How Payment Orchestration Differs from Payment Gateways

4 August, 2025 12 min read

- What is a payment gateway?

- What is payment orchestration?

- Architecture models to connect gateways and orchestration platforms

- How to choose the right payment software architecture

- Summary

Table of contents:

According to KPMG’s recent research, 93% of financial institutions and 87% of retailers are modernizing payments to meet changing customer expectations and unlock operational efficiencies. The key goal for all these businesses is to get an advanced, flexible, and scalable infrastructure.

That’s where choosing between payment orchestration and gateway becomes an important milestone, as these are two foundational technologies for digital transactions. You’ll learn about their key differences, features, and benefits for your acquiring business.

What is a payment gateway?

A payment gateway serves as the foundational technology enabling merchants to accept card-not-present transactions. It connects the merchant’s checkout environment with the acquiring bank, enabling secure transfer and authorization of payment data. The payment gateway acts as the secure “middleman” between the customer’s bank (issuer) and the business.

Here’s a typical transaction flow in a payment gateway explained.

| Step #1 | The customer enters their card details on a merchant’s checkout page. |

| Step #2 | Payment gateway securely captures this information, encrypts it, and sends it to the merchant’s acquiring bank or processor. |

| Step #3 | The processor routes the transaction request to the appropriate card network (Visa, Mastercard). |

| Step #4 | The card network forwards the request to the customer’s issuing bank. |

| Step #5 | The issuing bank checks for sufficient funds and performs fraud analysis before approving or declining the transaction. |

| Step #6 | Authorization response is sent back through the same chain: from the issuer to the card network, to the acquirer, and finally to the gateway. |

| Step #7 | Gateway communicates the final status (approved or declined) to the merchant’s website, which then displays the result to the customer. |

| Step #8 | If approved, the transaction is added to a batch for settlement, where funds are later transferred from the issuing bank to the merchant’s account, a process that typically takes a few days. |

A standard gateway handles functions such as tokenization, encryption, fraud detection, 3D Secure processing, and delivering the acquirer’s response back to the checkout interface. Gateways also support transaction settlement and refund logic.

However, most traditional gateways offer limited flexibility, often supporting just one acquiring bank. That creates bottlenecks in transaction optimization and limits global reach.

Learn more about the key actors and components of a modern payment ecosystem in our previous article to fully understand the connections between each element. This will help you see the importance of gateways and orchestration.

What is payment orchestration?

A payment orchestration platform is a higher-level technology that integrates multiple gateways, acquiring banks, fraud providers, and value-added services into one unified interface. Its core value lies in optimizing processing costs and increasing transaction conversion rates. For each payment, the platform dynamically selects the bank or PSP with the most competitive fees, reducing expenses for the merchant.

If a transaction is declined, it is automatically rerouted to an alternative provider, significantly improving approval rates. Beyond processing, orchestration manages the full payment lifecycle from routing and retries to reconciliation and reporting.

Here’s payment orchestration explained: merchants gain the power to connect with dozens or even hundreds of providers across regions. These platforms handle intelligent transaction routing, cascading retries, fraud prevention integration, reporting, and reconciliation.

It’s all available while removing the need for complex in-house infrastructure.

Orchestration platforms are ideal for:

- Fast-scaling companies;

- Subscription services;

- Digital platforms;

- Global retailers.

Orchestration platforms simplify backend complexity, provide cost savings, and bring revenue uplift due to higher approval rates.

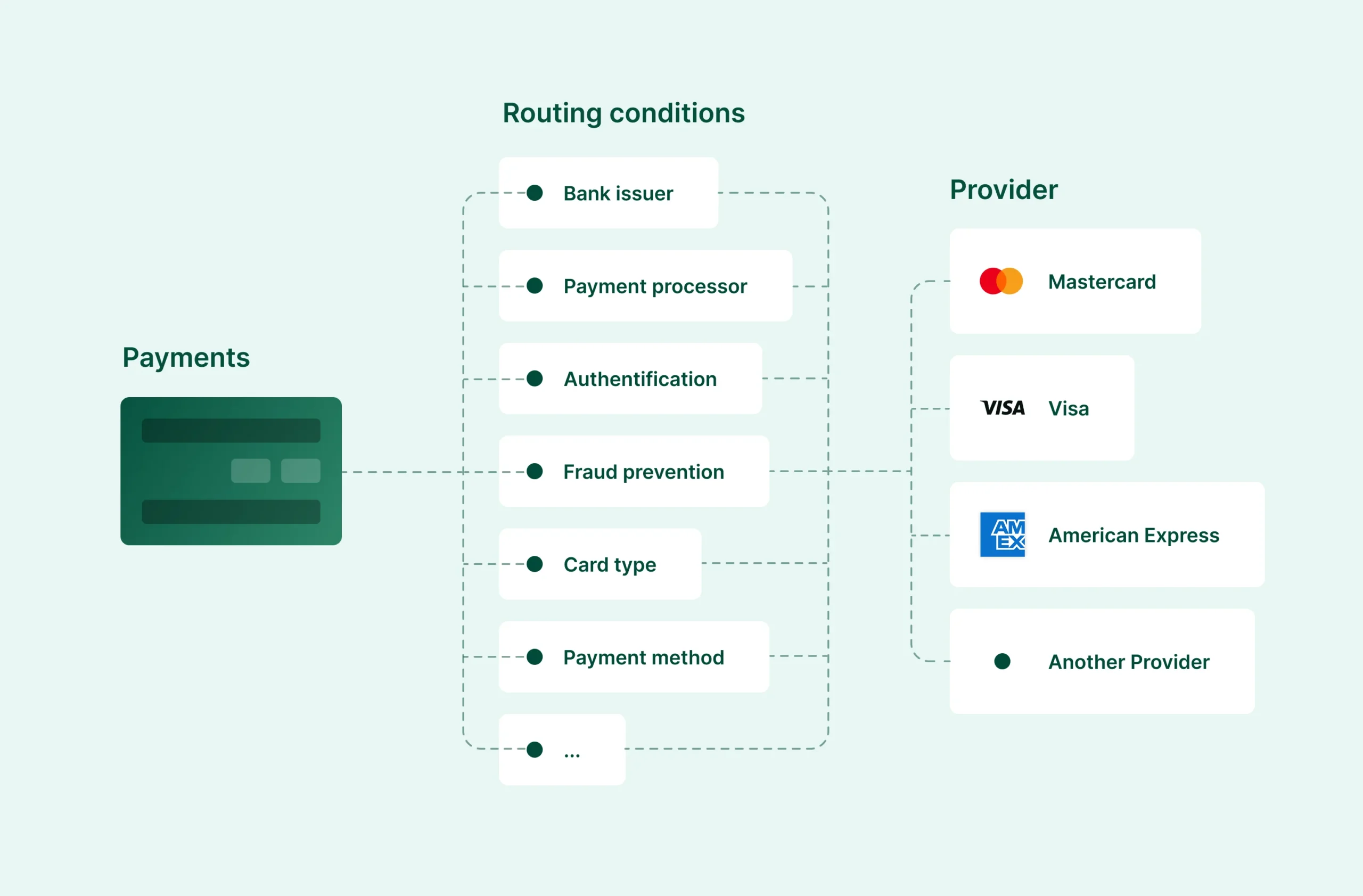

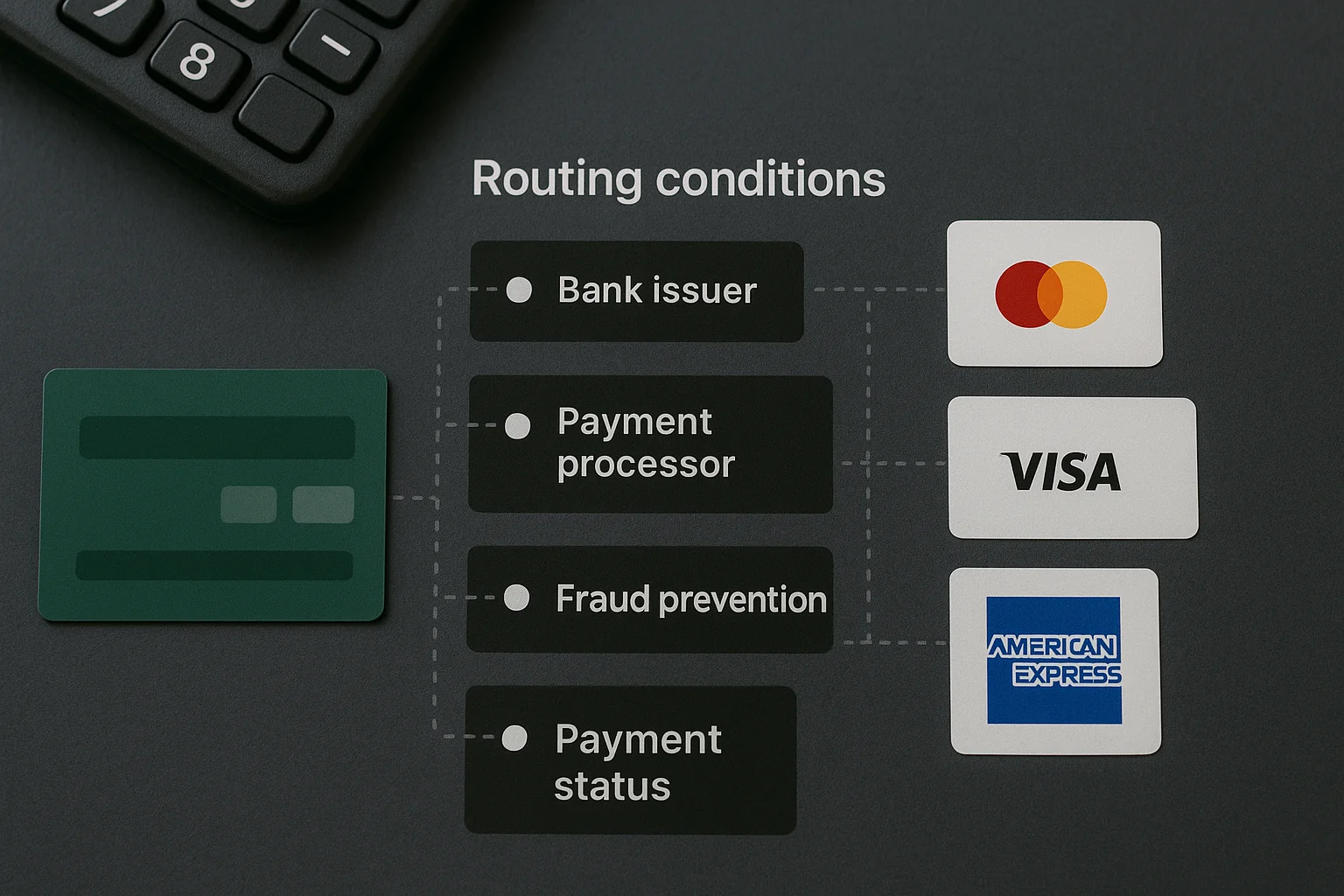

Key feature: payment routing & cascading

Among the most valuable features of orchestration platforms are smart routing and cascading.

Intelligent routing uses a predefined set of rules to automatically direct each transaction to the best payment service provider or acquirer in real-time. This is not a one-size-fits-all process, so the most valuable routes are chosen by analyzing multiple factors:

- Cost;

- Currency;

- Location;

- Historical success rates;

- Compliance needs.

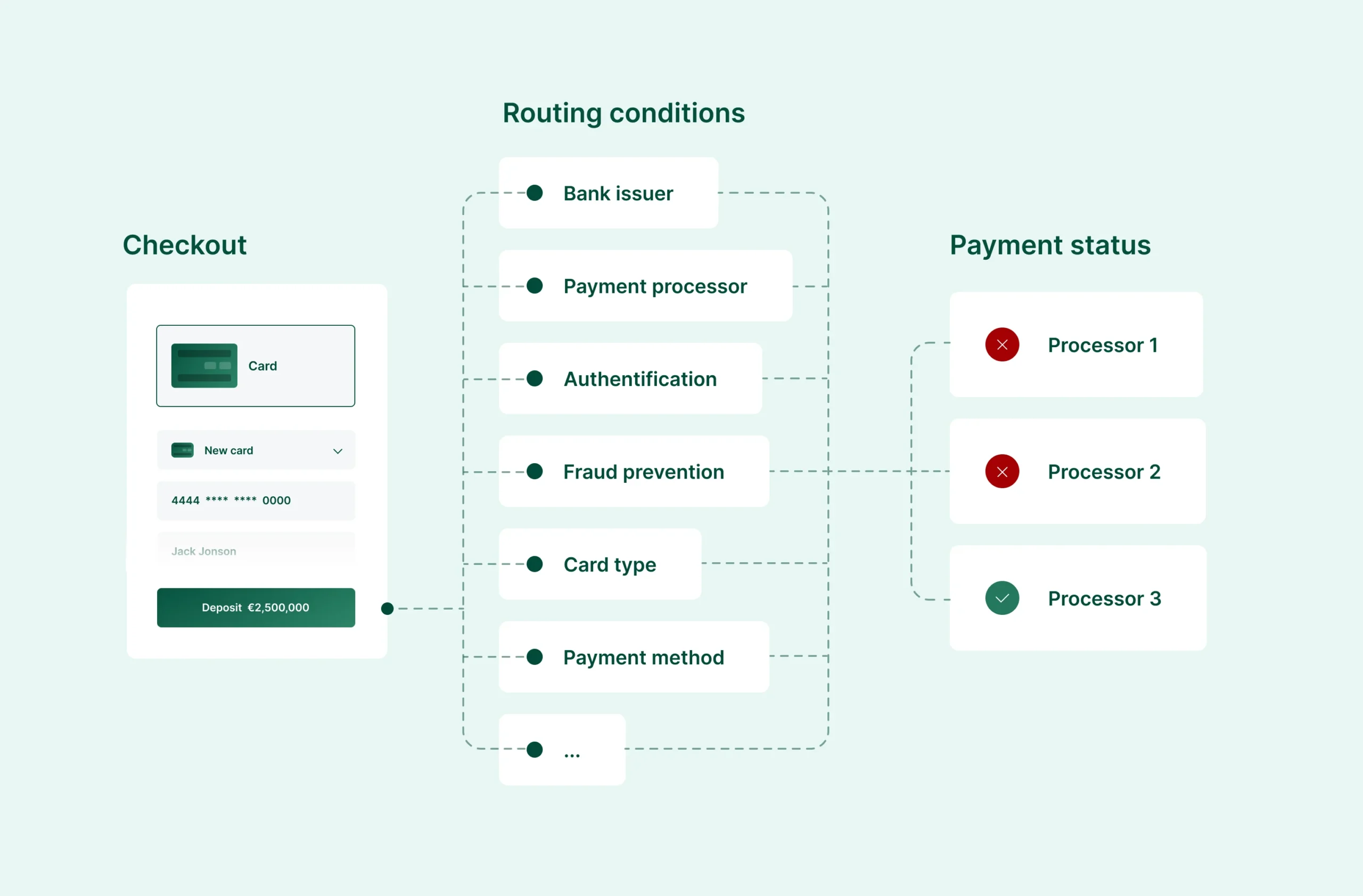

Cascading, also known as failover or smart retries, is the platform’s automated safety net for recovering failed transactions. When a transaction is declined, it is not always due to a lack of funds (a “hard decline”).

Often, it is a “soft decline” caused by a temporary technical glitch, a network timeout, or an overly sensitive fraud filter at the initial processor. With a traditional gateway, this sale is lost. With payment orchestration, the cascading feature automatically and instantly re-routes the same transaction to a second, third, or even fourth backup provider in the merchant’s network.

This entire process is invisible to the customer and happens in milliseconds, saving revenue that could be lost.

Benefits of payment orchestration for merchant business

Adopting a payment orchestration platform is a significant decision that brings many benefits:

- Higher payment approval rates through intelligent routing;

- Lower operational and processing costs with optimized provider logic;

- Accelerated geographic expansion with localized acquiring coverage;

- Stronger fraud and compliance oversight via third-party tools;

- Advanced data visibility through unified dashboards and analytics;

- Reduced vendor lock-in and simplified provider management;

- Improved business continuity with failover systems and retries.

Now that you’ve seen the key differences between payment orchestration vs payment gateway, let’s move on to some more technical information.

Architecture models to connect gateways and orchestration platforms

Understanding the difference between payment gateway and payment orchestration also requires analyzing how these systems are architecturally implemented. There are two primary models for connecting an orchestration layer to the underlying payment gateways and processors, each with distinct implications for a business’s operations, technical infrastructure, and vendor management.

1. Gateway and orchestration platform as separate systems

This is the traditional or “vendor-agnostic” architectural model. In this setup, a pure-play payment orchestration platform acts as a distinct middleware layer. The merchant’s e-commerce platform integrates with this orchestration layer via a single API.

The merchant then independently establishes commercial relationships with various acquiring banks. They “bring their own” processors to the orchestration platform, which then serves as the central hub to manage and route transactions among them.

The primary advantage of this model is its flexibility. A business can mix and match what it considers to be the best providers for different functions: one for card processing in North America, another for APMs in Europe, and many other options.

However, this flexibility comes with significant hidden complexities. The merchant is responsible for negotiating and managing multiple vendor contracts, each with its own pricing structure, settlement schedules, and support contacts. Teams must consolidate disparate reports from each provider to get a complete picture of their financial standing.

2. Monolithic solution combining both

Another approach is the monolithic or “full-stack” architecture.

It’s important to distinguish this from a “legacy monolith,” which implies outdated technology. In this context, a modern monolithic platform is an integrated solution where the payment gateway and the orchestration engine are built and delivered as a single, unified service by one provider. This next-generation platform handles both the core transaction processing and the intelligent optimization.

As monolith providers are full-scale payment institutions, they have more responsibility due to being both IT providers and financial services providers at the same time. They also still have to manage and negotiate multiple vendor contracts, keeping the load from the previous approach.

The benefits of this integrated model are centered on simplicity and efficiency:

- Simplified management: there is only one vendor to manage, one contract to negotiate, one integration to maintain, and a single point of contact for all support needs.

- Unified data and reconciliation: because all transaction data resides within a single system, reporting and reconciliation become seamless. There is one source of truth for all payment activity.

- Reduced technical and operational debt: the merchant effectively offloads the immense complexity of managing and maintaining connections to multiple global acquirers and processors to the platform provider.

Boxopay combines the core processing functions of a robust payment gateway software development solution with the advanced intelligence of a payment orchestration engine.

This monolithic architecture delivers the power of optimization without the operational friction and complexity that exist in the separate-systems model.

Separate Orchestration Layer vs Monolithic Architecture

Let’s take a look at the main difference between payment gateway and payment orchestration based on their architectural approach.

| Feature | Separate Orchestration Layer (Middleware) | Integrated Platform (Monolithic) |

|---|---|---|

| Integration Complexity | Single API to the orchestrator, but high operational complexity in managing underlying providers. | Single API to a unified platform, simplifying both technical and operational integration. |

| Vendor Management | Merchant manages multiple contracts, relationships, and fee schedules with each PSP. | Merchant manages a single relationship with the platform provider. |

| Reconciliation | Complex and manual; requires consolidating reports from multiple disparate systems. | Streamlined and automated; all data is in one system with unified reporting. |

| Data Visibility | Fragmented. A full-scale view requires significant data aggregation efforts. | Centralized. Provides a complete real-time view of all payment activity. |

| Technical Overhead | Lower initial development but high ongoing operational overhead. | Higher reliance on a single provider, but significantly lower internal overhead. |

| Speed to Market | Can be slowed by the need to establish individual processor relationships. | Faster, as the platform has pre-existing connections to a global network of acquirers. |

| Ideal User Profile | Large enterprises with dedicated payment teams and a desire for maximum provider diversity. | Businesses of all sizes seeking the power of orchestration without the operational complexity. |

How to choose the right payment software architecture

Choosing between a payment orchestration vs traditional gateway depends on your business size, complexity, region, and growth ambitions. Let’s see the key options.

1. Gateway-based PSPs (bank-centric providers)

These providers operate with one or two acquiring partners and are often backed by traditional banks. Their technology stacks are often inflexible but offer reliability. They’re suitable for local businesses, brick-and-mortar stores, or low-volume merchants with no need for dynamic routing.

Some operate under EMI licenses and intend to become full acquirers. While cost-effective in limited use cases, they lack scalability, and failure rates can be higher due to the absence of cascading logic. Boxopay’s white-label PSP solution is a great choice to mitigate these issues and get the most out of your gateway.

2. Orchestrator-based providers (merchant-centric models)

Orchestrator-based providers are generally divided into two separate categories.

Full-scale payment orchestrators

Full-scale payment orchestrators are tech companies specializing in orchestration only. They don’t process payments directly but offer routing logic, dashboards, fraud integrations, and hundreds of PSP connections.

This suits tech-savvy and international merchants seeking maximum control and flexibility. Such companies typically have dedicated payment teams, the leverage to negotiate direct deals with multiple global acquirers, and the resources to manage those complex relationships.

PSPs with payment orchestration capabilities

These providers are licensed PSPs that both process payments and offer a built-in orchestration layer. They maintain their own network of global acquiring relationships. When a merchant partners with them, they get access to this entire network and the intelligent routing capabilities to optimize it through a single integration and contract. This is the “all-in-one” merchant-centric model.

This solution is ideal for a broad range of businesses like fast-growing startups, businesses seeking for scale-up, and enterprises that want fewer integrations and quicker deployment. Boxopay’s SaaS payment gateway offers limitless scaling and evolution capabilities with all these features.

Full-scale orchestrators vs PSPs with orchestration features

Below is a comparison sheet covering the key features of both options.

| Category | PSP (Payment Service Provider) | Payment Orchestrator |

|---|---|---|

| Regulatory Status | Licensed financial institution (EMI, PI, PSP license). | Not a licensed financial entity (typically a tech platform). |

| Fund Handling | Can hold, settle, and disburse funds. | Does not hold or control funds — only routes instructions. |

| Transaction Processing | Handles authorization, settlement, clearing. | Routes transactions to PSPs/acquirers — does not process directly. |

| KYC / Compliance | Performs KYC/KYB, AML, and regulatory checks. | Not responsible for KYC — relies on integrated PSPs. |

| API Access | Typically offers one payment method/acquirer per integration | Single unified API to multiple PSPs, acquirers, payment methods. |

| Smart Routing | Limited — usually static. | Core feature — supports dynamic routing, retry logic, failover. |

| Analytics / Reporting | Basic — tied to its own transactions. | Aggregated analytics across multiple PSPs. |

| PCI DSS Requirements | Must comply (if handling card data). | Must comply (if handling or transmitting cardholder data). |

| Chargeback Management | Handles chargebacks and disputes. | No direct involvement in chargebacks — relies on PSPs. |

| Settlement & Payouts | Can perform payouts and merchant settlements. | Cannot initiate payouts — delegates to PSPs. |

| Customization | Limited — productized stack. | Flexible orchestration logic, business rules, A/B routing. |

| Example Providers | Stripe, Adyen, PayPal, Fondy, Wayforpay. | Spreedly, Primer, Corefy, Paydock, ProcessOut. |

3. Middle-tier providers: ISO & PayFacs

A critical and often overlooked segment of the market consists of payment intermediaries like:

- ISO: a third-party company that acts as a sales agent for acquiring banks, signing up merchants for payment processing services;

- PayFac: operates a master merchant account and onboards smaller businesses as “sub-merchants” under its umbrella, simplifying the onboarding process for them.

The business model of an ISO or PayFac is built on their network of acquiring partners and their ability to offer competitive pricing and value-added services to their portfolio of sub-merchants.

They need the power of orchestration to efficiently route transactions for their clients, manage complex fee structures, and provide unified reporting.

However, a public, multi-tenant orchestration platform is unsuitable for them. Using such a platform would expose their private network of banking relationships to a third-party vendor, damaging their competitive advantage. Furthermore, standard platforms often lack the specific features needed to manage complex sub-merchant hierarchies and billing.

That’s where Boxopay’s private payment orchestration platform helps. It’s a solution that can be deployed on-premises and provides complete control and confidentiality. You’ll leverage the power of an advanced orchestration engine while keeping your provider network, merchant data, and business logic entirely within your own environment.

Summary

The difference between payment gateway and payment orchestration is both technical and strategic. Gateways focus on executing payments, while orchestration platforms focus on optimizing and managing the entire payment experience. Choosing the right option depends on your scale, geographic reach, and infrastructure needs.

Boxopay’s white-label payment gateway and payment orchestration platform are designed to meet the needs of your business with any strategy. Your payment infrastructure will be supported with scalable infrastructure, rich features, and maximum security. Contact us now for a free consultation!

Contact our top experts

to pick products and services that fit your business needs

Schedule a meeting