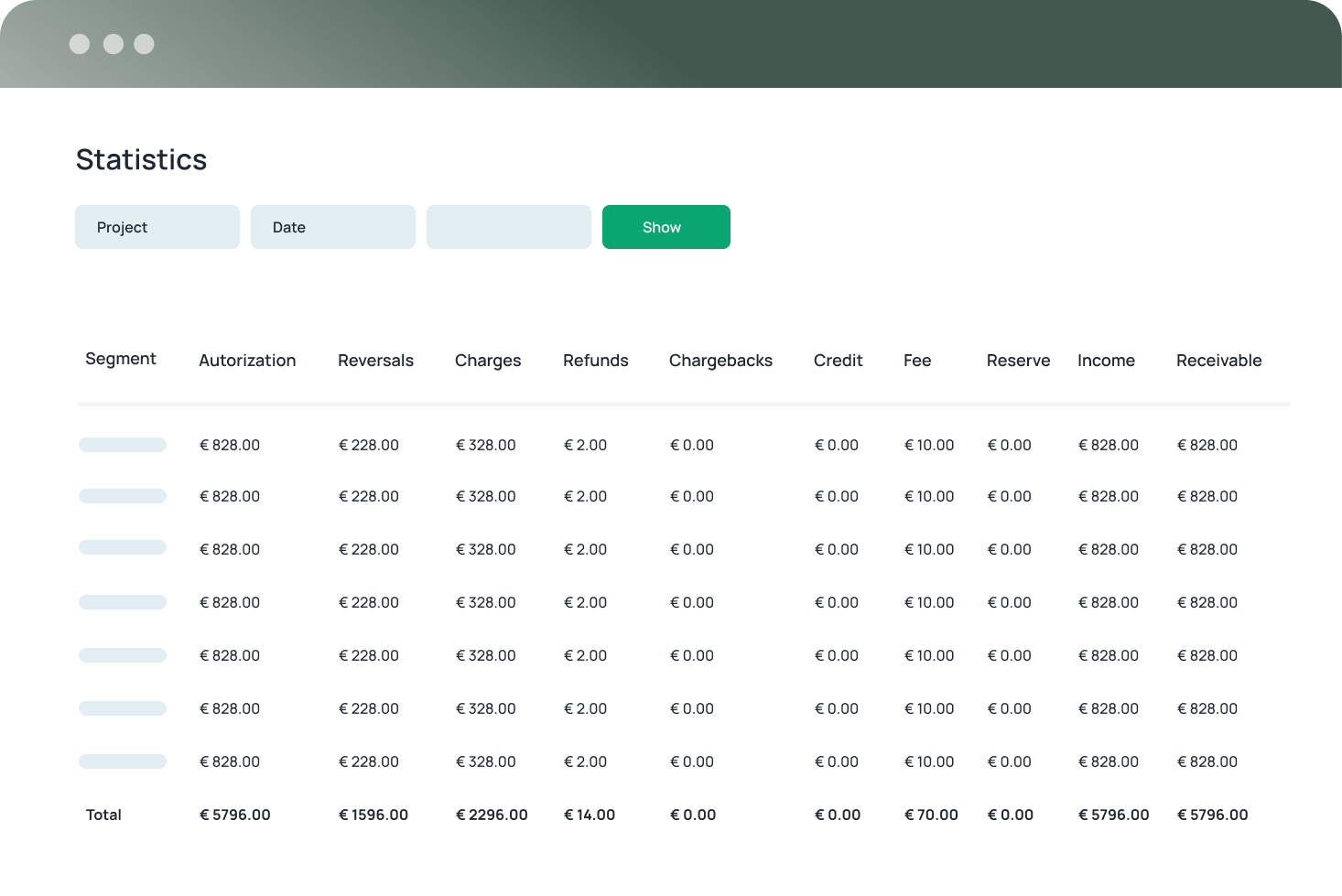

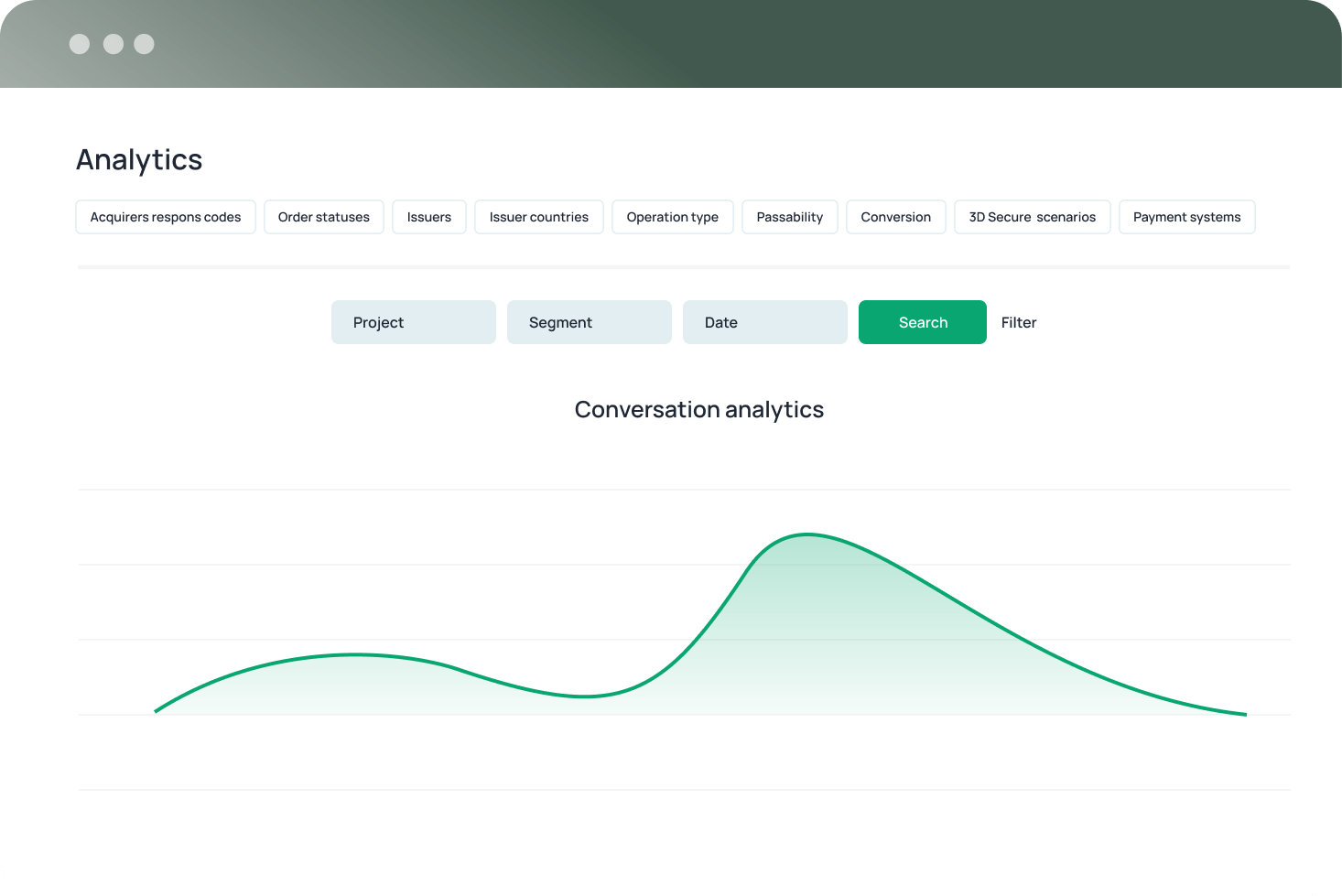

Reports on turnover and income analytics of payment conversion

Segmented reports with dozens of useful filters

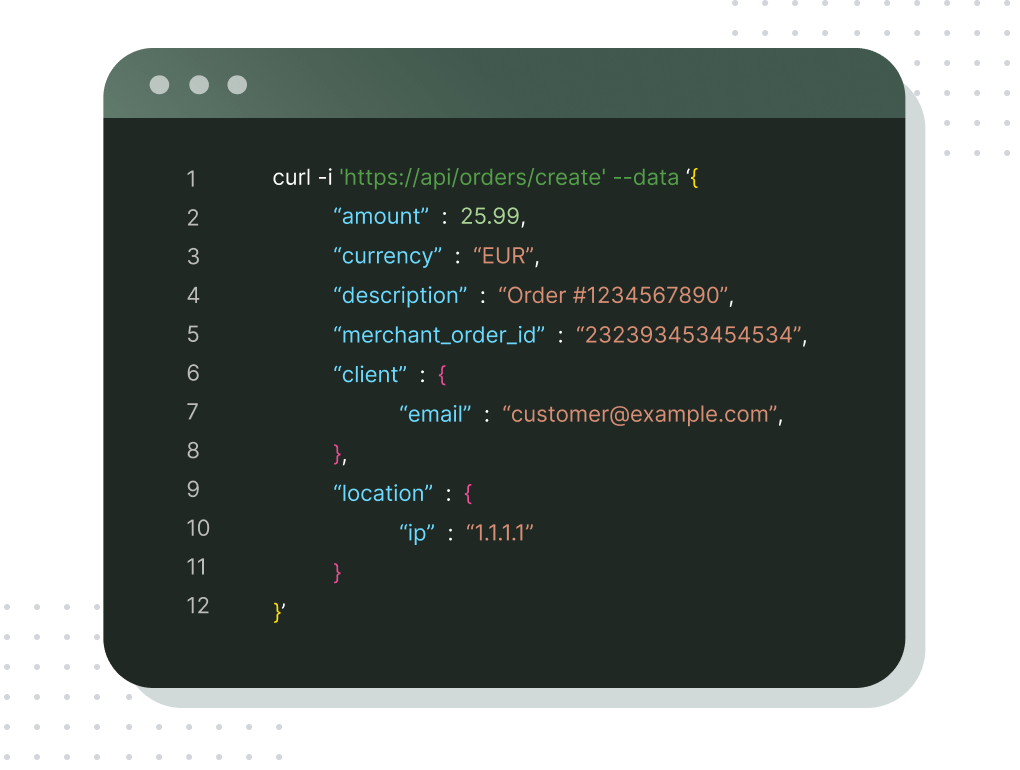

Provide your merchants with our API-first capabilities designed for a smooth integration

- Well documented and easy to integrate RESTful API

- Ready-made test scenarios for sandbox testing

- Server-to-server and hosted page integrations with unified API

- API integration of merchant back office features into your existing system

- API calls logging in the merchant back office for convenient debugging

Let’s look closer at functionality for merchants

Book a DemoFor providers

Use our powerful modules to set up and scale your business with ease