Get ready for new market opportunities, fast and hassle-free

We empower the existing infrastructure of change-making banks with a holistic user-friendly REST API, merging in-demand services into a single multi-tenant platform to provide a modern financial experience for your current and new customers.

Gain a multi-functional API Platform

Launch new fintech projects and provide a wide range of modern solutions, improving and enriching your existing services.

Save time and money on software development

Get a ready-to-use cost-effective solution that’s integrated with top banking software along with expert support in implementation.

Stay free from third-party platforms

Host our software on your own infrastructure and become a modern tech-prepared BaaS API provider.

Reach market leadership

Evolve your market fit in the emerging niche of embedded finance and digital banking.

Expand your target audience

Turn your competitors into partners, providing you with new customers. Create value for new B2C, B2B, and B2B2X segments.

Increase your revenue

Improve and scale your services for existing customers, growing their lifetime value.

Expand the range of your clients

Start providing banking-as-a-service solutions, both for your end clients and business partners

Deliver a wide range of modern banking and payment services

Private and business accounts

Multi-currency

IBANs

Virtual and physical cards

SEPA and

SWIFT

Automated KYC onboarding

Payment gateway

for acquiring

Fraud prevention

AML

Compliance

Full-featured

back-office

Custom tariffs

Card issuing

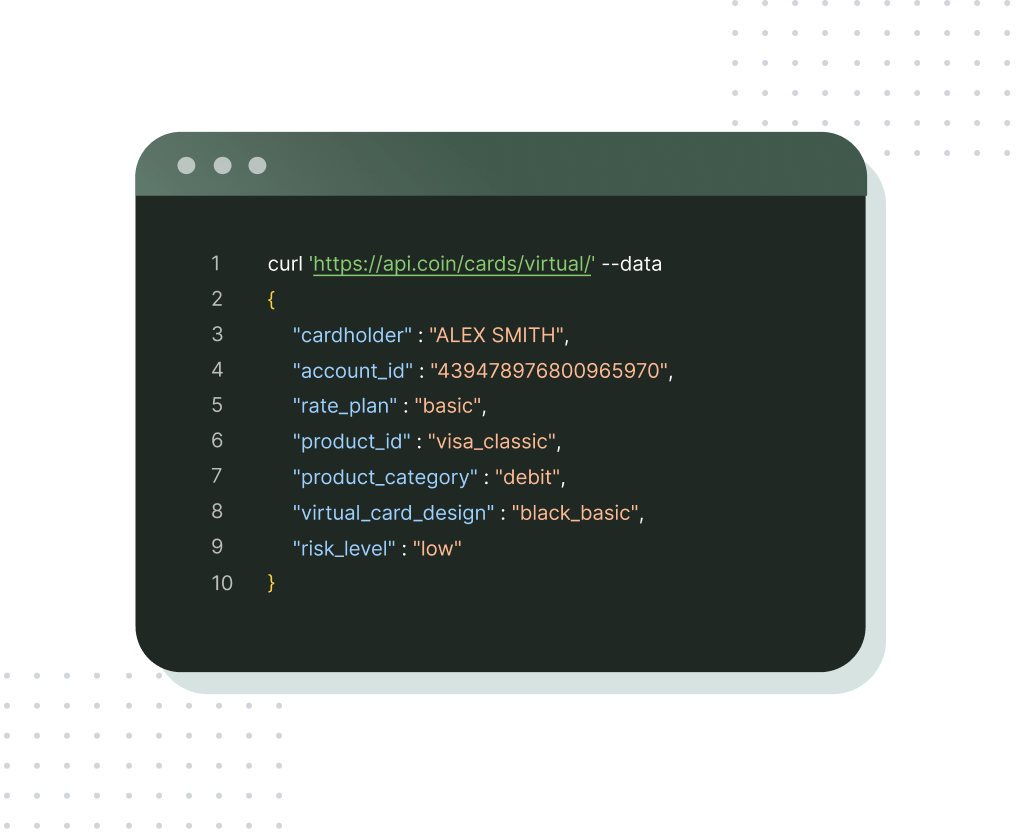

Become a state-of-the-art issuer and BaaS API provider

Use our multi-tenant embedded finance software to easily launch your own unlimited fintech projects and engage other fintechs, large brands, and digital products.

Enable connected businesses to launch white-label card programs, build unique financial products, and get to market faster.

Bring all your fintechs` needs to life with a unified API

- Let your fintechs create outstanding digital banking applications for end-clients with features that fully meet their expectations.

- Grease the wheels of your sponsored fintechs and brands and help them create internal back-office systems and deal with new client onboarding, card and account management, as well as authorization and transaction processing from a single interface.

- Provide them with all the data to build any type of dashboard and analytical system.

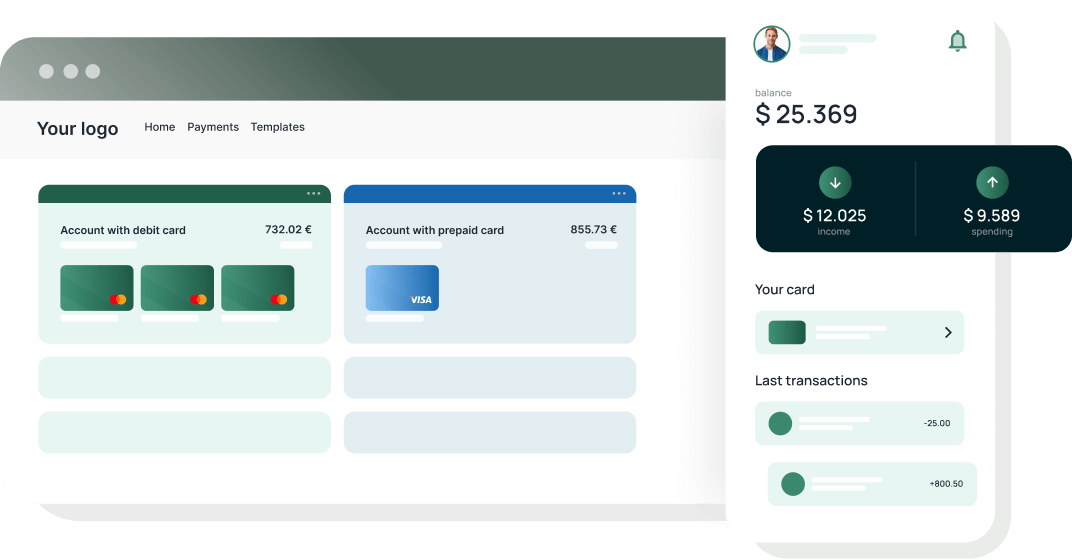

Make white-label online banking apps your exceptional value

Mobile neobank

Deliver your end-users a full-featured mobile-only neobank solution. Resell it to your sponsored fintechs as a white-label solution to speed up their development.

Digital web banking

Use our digital banking web application to demonstrate API capabilities for fintechs or enhance your current value proposition for end-clients.

- Any card scheme

- Any money transfer method

- Top-up via AFT

- Multicurrency

- Virtual and physical cards

- Debit and prepaid cards

Single functionality for retail and business clients

Fast onboarding

Utilize our additional functionality to automate your KYC onboarding process and ensure online registration in a few minutes for end-clients of any type.

Card and account management

Let your clients open and manage accounts in multiple currencies, order and connect unlimited virtual and physical cards, create personal settings, as well as access balances and statements.

Money transfers and payments

Give cardholders the green light for easily transfering funds between accounts and cards, making payments to any bank, and topping up accounts via card-to-card transfers. Enhance end-client efficiency with payment templates and scheduling.

Simple business operations

Expand your corporate end-clients’ and merchants’ capabilities with comprehensive account statements, dual-stage payment processing, batch payouts, and seamless third-party software integrations for automated transfers.

Customer support

Assist clients via in-app messaging, deliver instant notifications, ensure secure authorization and personal data storage.

Personal finance options

Offer retail end-clients wealth management tools for investment oversight, and financial growth strategies. Additionally, provide budgeting, expense tracking, and tools to set fiscal goals.

Disregard infrastructure modernization with add-on software

Our platform seamlessly integrates with your existing core banking and issuer processing software so you don’t have to modify your existing capacities.

You can enhance your current business management ecosystem using our platform headless mode or organize your business processes with our ready-made back-office.

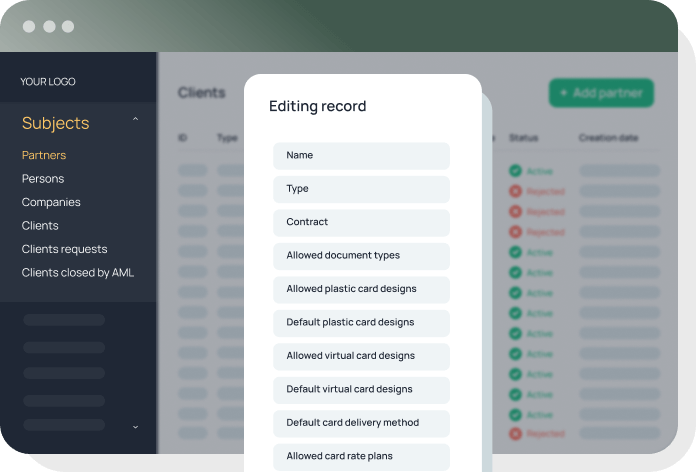

A single back-office

for fintech and banking operation management

Fintech management

Onboard fintechs, configure their products, commissions, and essential data with no sweat at all. Generate contracts and personalized terms for each fintech, streamline financial interactions using automated billing, access comprehensive statistics and exportable reports on fintech activities.

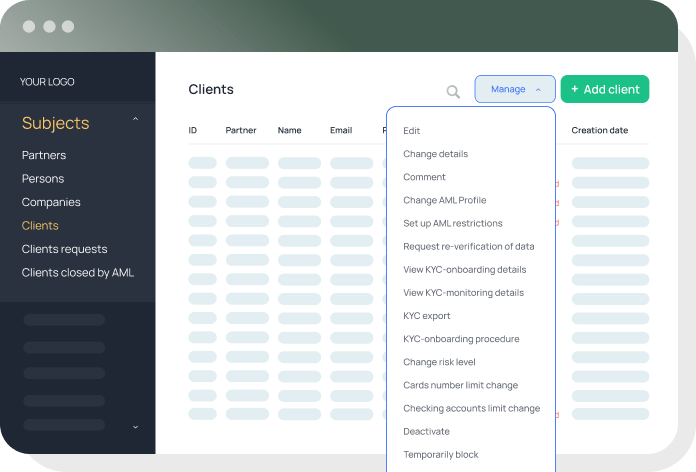

Client management

Manage retail and business end-clients, handle KYC data, and streamline onboarding during in-person interactions or with third-party automation tools. Establish AML terms, and receive automated alerts for rules violation. Account for AML-closed clients and ask active ones to update their personal data.

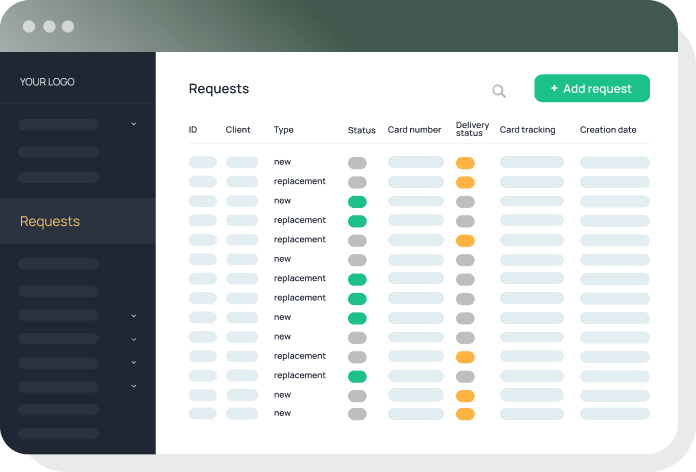

Card and account management

Handle client requests for debit cards, manage issuance, shipping, and account operations. Customize card settings, currency, rate plans, rules, activation, blocking, and tokenization effortlessly.

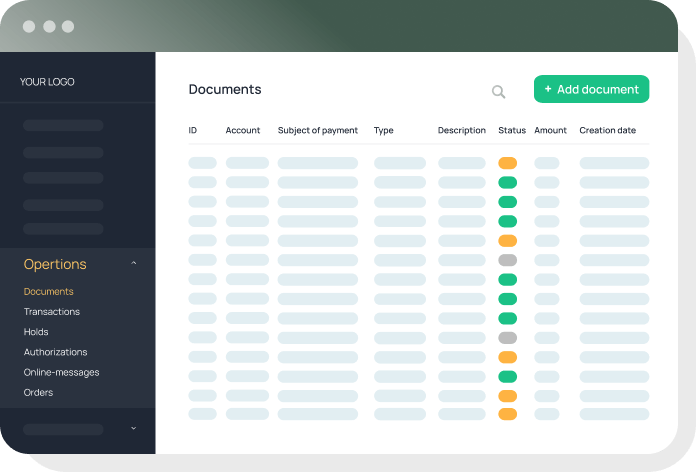

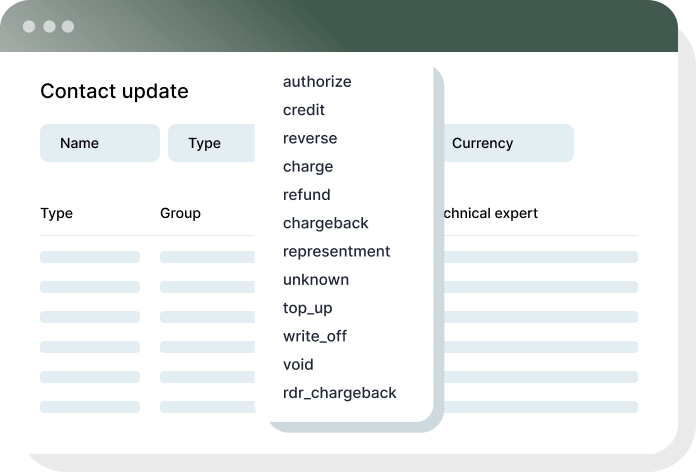

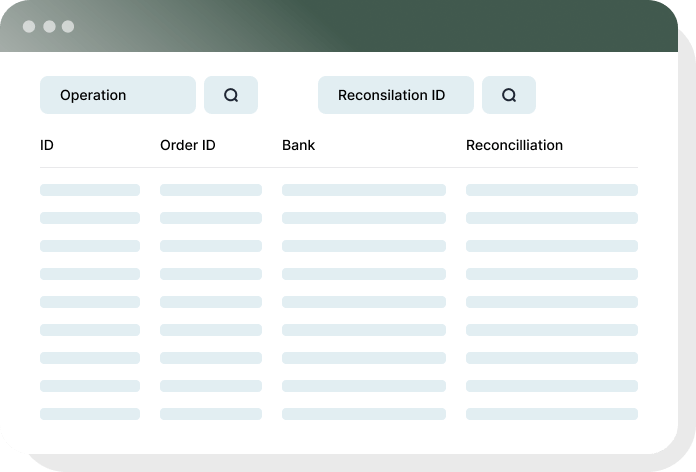

Operation management

Record all the data about your and your fintechs’ clients’ events, transaction requests, transfers, orders, and payments. See the real-time statuses of each transaction, consider authorizations, holds, and online messages from acquiring banks.

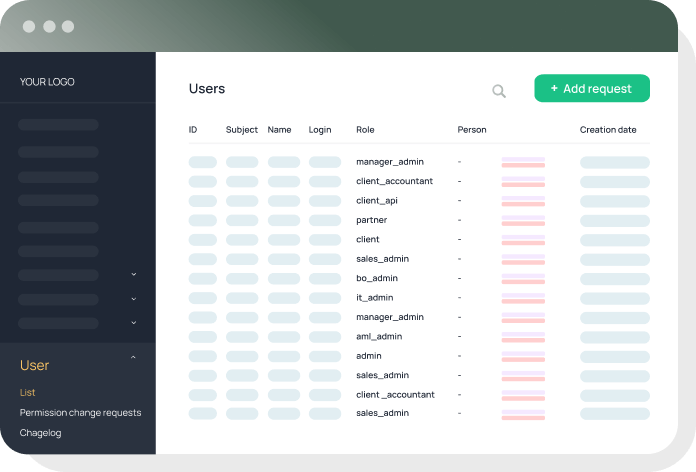

User and role management

Grant end-clients access to neobank apps or digital banking, either manually or through online registration. Manage your back-office users and their specific role capabilities.

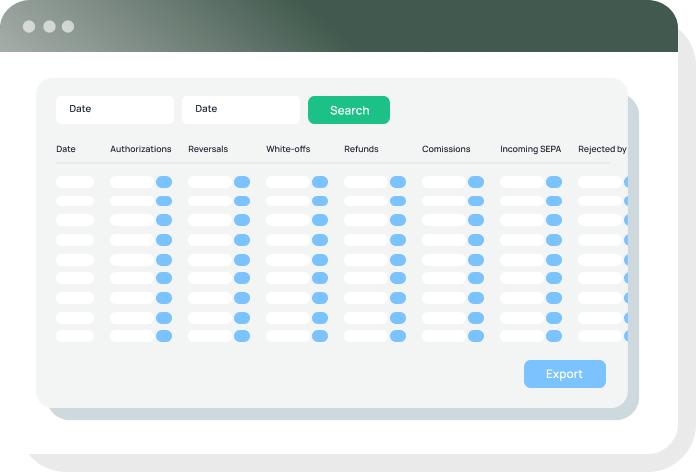

Analytical reports

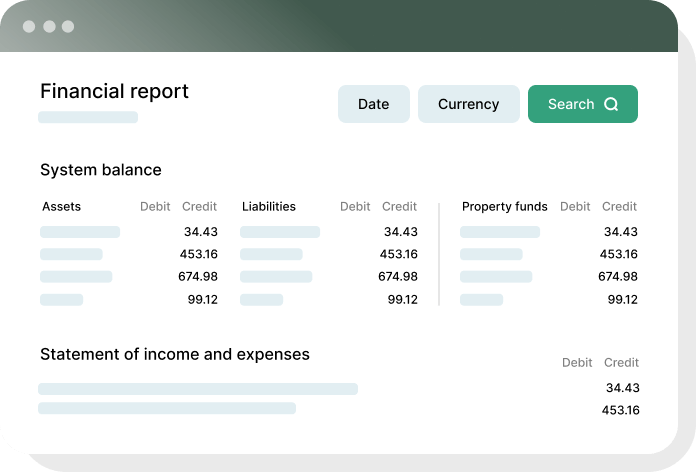

Monitor daily operations, tally transaction counts and values across all types, simplify reconciliation processes and other routine for your financial and customer support departments.

Merchant acquiring

Make your business clients totally satisfied with an all-in-one merchant acquiring solution

Engage merchants of any size and type, from PSP to fintech game-changers

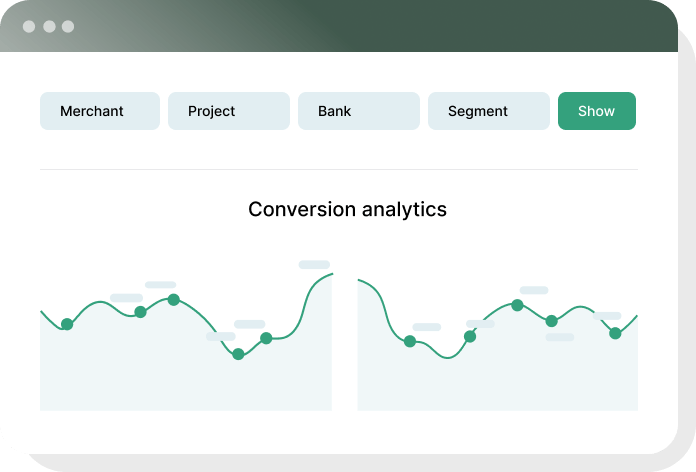

Increase your and your merchants’ revenue and payment conversion rate while keeping your business risks low with our strong tech solution, which includes a smart cascading and AI-powered fraud prevention system

- Powerful merchant portal

- Customizable payment page

- AI-powered antifraud

- Robust API

- Multicurrency

- Fast onboarding

- 3-D Secure payments

- Payment without CVV

- Recurring payment

- Payments by link

- One-click payments

- OCT payouts

- AFT payments

- Split payments

Advanced management capabilities for merchants

A powerful toolkit for automating bank routines

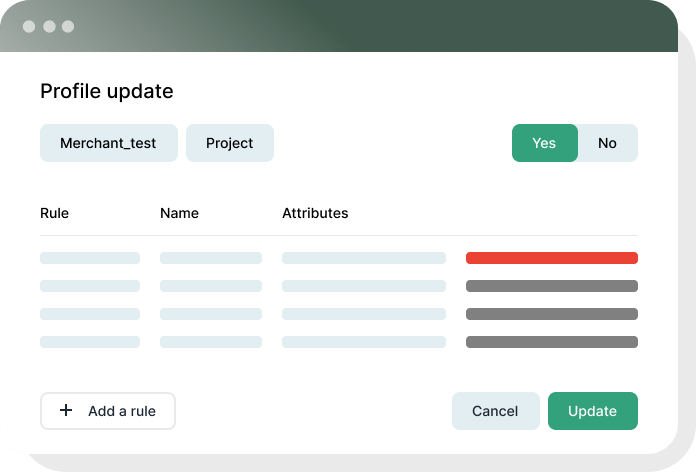

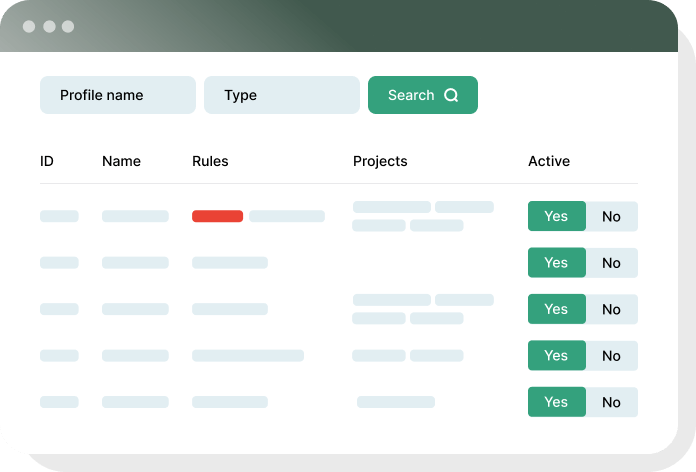

Limits engine

Ensure that your transactions automatically comply with the conditions you define in agreement with your merchant. Set up groups of customizable rules, fulfillment of which reject the payment or send it for 3-D Secure processing.

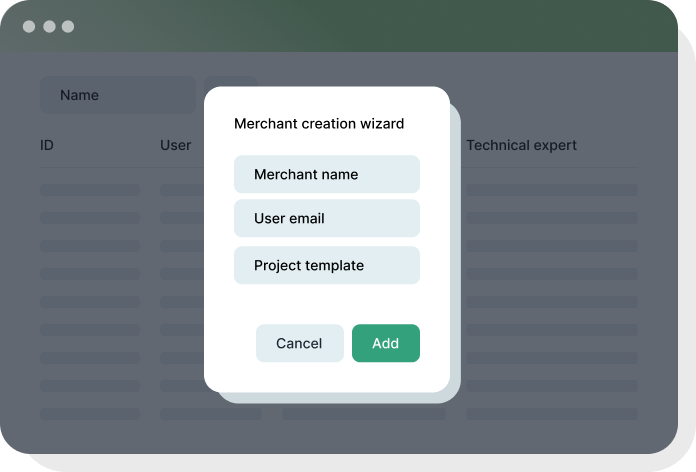

Merchant management

Automate getting and operating of all required documents and data for merchant validation and onboarding in a digital suite, create new merchant projects or terminals, and track orders.

Risk management system

Ensure that your transactions automatically comply with the conditions you define in agreement with your merchant. Set up groups of customizable rules, fulfillment of which reject the payment or send it for 3-D Secure processing.

Contracts and hold accounts

Automate getting and operating of all required documents and data for merchant validation and onboarding in a digital suite, create new merchant projects or terminals, and track orders.

Reconciliation

Set up simple and clear manual or automatic reconciliation for multiple projects, payment methods, and currencies.

Financial accounting

Empower your back-office team with control and reporting tools for double-entry accounting. Use a set of accounting reports.

Analytics dashboard

Monitor your and your merchants’ business performance in real-time. Get exhaustive statistics about conversion rates, orders, chargebacks, cash flows, acceptance rates, and payment methods.

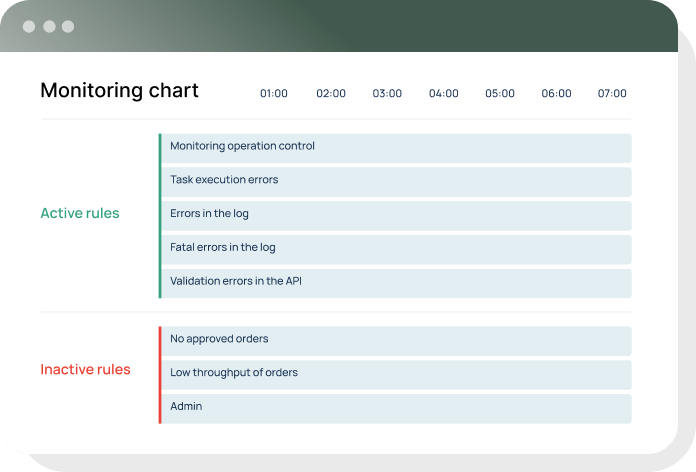

Monitoring system

Detect errors and decreases in the conversion of payment in real-time with a smart notification system that matches your custom settings.

Why choose Boxopay as your transformation partner?

Strong expertise

- 13 years of experience

- Business consulting and support until your first transactions

Tech support

- Comprehensive software setup with 0 cost

- 2 times per month system updates

- Integration services

Full compliance

- PCI DSS Level 1

- GDPR and PSD2

- 3-D Secure 2.0