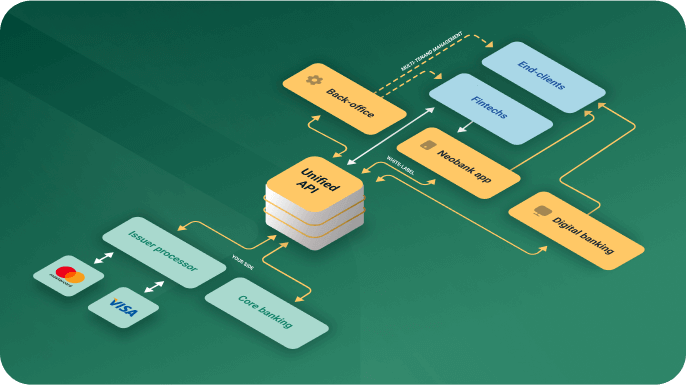

Become a modern issuer and BaaS API provider for fintechs and brands

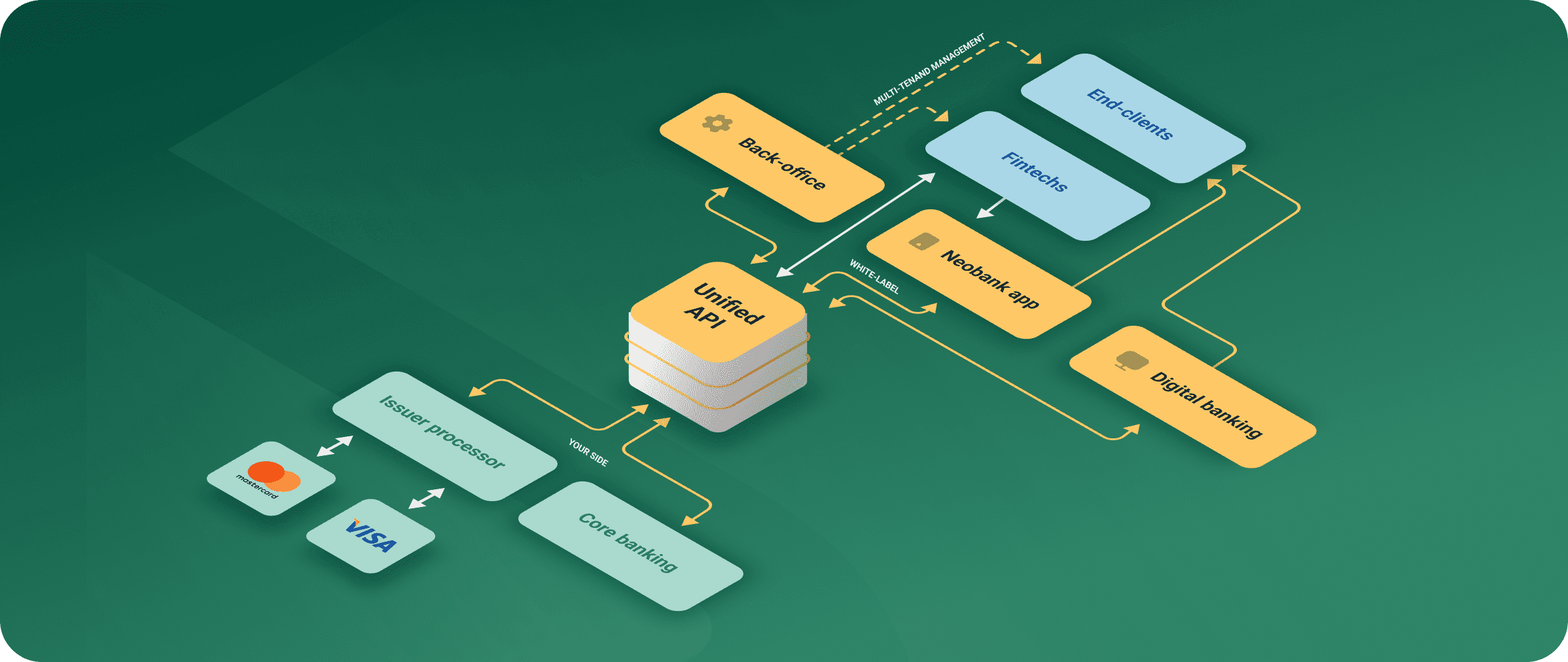

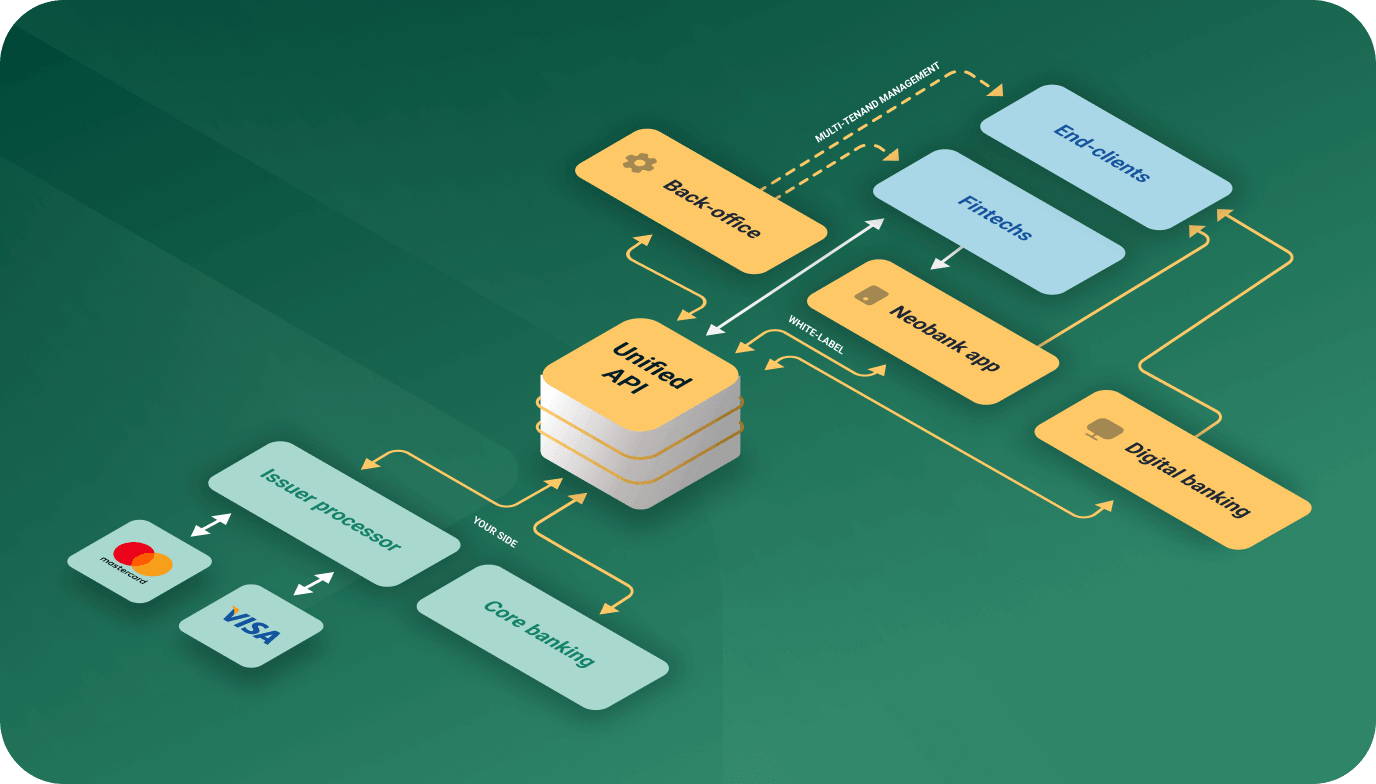

Get to market in a trice with a white-label prepaid and debit card issuing platform, multi-tenant fintech management solution, digital banking, and neobank app.

We support licensed institutions on their way to becoming white-label card issuers

Get a unique market solution that will make you stand out from competitors and unlock great revenue opportunities right away.

Who we serve

We are here for new challenger banks as well as other licensed and certified financial providers like digital wallets. We serve businesses that focus on card issuing services and diversify their portfolio with fintechs and brands (white-label bank issuer model).

Who you can serve

With our core and ready-made apps, you can serve your retail, business clients, and merchants while increasing profits with embedded finance services for neobanks, fintechs, and brands.

What do you need besides

We provide an add-on solution with a unified API, consolidating data from your core banking and issuer processing software, so you need both. Moreover, you need an EMI license and Visa or Mastercard certifications.

What will you gain as a provider

Minimize time to market with a one-of-a-kind tech solution for managing fintechs, clients, accounts, and cards from a single back-office covering all your business needs from KYC/AML to technical support.

Your value for fintechs and brands

You can boost well-established companies with their own branded payment card programs, as well as help fintech startups make it to the top with a powerful BaaS API or end-to-end solution including white-label neobank app.

Your value for end-clients

We will cover all the bases of your retail and business clients with a ready-made digital banking solution and a mobile-only neobank app that exceeds their expectations.

Check how our unique software fits your must-haves

Look over out specific benefits you get instead of in-house development hassle and collaboration with insecure BaaS API platforms.

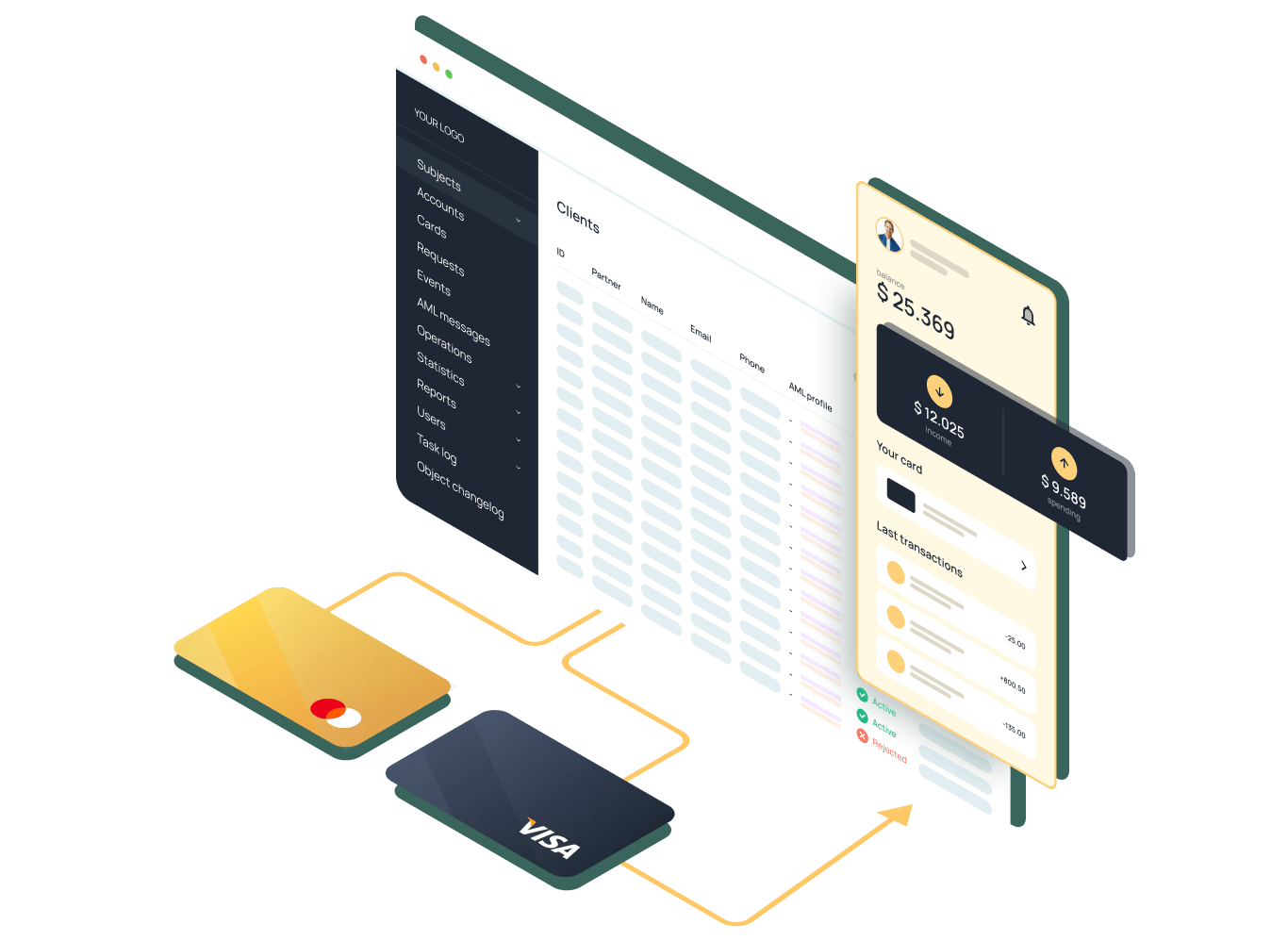

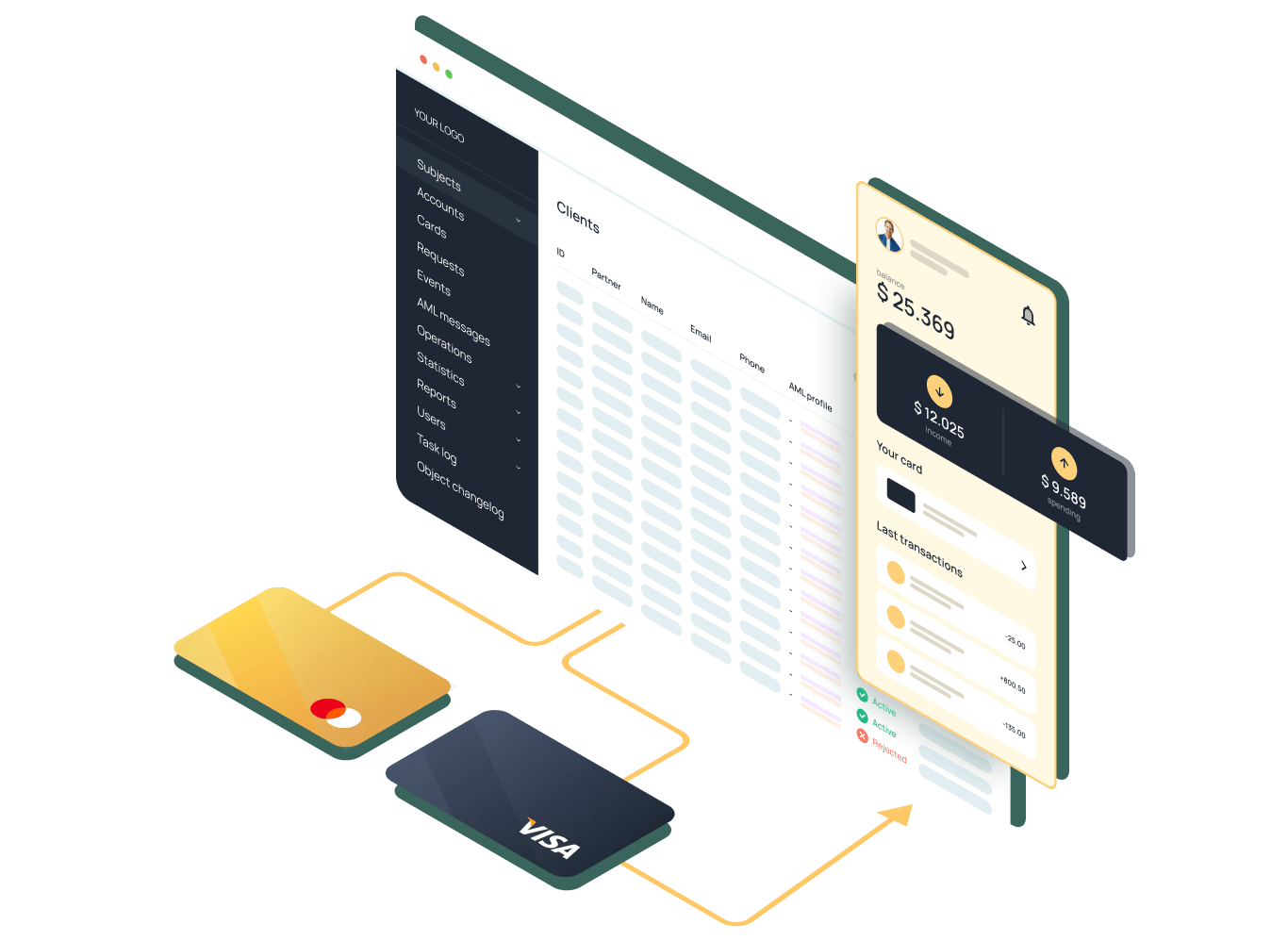

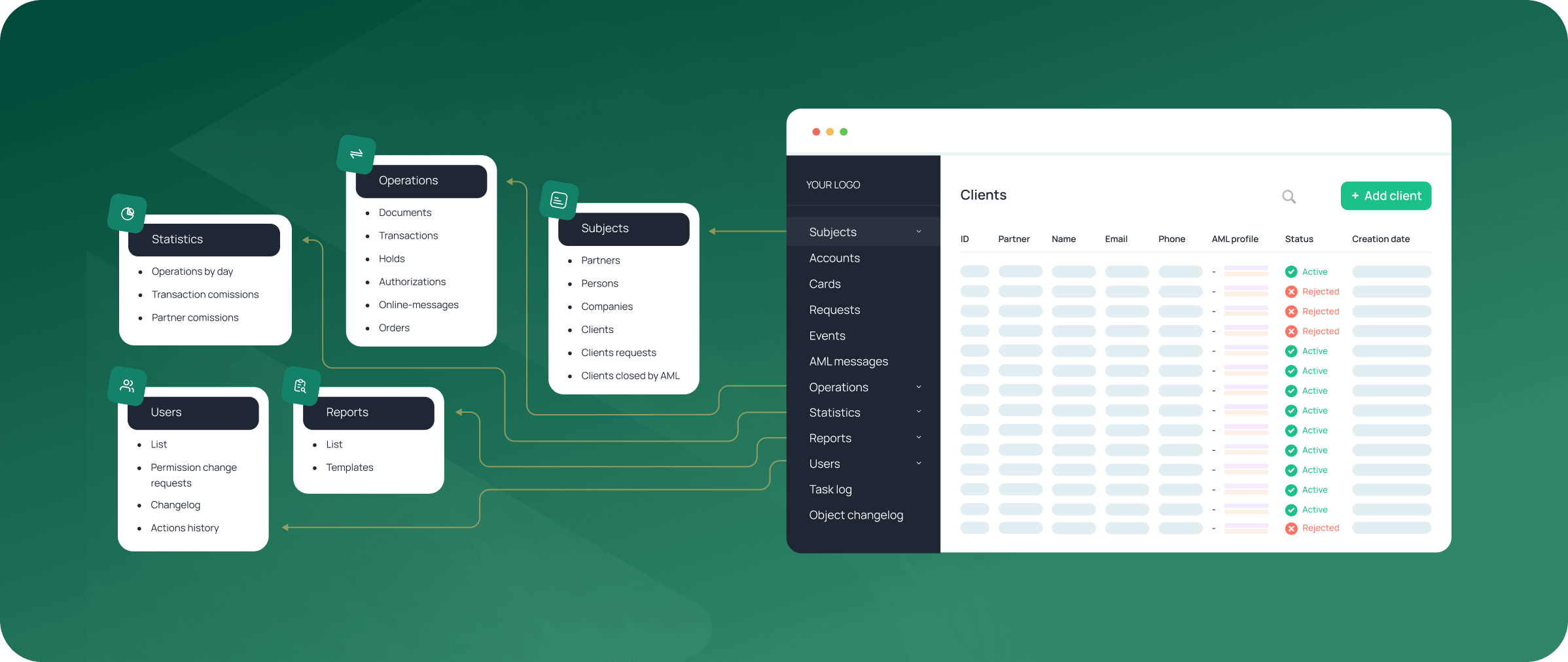

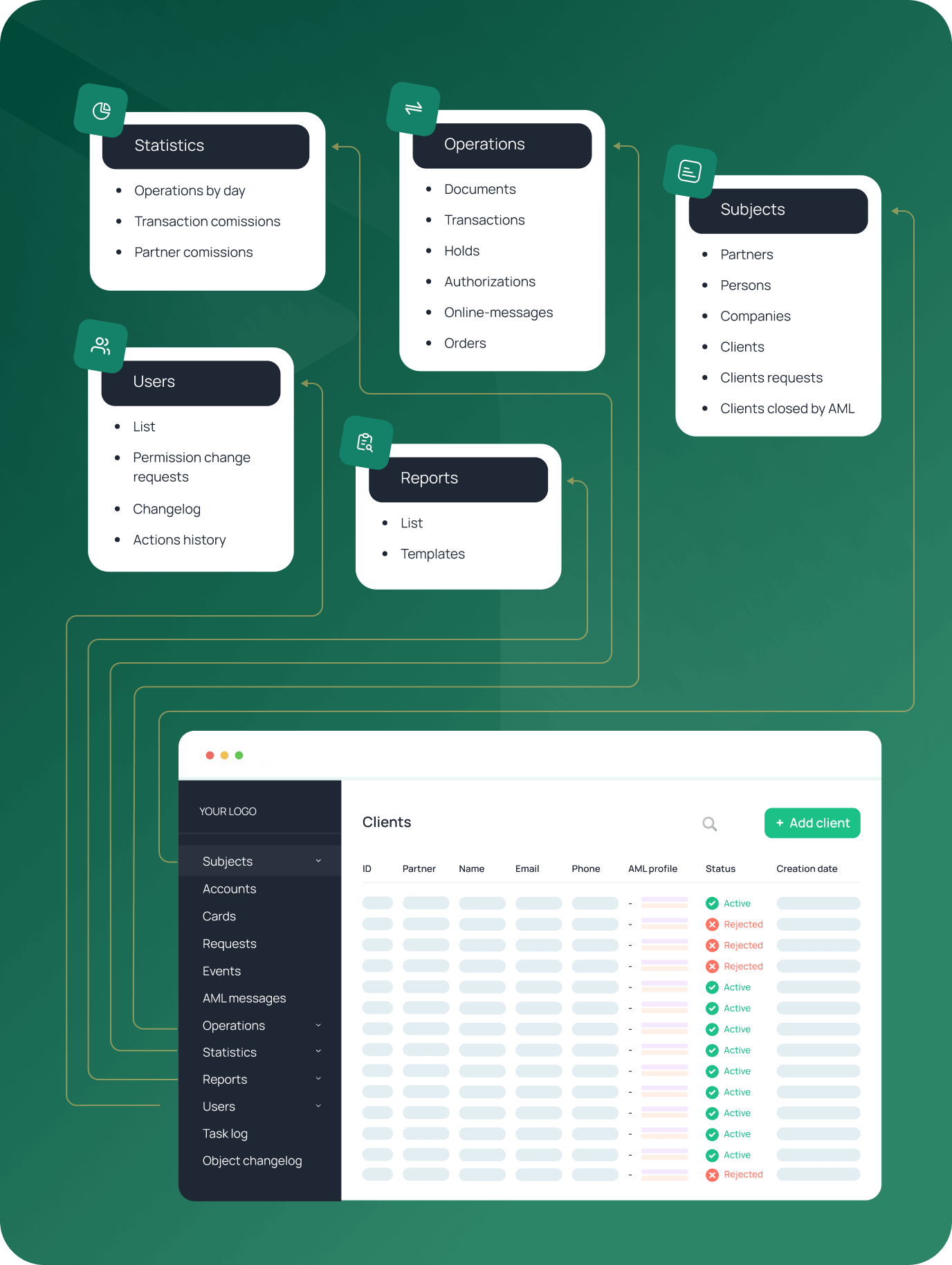

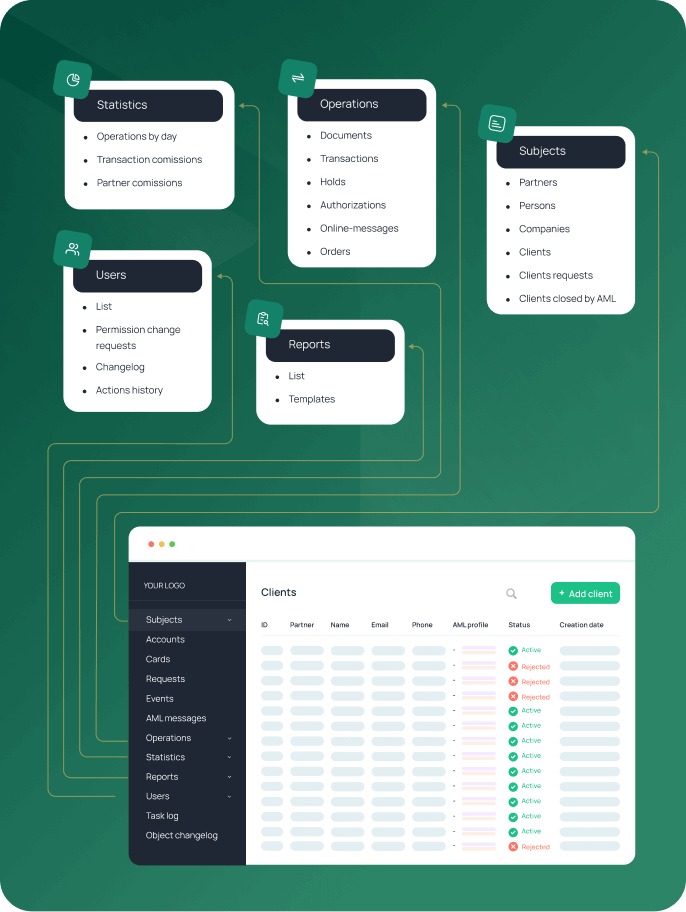

A unified interface

We provide a ready-made back-office for client, account, card, and transaction management simplifying and automating time-consuming business processes.

Headless mode

If you prefer to develop your own back-office or end-client apps, use our powerful API to create solutions that expand your unique values.

Multi-tenant fintech management

We clean you the way to start earning as a BaaS provider for fintechs and brands with a ready-made toolset for companies onboarding and handling.

Independence from software suppliers

Steer clear of sharing your data with cloud BaaS platforms and hosting the software on-premises to reach maximum business autonomy and flexibility.

Ready-made applications

Don’t waste time to win the market. Use our web and mobile apps for end-users, customize them to your specific needs, and provide your fintechs as well as their clients with white-label neobank.

Vendor-agnostic integration

No matter what core banking and issuer processing solutions you use, we’ll ensure a seamless integration with our platform.

Stay flexible from the very start and on

Shape and change your business model as you please with our universal features and compatible products.

Start as an issuer for end-clients and evolve to a white-label BaaS provider when you’re ready, or combine both directions initially.

Serve retail, business clients, and merchants of any size, or focus on a single segment.

Provide your end-clients with a mobile-only neobank application or reach web users with white-label digital banking as well.

Fast onboarding

Increase the number of clients drastically and speed up their onboarding. Reduce the resources of your KYC/AML team with an automated client onboarding solution.

Learn moreMerchant acquiring

Expand the profile of your business in the long run and open the acquiring direction using our trusted all-in-one white-label payment gateway.

Learn moreFor end-clients

Offer digital products your clients wish to stay with

Provide

our white-label application to your own and fintechs’ clients

Add

your own important features with our custom development services

Use

ready-made products or build unique ones with powerful API

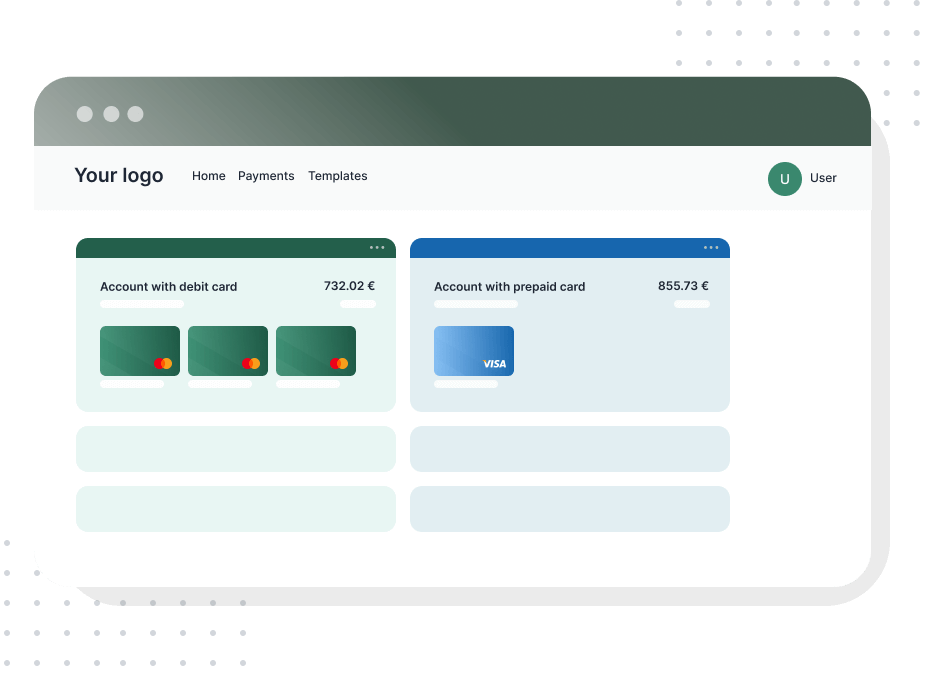

Digital web banking

Accessible to your end-clients. Also, use it to demonstrate API capabilities to fintechs.

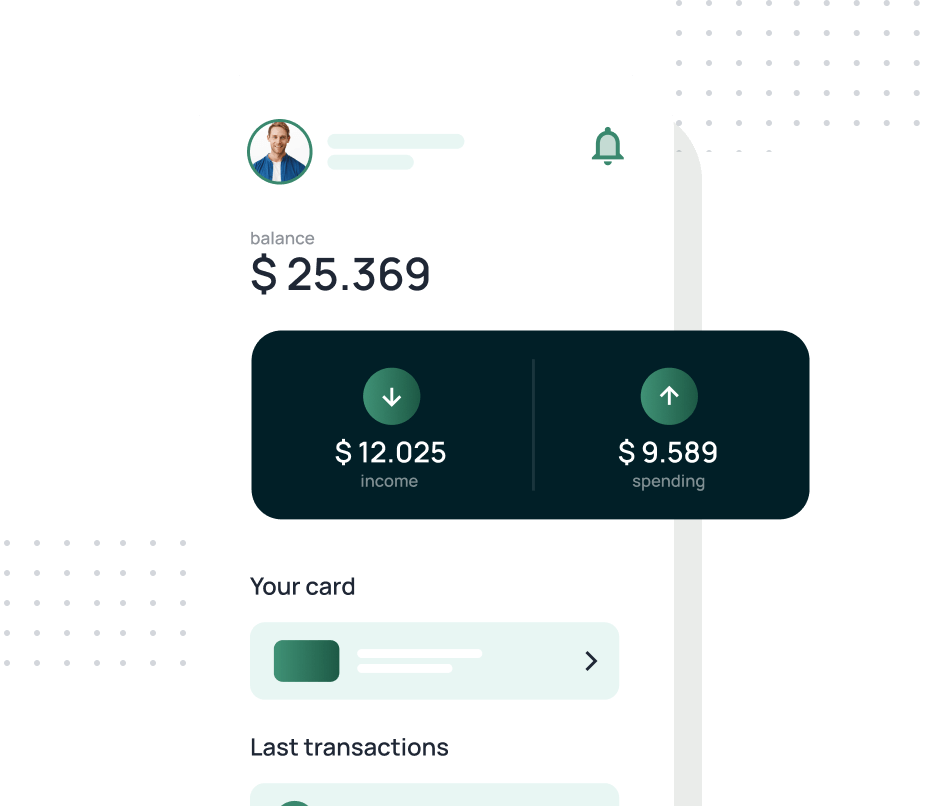

Neobank app

Accessible to your and your fintechs’ clients as a white-label solution.

Core features

Provide a single functionality for retail and business users.

Card management

Allow your end-users to configure their cards as they see fit managing ATM operations, internet purchases, 3‑D Secure, PIN, and more. They can easily issue new virtual cards in an instant, and order physical cards of any type with doorstep delivery.

Account management

Empower account holders with the ability to connect unlimited cards, access account balances, get transaction and commission statements, see authorized and confirmed transactions, and separate available and blocked balances.

Top-ups, transfers, and payments

Give cardholders the ability to transfer funds between their accounts and cards, make SEPA/SWIFT payments to accounts of any bank, and top up accounts from other cards (AFT).

Money transfer templates

Allow your end-clients to save time using templates for regular payments with pre-filled details, update templates, and schedule their payments.

Special options for business clients

Provide your corporate end-clients and merchants with detailed account statements, two-stage payment processing options, batch payouts, and integrations with third-party software for transfer automation.

Neobank features for personal finances

Provide your retail end-clients with wealth management capabilities including investment overseeing and strategizing financial growth. Additionally, ensure access to budgeting, expense monitoring, and tools for establishing fiscal objectives.

Security and fraud prevention

Ensure multi-faceted authentication, incorporating biometric-based logins, and implementing cutting-edge security protocols to safeguard delicate information and prevent any unauthorized access attempts.

Customer support and notifications

Assist your end-clients through in-app messaging and provide users with instant notifications. You can also easily integrate with any third-party client support solution.

For your fintechs

Uncover embedded finance opportunities for fintechs and brands

Become a full-fledged BaaS provider

Provide your fintechs with both financial services and powerful technology for modern product development and white-label card issuance.

Limit access to fintech data

If you deal with licensed and certified companies, they can host client funds and data on their side using only your banking-as-a-platform capabilities aimed to speed up time-to-market.

Enable only headless capabilities

The main solution you offer for partners as a BaaS provider is our unified fintech API that is sufficient to support any innovative product.

Simplify fintechs` development

Your fintechs can be totally flexible in their development using your ready-made white-label neobank app to enter the market in no time, and then change it on their custom solution that operates through your API.

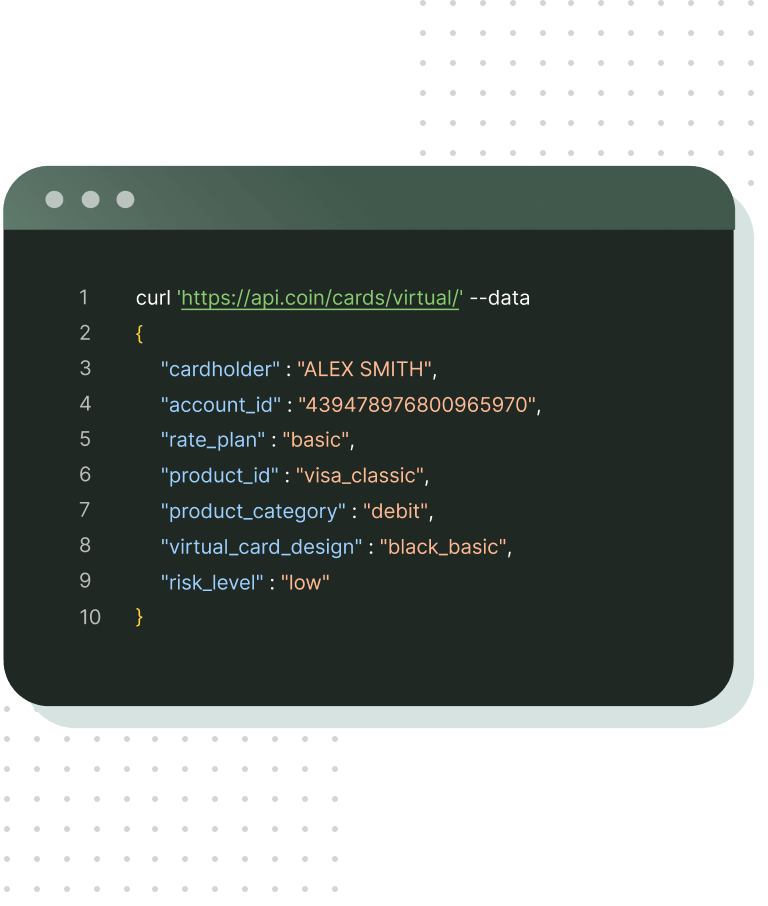

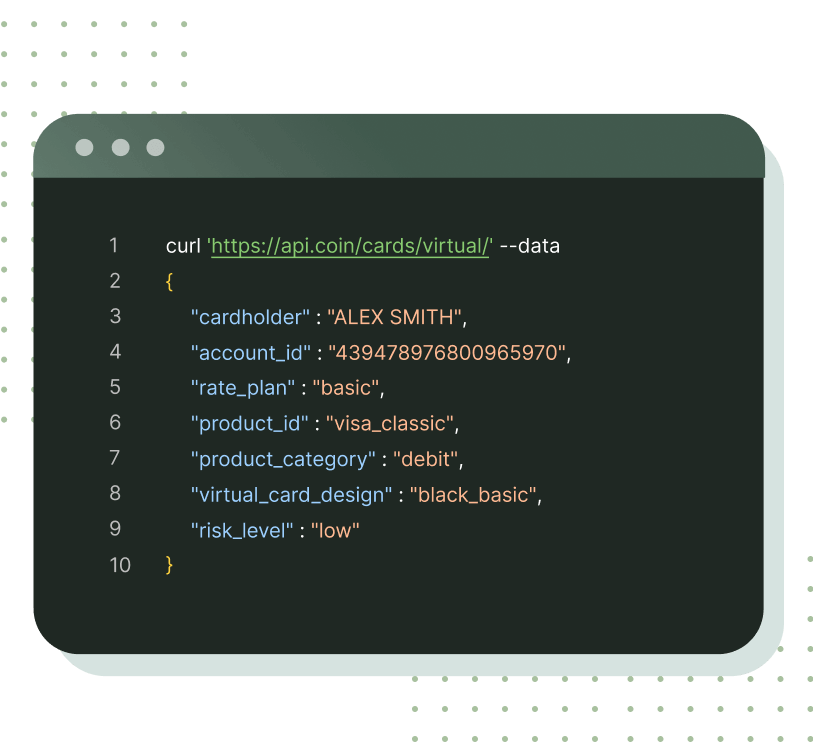

Unified API capabilities

A single interface to develop apps for end-clients and an internal back-office system, covering client, account, card, and transaction management.

Clients

Create, update, deactivate, and reopen retail and business clients, as well as operate with any KYC data.

Accounts

Create, update, deactivate, and archive client accounts, specify their currency, and connect cards.

Documents

Proceed with money orders like transfers between accounts and cards, funds sending, and withdrawing.

Online messages

Get messages about debiting money by acquiring banks along with all acquirer and transaction details.

Card applications

Proceed with requests from clients for new virtual and physical white-label debit cards, and organize issuing and shipping.

Cards

Create new labeled debit cards, update their settings, set up rate plans and rules, activate, block, tokenize, and more.

Transactions

Operate with the list and count of any transaction type, including card clearing, SWIFT/SEPA transfers, etc.

Authorizations and holds

Record all transactions authorized and held by merchants, and retrieve available and blocked customer balances.

For you

Manage most of your business operations from a single window

Automate relations with fintechs

- Onboard new fintechs, set up products, commissions, and all the necessary data without a hitch.

- Create contracts and custom terms for each fintech, and get automatically generated bills to simplify your financial relations with connected businesses.

Get a full-featured suite for KYC/AML

- Grease the wheels of your team with third-party automated products and digital tools for end-client onboarding during in-person communication.

- Set up AML terms for each client and get automated alarms when the rules are broken.

Manage users of your end-client apps

- Provide access for your end-clients to neobank app or digital banking, manually or automatically.

- Manage users and their capabilities in apps with a corresponding back-office section.

Operate with all entities available via API

- Get all the functionality for for client, account, card, and transaction management in a user-friendly web interface.

- Consolidate data from your and your fintechs` products in a single place, and create any configurations with a filter system hands down.

Provide financial team with custom reports

- Track operations by day, keep count of the number and value of transactions of any type, and easily perform reconciliations.

- Get statistics and export reports on all types of fintech activities and commissions.

Engage all your departments

- Use our back-office as an ERP. Create special permissions with our role management system.

- Simplify tasks for the tech team using change logs, connector management interface, and more.

Why choose Boxopay as your white-label card-issuing platform vendor?

Strong expertise

- 13 years of experience

- 5 white-label debit card issuers successfully launched

- Business consulting and support until your first transactions

Tech support

- Turnkey software setup

- 2 times per month system updates

- Integration services

- Infrastructure support

- On-demand tailor-made development

Full compliance

- PSD2

- PCI DSS Level 1

- GDPR and PSD2

- 3-D Secure 2.0