Building IT Infrastructure for Acquirers

23 December, 2024 13 min read

- Approaches to building IT infrastructure for acquirers

- Acquirer business software: what to consider

- Step-by-step acquirer IT infrastructure launch process

- How can Boxopay help you set up acquirer IT infrastructure?

- FAQ

Table of contents:

In our previous article, we shared how to start an acquirer business in 2025. This process is based on multiple complex steps that require detailed planning and a stringent approach. One of these steps is acquirer IT infrastructure deployment, which determines your business’s technological foundation.

Boxopay’s team prepared a step-by-step acquirer infrastructure setup guide to help you create the right solution with minimum hassle. Read on to learn about the types of solutions, the required steps, and how to make it all work for your business.

Approaches to building IT infrastructure for acquirers

Setting the appropriate infrastructure is a foundational decision that impacts all your future operations. Based on the current market’s trends, there are two ways for acquirers to establish their IT infrastructure:

- Building a solution from scratch

Acquirers can develop their payment processing infrastructure independently. This approach provides them with full control over the solution but requires significant expertise and resource investment. Moreover, it takes more resources to maintain the solution in the future.

- Using a white-label payment gateway

Many acquirers use white-label gateway solutions, making launching payment services easier. These gateways allow them to bypass the complexity of building infrastructure from scratch, offering a pre-configured platform that can be tailored to their brand.

It’s also necessary to note that there are two key acquirer system deployment strategies, both coming with their own pros and cons. We’ll cover them next.

#1. SaaS solutions

The Software as a Service model dominates the market. In this setup, the payment gateway is hosted and managed by the vendor. Acquirers benefit from rapid deployment, lower initial costs, and reduced responsibility for ongoing maintenance.

However, this approach may not always be suitable for acquirers. It often does not meet the requirements for principal licensing, which mandates that acquirers have their own PCI DSS Level 1 certification. Vendors typically do not provide their PCI DSS certification for such cases.

Additionally, SaaS gateways often offer limited functionality, which may be insufficient for managing back-office operations comprehensively. This restricted feature set can fail to meet the full range of an acquirer’s operational needs.

#2. On-premises deployment

An alternative is on-premises deployment, where the acquirer hosts and manages the white-label software within its infrastructure. Unlike SaaS, this model offers complete control over data, system configuration, and compliance. However, it requires acquirers to meet critical prerequisites. One of these is obtaining PCI DSS Level 1 certification, which ensures the secure handling of payment data. You’ll also have to keep in mind the costs of setting up a server infrastructure and maintenance needs.

Acquirer business software: what to consider

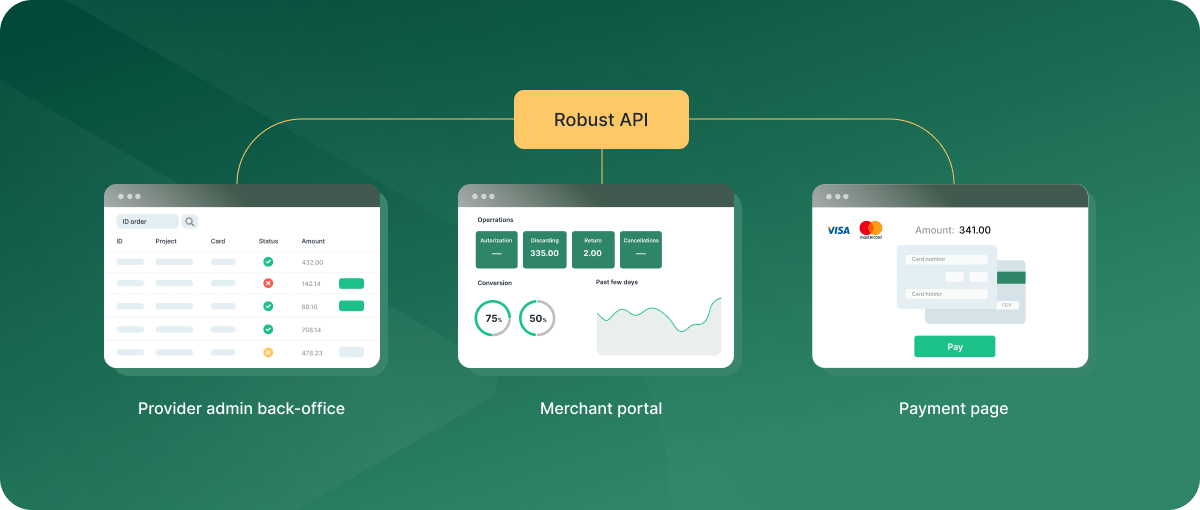

As an acquirer, you’ll need high-quality and flexible software to enhance your operations and make them more convenient. This includes a merchant portal, a customizable payment page, and a provider back office. While they may seem insignificant at first glance, they’re a foundational element of your business. All these are provided by Boxopay’s solutions for acquirers.

Let’s take a closer look at the merchant-facing applications you’ll need.

1. Merchant portal

A merchant portal allows your clients to maintain full control and visibility over transactions and business activities. This typically includes several features:

- Transaction management with real-time insights into payments, chargebacks, and settlements;

- Onboarding automation that enables merchants to complete KYC procedures and set up accounts without delay;

- Reporting tools with detailed information on trends, cash flows, and chargeback metrics;

- Multi-currency support for international merchants;

- Customizable settings to adjust transaction rules, dynamic descriptors, fee structures, etc.

It’s an all-in-one place to accelerate merchant processes. You can get all these features with Boxopay’s software for acquirers.

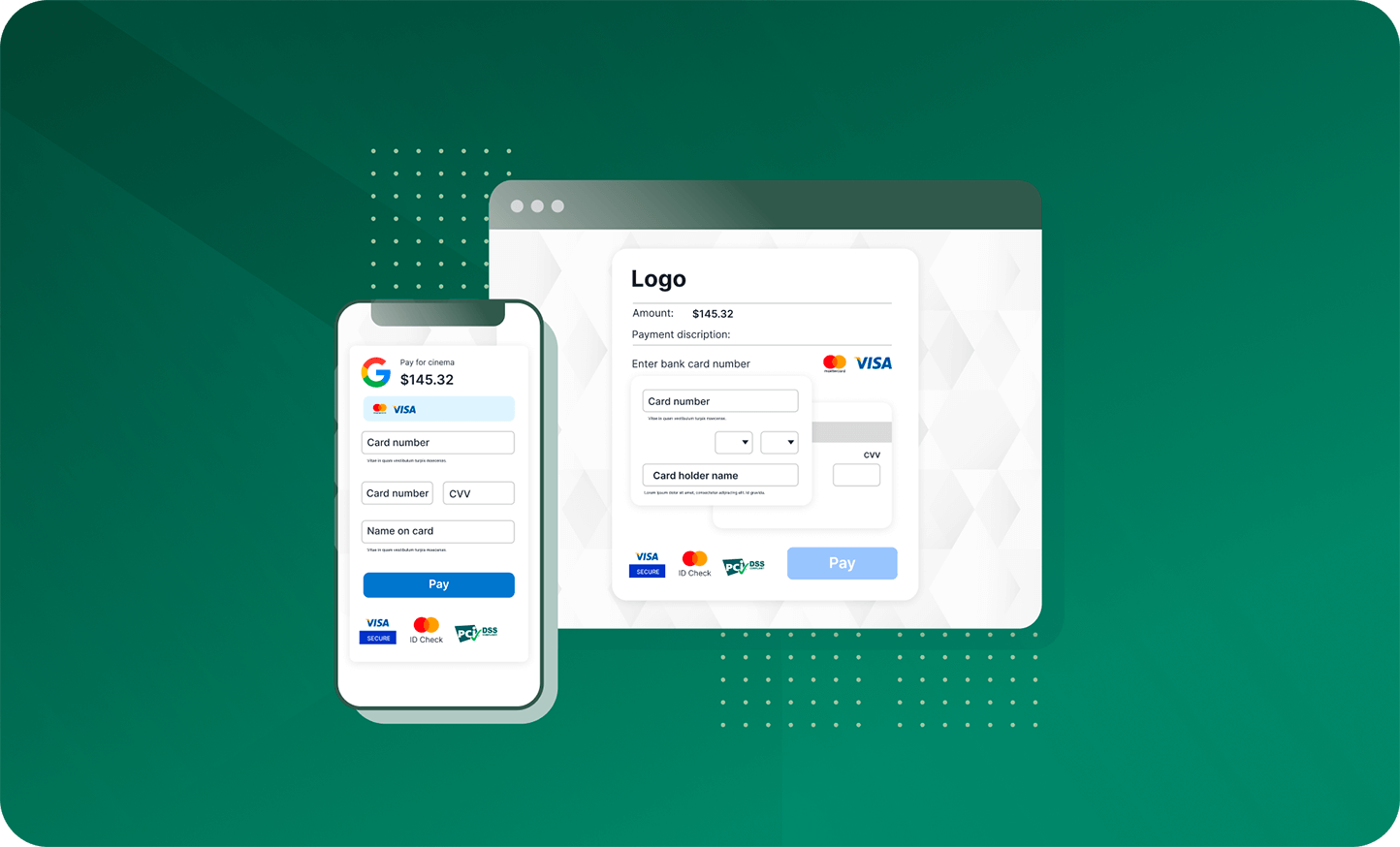

2. Customizable payment page

A customizable payment page is a crucial touchpoint in the customer journey, directly influencing conversion rates and customer satisfaction. Boxopay’s solution allows you to:

- Fully customize the page with your logos, colors, and themes for branding;

- Integrate A/B testing capabilities to see which design works best;

- Adapt to all devices and platforms with a responsive design;

- Support custom domains, embed the solution with a widget, add one-click payments, provide detailed reasons for payment rejection, and process non-standard cards or cards without CVV.

It’s a powerful tool that allows companies to stand out as a consistent brand with a fully optimized payment process.

3. Acquirer back office

The software in your payment processing infrastructure must include a full-scale operational suite:

- Business process automation: merchant onboarding and KYC/AML, smart routing and cascading, reconciliation, anti-fraud and risk management, and financial accounting tools;

- Merchant management: contract and tariff management, fee management and real-time calculation, limit engine;

- Reporting and analytics: real-time dashboards, detailed reports, and data-driven insights;

- Compliance: PCI DSS Level 1 compliance.

You can access all these features with Boxopay’s white-label solution for acquiring businesses, covering everything needed to keep your operation running smoothly. It’s the perfect opportunity to launch your acquirer business with minimum hassle.

Step-by-step acquirer IT infrastructure launch process

Now that we’ve covered the key software solutions you’ll need, let’s take a closer look at the typical acquirer backend infrastructure. You already know that deployment can be on-premises or SaaS-based. We’ll share Boxopay’s approach to providing you with a turnkey IT deployment.

Step 1: Understanding your needs

The discovery phase is a necessary foundation for your acquirer platform architecture. It’s important to understand your needs and expectations before working on the infrastructure, as this can significantly change the development vector. This is what you should consider.

| Point | Explanation |

|---|---|

| Possible goals |

|

| Possible needs |

|

| Regulatory compliance |

|

Step 2: Setting up the server infrastructure

The next step in building your acquirer infrastructure is setting up a full-scale server. This process is similar to the PSP infrastructure setup we described in our previous article. You’ll have to complete the following key steps to launch your back-end payment processing solution:

- Evaluate options: cloud solutions vs. dedicated servers.

- Select a local cloud provider.

- Configure servers to meet PCI DSS Level 1 requirements.

- Ensure secure connectivity between servers.

- Ensure infrastructure scalability.

- Address local specifics and project requirements.

Once you’ve completed these steps, you can move on to software deployment and certification. This process is a bit more complex due to the certification requirements.

Step 3: Software deployment & certification

After setting up your server infrastructure, you must continue with software deployment and PCI DSS Level 1 certification. The process involves setting up secure infrastructures, configuring key components, and ensuring compliance with stringent payment security standards.

You’ll have to complete the following steps:

- Establish testing and production infrastructures with restricted console server access.

- Deploy DNS server and local repository for component updates.

- Configure the Docker repository and set up the application control server.

- Install and configure the database management system.

- Set up application servers 1 and 2, balancing traffic between them.

- Implement antivirus software and configure log storage.

- Set up HIDS/HIPS and establish system and application monitoring.

- Deploy the document management system.

- Perform stress testing and conduct a PCI DSS audit.

- Complete PCI DSS certification and finalize the project.

The PCI DSS Level 1 certification ensures acquirers meet the highest security standards for processing, storing, and transmitting cardholder data. The process involves:

- Gap analysis;

- Integrating firewalls, encryption, access controls, etc;

- Logging and monitoring systems;

- Vulnerability scanning;

- Compliance audit with a Qualified Security Assessor.

If your solution meets all the requirements for the certification, you’ll complete it successfully and get certified. This allows you to move on to branding and acquirer system integration to use Visa/Mastercard in your product.

Step 4: Branding the solution

Before moving on with the payment scheme integration, it’s also necessary to set the right branding from the very start. You’ll have to consider:

- Creating a logo, color scheme, and design elements for the solution;

- Personalizing the merchant and admin portals;

- Making a consistent tone of voice and design.

This step ensures that your acquirer solution looks and feels like your own product, providing you with everything required for business. Boxopay provides all the features for customization, allowing you to set everything to your preferences.

Step 5: Integrating Visa/Mastercard

The Visa/Mastercard acquirer infrastructure integration is one of the key steps to launch your business. There are three main approaches to working with these payment schemes. Refer to the sheet below.

| ISO8583 (VAP, MIP) | API-based | Third-party processor | |

| Direct integration | ✅ | ✅ | – |

| Integration time frame | 12 months | 3–4 months | from 2 months |

| Capital expenses | high | low | from 0 EUR |

| Operational expenses | from 0 EUR | individual fee for cloud infrastructure exploitation | transactional-based fee |

| On-premises infrastructure | needed | – | – |

| Maintenance of technical aspects | high | medium | – |

| Licensing and Certification | Visa/Mastercard Principal Membership Licensing

+ VisaNet Processor/MSP Certification |

Visa/Mastercard Principal Membership Licensing

+ VisaNet Processor/MSP Certification (Simple) |

Visa/Mastercard Principal Membership Licensing |

| Ongoing services and support | – | – | ✅ |

Now let’s take a closer look at the peculiarities of the acquirer payment gateway integration process for each approach. We’ll cover them from the easiest to the most difficult.

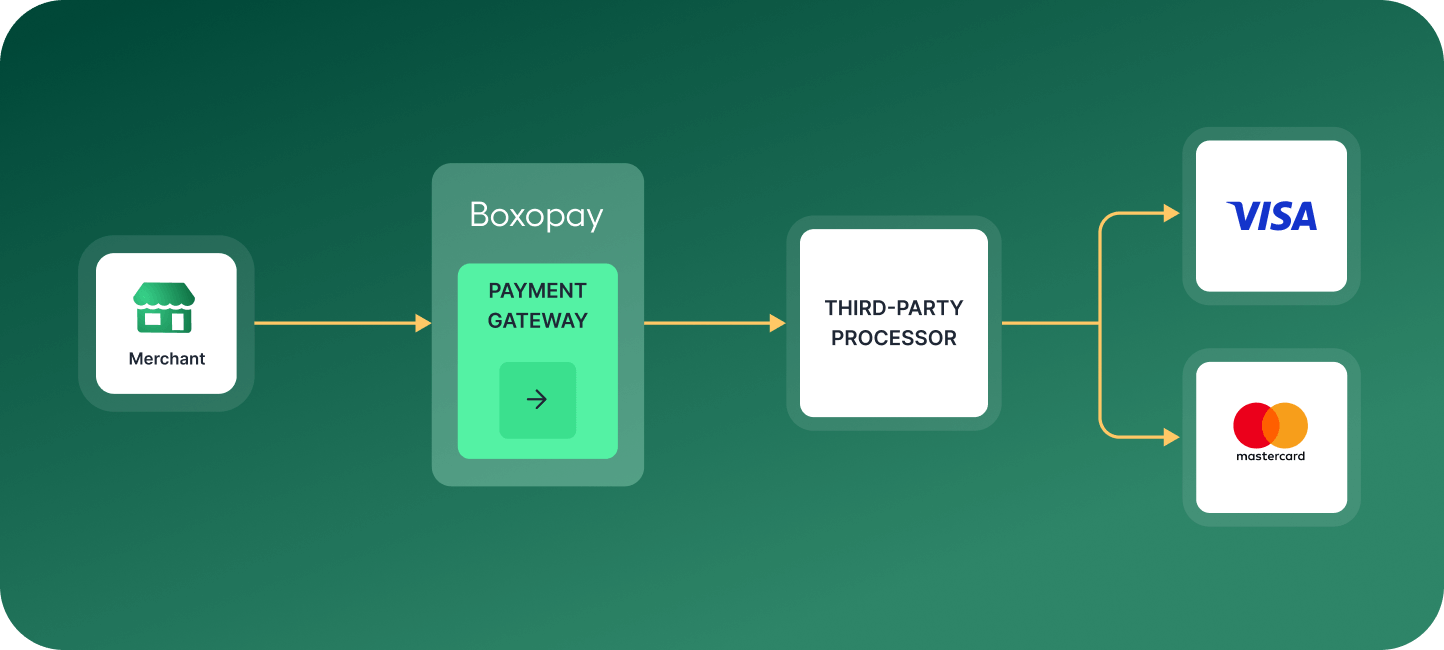

1. Third-party processor

If you want to avoid most technical complexities and focus on your internal business operations, this is the easiest way to start working with Visa/Mastercard. The certification process is already completed by your solution provider, saving you time and resources.

Boxopay’s team handles the integration with your chosen processors, simplifying the technical aspects of your business. This is the fastest way to enter the market, with typical launch times ranging from 2 to 6 months. You also get ongoing services and support.

Choosing Boxopay’s partner processor will help you launch even faster. The processor is already pre-integrated with Boxopay, reducing the launch process by at least one month. Additionally, it fully manages your integration project, including preparing standard documentation. This allows the launch timeline to be shortened from 6 months to as little as 3 months.

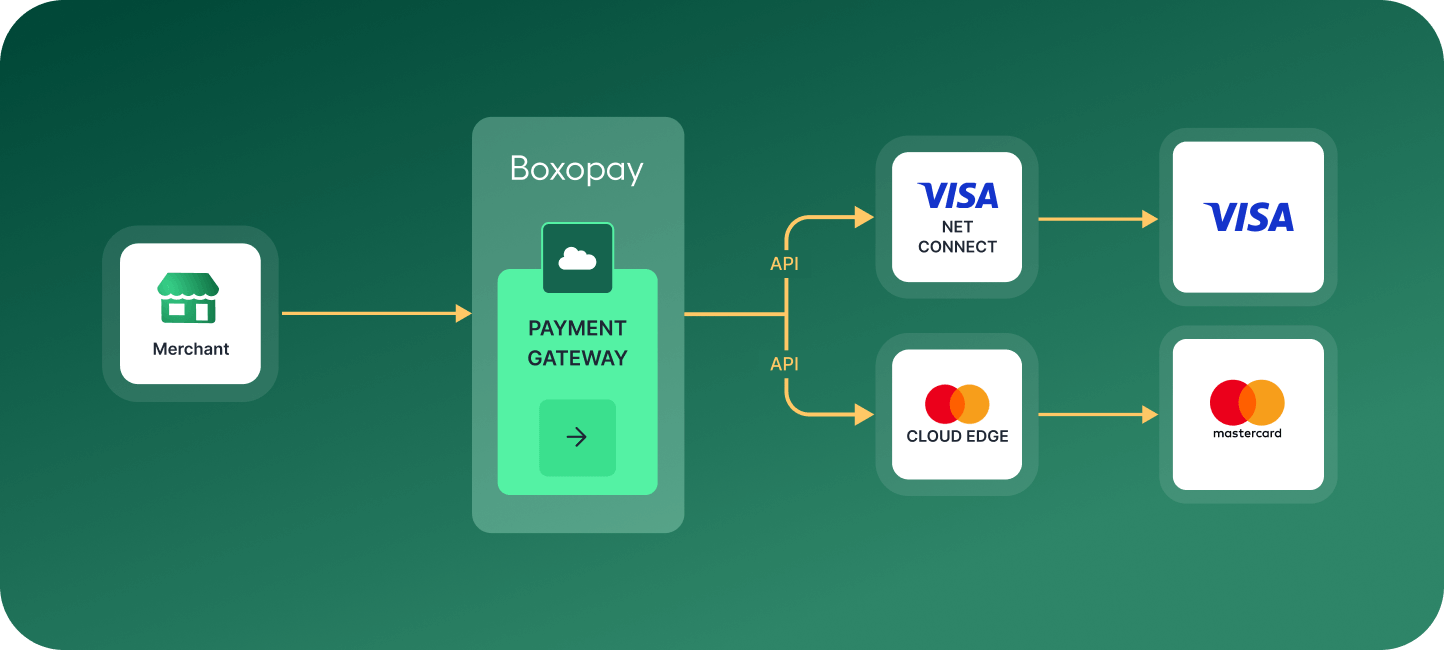

2. API-based integration (VisaNet Connect or Mastercard Cloud Edge)

API-based integration is a modern alternative that allows you to remove all intermediaries and interact directly with payment schemes. You’ll have to complete a typical API integration process to simplify the certification process and avoid setting up additional hardware.

Considering we’re focusing on Visa and Mastercard, these are your options:

- Visa Cloud Connect: a secure & reliable API-based integration that connects directly to VisaNet without requiring hardware-intensive setups. It includes great security measures like data encryption and monitoring, ensuring a reliable way for payments.

- Mastercard Cloud Edge: allows you to seamlessly integrate with Mastercard’s payment network, using scalable cloud-based technology to simplify the connection process. You’ll avoid traditional challenges in interacting with this payment scheme.

If you choose API-based integrations and work with another gateway provider, you’ll have to develop additional software to handle online interactions with these payment schemes. However, Boxopay provides you with this functionality out of the box. This helps you save both time and money.

The typical setup time for an API-based integration is around 3–4 months.

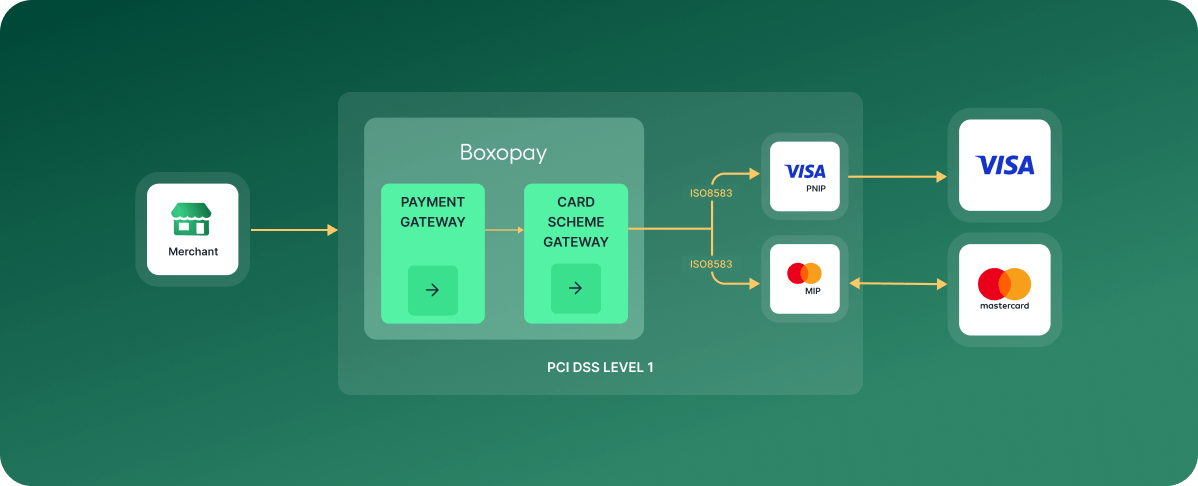

3. Direct ISO8583 integration

Direct ISO8583 integration is the traditional method to get maximum autonomy while working with payment schemes like Visa and Mastercard. You get high reliability and low transaction costs, but you need to invest immense resources and expertise. Typically, the setup time for this approach is around 12 months.

Integrating ISO8583 requires you to follow this process:

- Infrastructure setup

Install and configure VAP (VisaNet Access Point) and MIP (Master Interface Processor) components to handle ISO8583 messaging. Then, ensure the infrastructure meets PCI DSS Level 1 standards for data security. Don’t forget to implement failover mechanisms for uninterrupted transaction processing.

- Transaction processing integration

Implement ISO8583 message structures for authorization, clearing, and settlement. Afterward, establish a stable and secure connection for real-time transaction processing. Remember to configure tools to monitor transactions and analyze logs in plain format to ensure system reliability.

- Certification with Visa/Mastercard

This step involves becoming a VisaNet Processor or a Mastercard Member Service Provider, an important certification that allows you to operate as a processor. This is a complex and stringent process, but Boxopay’s expertise ensures it is fast and simple.

Our software facilitates seamless connections with both offline and online card scheme environments for certification. Also, we provide a ready-made set of test cases to ensure you get a successful assessment. This saves your time and resources, allowing you to get certified faster and with less effort.

- Go live and maintain the solution

Validate the environment and use dashboards to track performance. If any issues arise, you must fix them promptly to prevent errors and downtime. You’ll also have to constantly update the system to comply with new standards and regulations.

As a result, you’ll get a full-scale acquirer infrastructure for payment services.

Step 5: Testing pilot transactions

It’s necessary to ensure your acquirer infrastructure and payment gateway work as intended before going live. This stage is needed to validate your system’s readiness to process real-world transactions and identify issues before deployment.

You will have to simulate live transactions using Visa/Mastercard test cards to verify the complete payment flow. This includes authorization, clearing, and settlement processes. Test all payment methods and scenarios, including recurring payments, refunds, and chargebacks.

Use your dashboard to track transaction success rates, response times, error logs, and any other important information. If any bottlenecks occur, your engineers will have to fix them promptly. Don’t forget to maintain clear and detailed documentation – it’s a must-have for a long-term solution.

How can Boxopay help you set up acquirer IT infrastructure?

Boxopay provides turnkey solutions to help you set up and manage your acquirer’s IT infrastructure quickly and easily. We handle every step of the process. While you focus on obtaining an electronic money institution license and growing your business, our software engineers cover all technical and operational requirements.

Apart from that, we can help you with custom development services to adapt our solutions to your company’s requirements. This means you can get extra features, integrations, branding, and much more. We’ll consult you on the way and help you find the best decision based on our many years of experience.

And here’s the best part – we’re the most cost-effective solution:

- Free software maintenance;

- Software leasing model;

- Transparent pricing.

Your success is our success. That’s why we’re interested in mutual growth and cooperation. Let’s team up!

FAQ

What are the benefits of using third-party integration with payment schemes?

Third-party integration reduces the setup time and minimizes costs. However, the biggest benefit is the possibility of getting pre-certified solutions for fast market entry.

What challenges can arise during payment scheme integration?

The greatest challenges are ensuring compatibility, managing regulatory compliance, and maintaining security. Another challenge can include maintaining performance during high transaction volumes, but it depends on your infrastructure and software provider.

Can third-party payment scheme integration still offer flexibility for acquirers?

Yes, Boxopay’s solutions provide full customization options along with risk management capabilities. Check out all our solutions here.

Contact our top experts

to pick products and services that fit your business needs

Schedule a meeting