Licensing as an Acquirer for Visa & Mastercard in 2025

29 January, 2025 11 min read

- Why do you need a Visa & Mastercard license?

- How to complete Visa’s licensing program

- How to complete Mastercard’s licensing program

- Technical integration: an important step beyond licensing

- Get end-to-end business software solutions with Boxopay

Table of contents:

If you’ve decided to launch an acquirer business, then you’ll have to get licensed by the world’s largest payment processors: Visa and Mastercard. This is a complex process with multiple documents, fees, and requirements involved. Read on to learn everything about the acquirer licensing process in detail.

Why do you need a Visa & Mastercard license?

Obtaining a Visa and Mastercard license for your acquirer business is necessary to access a full range of possibilities. Some of the benefits and capabilities you’ll get include:

- Authorization to legally process payments on behalf of merchants;

- Direct access to global payment networks without third-party intermediaries;

- Merchant acquiring capabilities with POS terminals, online payment gateways, etc.;

- Settlement and clearing rights for faster transactions and improved cash flows;

- Access to fraud prevention tools, chargeback management systems, and other features.

Most importantly, working directly with these payment networks provides more flexibility for product development and marketing initiatives. You’ll be able to customize your payment solutions, set merchant pricing strategies, and meet all your needs without artificial limitations.

How long does Visa/Mastercard licensing take?

Licensing for acquirers with both Visa and Mastercard typically takes between 3 and 6 months, but this can vary based on the complexity of the application and regulatory requirements. A lot of factors impact the licensing timeline. If you already meet all acquirer compliance requirements, then you shouldn’t experience any delays.

How much does Visa/Mastercard licensing cost?

Before completing the licensing of issuers and acquirers for your business, consider evaluating the potential budgets required. While the costs aren’t publicly disclosed and vary based on multiple factors, we gathered an approximate estimate in the sheet below.

| Visa | Mastercard |

|---|---|

| €50,000 and €100,000 for the first year of your Principal Membership. | €50,000 to €100,000 for the first year of your Principal Membership. |

Authorization fee:

|

Acquirer license fee:

|

Clearing & settlement fee:

|

Acquirer brand volume fee:

|

Fixed acquirer network fee (FANF):

|

Card-not-present fee:

|

Base transmission fee:

|

Digital enablement fee:

|

Digital commerce service fee:

|

Excessive authorization integrity fee:

|

Misuse fee:

|

Merchant location fee:

|

Note that these rates depend on many factors. Your business may get another individual estimate once you complete the Mastercard/Visa licensing process. The representatives of both companies will provide you with all the required information during the consultation phase.

Regional regulations

Acquirer licensing processes for Visa and Mastercard vary significantly based on regional regulatory frameworks. Different jurisdictions impose their own legal, compliance, and operational requirements that acquirers must meet before obtaining a license. You will need a separate license for each region.

Let’s overview the key regions and their regulatory bodies.

| Region | Regulatory authority | Key requirements | Some included countries |

|---|---|---|---|

| European Union | European Banking Authority (EBA), Local Financial Regulators (e.g., BaFin, FCA). |

|

France, Germany, Italy, Spain, Netherlands, Belgium, Sweden, Poland, Austria, Portugal, Greece, etc. |

| North America | Federal Reserve, OCC, FinCEN. |

|

United States, Canada, Mexico. |

| Asia-Pacific | Monetary Authority of Singapore (MAS), RBI, CBIRC. |

|

China, India, Japan, Australia, Singapore, South Korea, Indonesia, Malaysia, Thailand, the Philippines, Vietnam. |

| Middle East & Africa | Central Bank of the UAE, SARB, SAMA. |

|

UAE, Saudi Arabia, South Africa, Egypt, Nigeria, Kenya, Qatar, Turkey, Israel, Morocco. |

| Latin America | Banco Central do Brasil, CNBV. |

|

Brazil, Mexico, Argentina, Chile, Colombia, Peru, Ecuador, Uruguay, Venezuela. |

How to complete Visa’s licensing program

Visa provides different types of acquirer licenses to financial institutions and organizations aiming to offer acquiring services. The two main types include Principal Members and Associate Members. Let’s take a closer look at their differences in the sheet below.

| Principal Member | Associate Member |

|---|---|

| Suitable for larger institutions with experience in risk underwriting, credit management, billing, and collecting payments. | Suitable for smaller institutions that work with the help of a Principal Member for aspects like settlement, reporting, and fee payment. |

|

|

1. Create a Visa partner account

The first step to starting your Visa acquirer licensing is creating an account:

- Sign up on Visa’s partner portal.

- Enter your name, email, organization, country, and create a password.

- Activate your account by following the link in your email.

- Sign in to your account and complete the profile setup.

You’ll be then transferred to Visa’s dashboard.

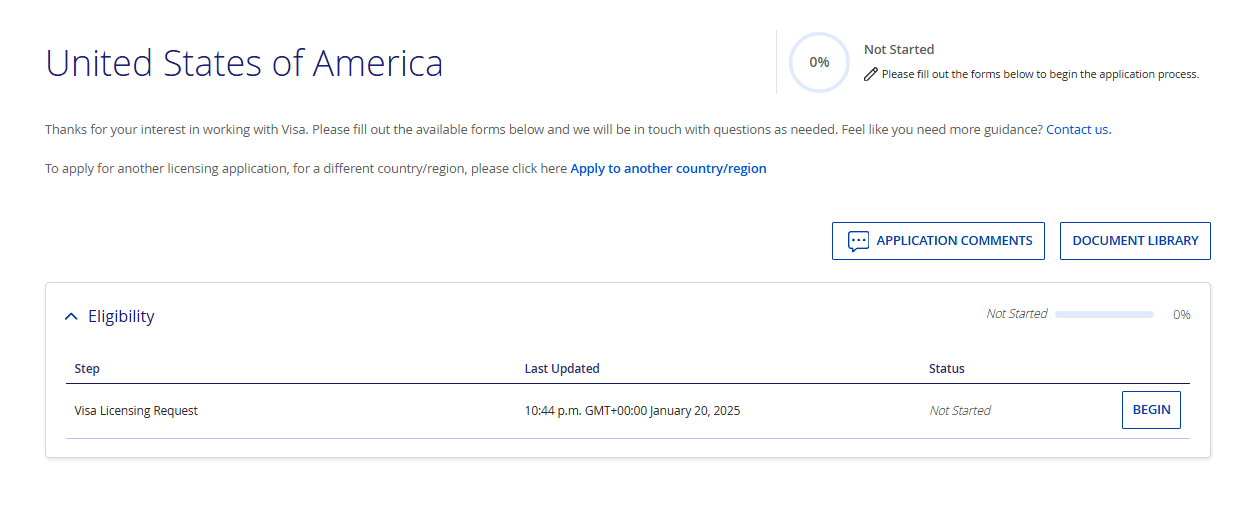

2. Submit your application

Among all the available options, choose “Visa License”. It’s the most suitable option to continue the acquirer licensing process. The system will then ask you to share the following information:

- Company information: legal name, trade name, number of employees, address, country, website;

- Contact information: name and surname, title, email address, phone number;

- Business type: choose the “Acquirer” option.

After that, you’ll be asked to choose the country and region of your application. This will determine the next steps, as each country has its own acquirer licensing standards. For demonstration purposes, we’ll choose the United States of America as an example.

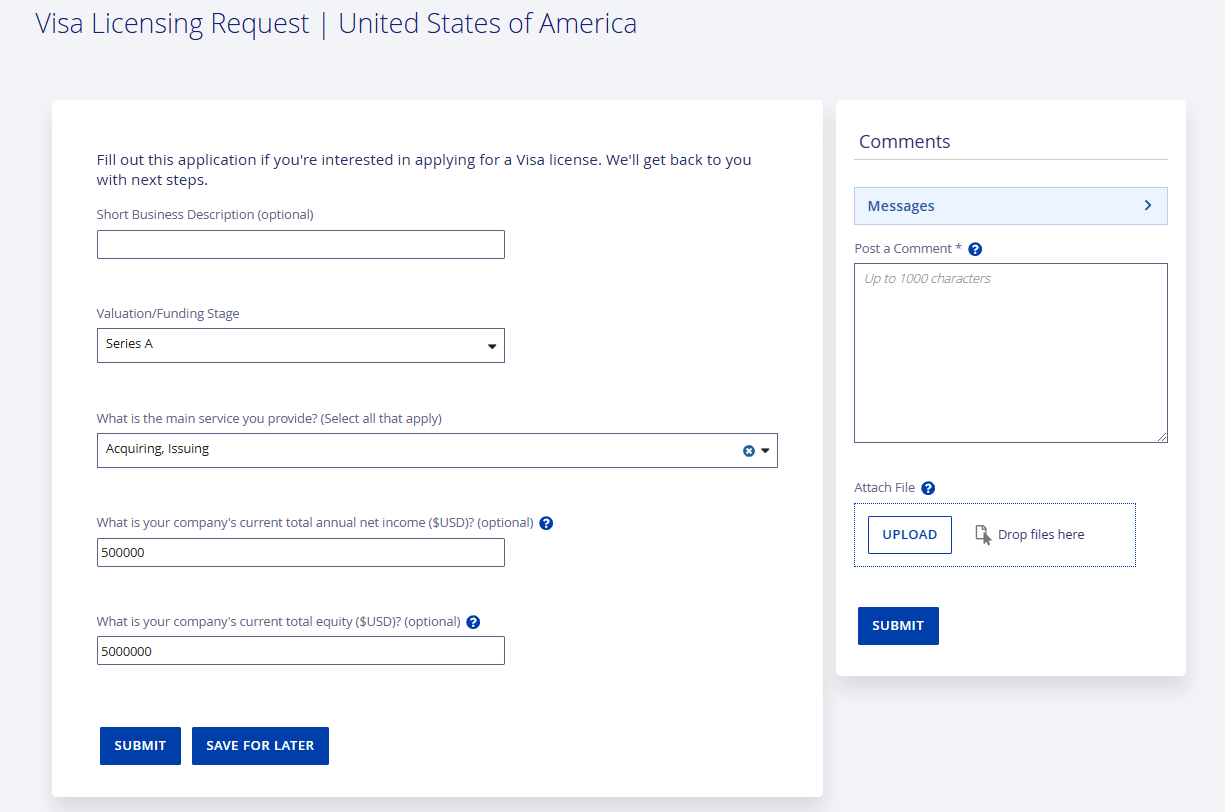

The system will then ask you to add some other information:

- A description of your business;

- Your valuation and funding stages;

- Your main services;

- Your total annual net income and current total equity.

You’ll be able to attach relevant documents to prove your claims and add extra explanations in the comments section. In case the Visa team has any questions, they will respond within this section.

While it isn’t indicated in this section, we recommend adding the following documents:

- Regulatory credentials or banking license;

- Audited financial statements for the past 3 years.

This ensures the Visa team will have no additional questions and blockers when processing your payment acquirer licensing. Once you submit these documents, you’ll have to wait for them to be processed before moving forward to country-specific forms.

Note: if you still don’t have an electronic money institution license, check out our previous guide to get a step-by-step explanation on acquiring it. You’ll need it to start working in this industry.

3. Add country-specific forms

Once your initial application is processed, Visa will provide you with specific forms depending on the region you are applying for. These typically include:

- Anti-money laundering documentation: your business must comply with regulatory requirements regarding financial crime prevention. Visa may request your AML policy, risk assessment reports, KYC and merchant due diligence documentation, and others.

- Licensing agreement: a formal agreement outlining your obligations as a Visa acquirer, including transaction processing rules and compliance expectations.

- Sponsorship agreement: if you are applying as an Associate Member, a sponsorship agreement with a Principal Member must be submitted to validate your application.

Carefully review and fill out all forms accurately, as incomplete or incorrect submissions will delay the approval process. This process may take 4–8 weeks depending on many factors.

4. Wait for approval

Once all required forms and supporting documentation have been submitted, the Visa team will initiate the approval process. They will conduct thorough due diligence, technical assessment, and risk assessment to ensure you comply with all their requirements. You’ll typically receive follow-ups with your Visa relationship manager to track your acquirer IT certification progress.

Get end-to-end support for your acquiring business

Contact Boxopay’s experts for a consultation

How to complete Mastercard’s licensing program

Mastercard offers a structured process to obtain a direct license, which provides financial and non-financial institutions access to its global payment network. The licensing process consists of several key steps and includes two types of memberships: Principal Customer and Affiliate Customer.

| Principal Customer | Affiliate Customer |

|---|---|

|

|

1. Consultation with Mastercard

The Mastercard acquirer licensing process begins with an initial consultation with the company’s representatives. During this stage, you discuss your business objectives, operational goals, and regulatory readiness. Mastercard’s team assesses your readiness and walks you through all requirements.

2. Prequalification check

Once the consultation is complete, you will undergo a prequalification check to assess compliance with Mastercard’s eligibility criteria. This step involves submitting:

- An onboarding template;

- Act of incorporation;

- Regulatory license;

- Financial statements;

- AML policy;

- Compliance charts;

- BIN request;

- Form 658.

This is Mastercard’s acquirer licensing checklist to apply. You’ll also have to send a signed license agreement along with all other documents to the team’s franchise representative. Then you’ll have to wait for verification and approval.

Note: while the acquirer licensing requirements indicate the aforementioned documents, Mastercard may require additional documentation in the process. This can be related to risk assessment and local regulatory compliance.

3. ICA/BIN release

One of the final financial acquirer licensing steps is the ICA/BIN release after your license is granted. The ICA allows you to participate in the Mastercard network, while the BIN provides card issuance and transaction processing.

Receiving these identifiers is a crucial milestone, allowing you to proceed with technical implementation and testing. You’ll have to test everything in detail to ensure complete regulatory compliance and seamless transaction processing before going live.

Technical integration: an important step beyond licensing

Apart from getting a license, becoming an acquirer also requires you to complete the technical integration with payment networks. Unlike the PSP infrastructure setup process, where integration typically involves connecting to acquirers, an acquirer acts as the link that must establish direct connections with payment schemes. There are several approaches to achieve this, and we’ve covered them in detail in our article Building IT Infrastructure for Acquirers:

- Through a third-party processor: working with an established payment processor to handle transaction routing and compliance.

- Direct integration via API: building custom infrastructure to connect directly with card networks for greater control.

- Direct integration via ISO8583: establishing a partnership with a licensed acquiring institution for direct network access.

The process doesn’t end here. Acquirers are also expected to address the formal aspects of the integration project like SLAs, merchant agreements, compliance documentation, etc. Boxopay’s team provides a turnkey service to cover all these processes.

Need help with your technical integration?

Contact Boxopay’s experts for a consultation

Get end-to-end business software solutions with Boxopay

Achieving Visa and Mastercard certification is a complex and time-consuming process that requires deep industry knowledge and a strategic approach. You can avoid all the obstacles and go the easy way while still keeping all the benefits with Boxopay’s turnkey acquirer service.

Some of the features you’ll get:

- Turnkey setup, payment system integrations, and full certification support to cover all technical aspects for your acquirer business to launch with ease;

- A full-functional business management system with smart processing, management, reporting, and analytics to cover all your business activities;

- Full control over your brand, tech, and data without vendor lock to bring all your ideas to life;

- End-to-end development and support along the way.

Your success is our success. Team up with Boxopay to launch your acquiring business at ease!