How to Start an Acquirer in 2025

3 December, 2024 12 min read

- Difference between an acquirer, bank acquirer, and challenger bank

- E-commerce acquiring vs in-store acquiring

- White-label software — the optimal choice for launching an acquirer business

- 5 key steps to become an acquirer

- How can Boxopay help you launch an acquirer?

- FAQ

Table of contents:

According to Boston Consulting Group’s report, the global acquirer market is projected to grow by 6.9% annually and reach $100 billion by 2027. Acquirers serve as the backbone for merchants by enabling card payments, significantly impacting the e-commerce industry, estimated at $4.20 trillion in 2024 in the APAC.

Launching a bank acquirer business requires dealing with multiple regulatory, technological, and competitive aspects. It’s a long-term and costly process that requires extensive patience and expertise. However, partnering with Boxopay can help you start a payment-acquiring business with minimum hassle. Read on to find out how to build a bank acquirer avoiding all extra steps in 2025.

Difference between an acquirer, bank acquirer, and challenger bank

Although some terms sound similar, they are different entities within the financial and payments ecosystem. It’s important to clarify these definitions, as “Acquirer” can mean different things to other people, depending on their perspective or the business model in question.

An acquirer is usually the starting point for many businesses, which gradually evolve into a bank acquirer and later transition into a challenger bank. Understanding each stage and its distinctions will help you align your expectations and understand what’s best for your needs.

Acquirer

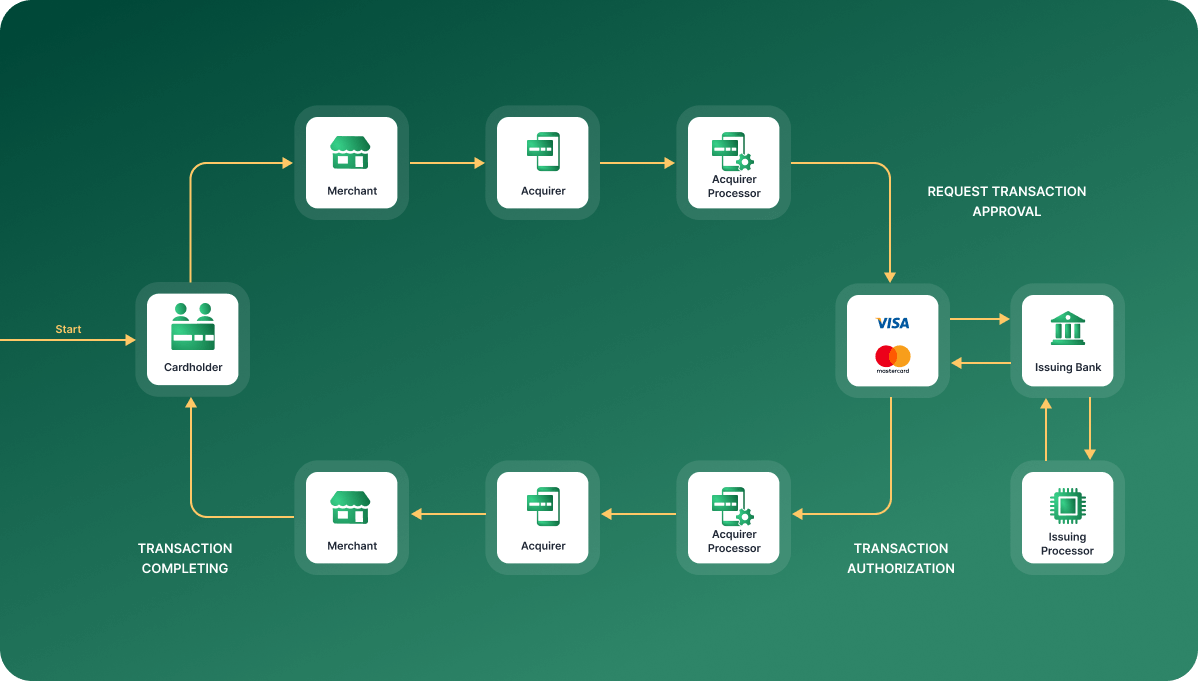

An acquirer, also referred to as a merchant acquirer, is a financial institution that enables merchants to accept card payments. This entity acts as a mediator between merchants and card networks like Visa or Mastercard. It’s also responsible for authorizing transactions, settling payments, and ensuring funds are transferred from the cardholder’s bank to the merchant’s account.

If you want to become an acquirer, remember these key points:

- Acquirers operate with an EMI license;

- They manage and store merchant funds;

- They usually don’t open bank accounts unlike acquiring banks.

That’s the business model that we’re focusing on in this article.

Bank acquirer

A bank acquiring business is a financial institution that operates under banking regulations and offers additional services beyond payment processing. Unlike regular acquirers, acquiring banks can open accounts for merchants and keep the money flowing directly within the institution.

Challenger bank

A challenger bank is a full-scale institution that can emit credit & debit cards, process payments, provide insurance, and cover all other services of a typical bank. However, these banks aim to compete with established banks by offering innovative services and better experiences through technologies.

| Acquirer | Bank acquirer | Challenger bank | |

|---|---|---|---|

| Definition | Financial institutions, that process merchant card payments | A banking institution acting as an acquirer | A digital-only bank competing with traditional banks |

| Primary role | Processes payments for merchants. | Processes payments and provides bank account services. | Provides full banking services exclusively online. |

Boxopay’s PayTech solutions aren’t limited to regular acquirers: they’re suitable for all these institutions. However, you’ll also need core banking features if you intend to work with an acquiring bank and challenger bank.

E-commerce acquiring vs in-store acquiring

Before launching an acquiring business, it’s necessary to understand whether you’re going to work with online or offline merchants. The current trend is omnichannel sales, with 73% of retail shoppers being omnichannel shoppers. What’s more, Google considers that omnichannel strategies drive an 80% higher rate of incremental store visits. That’s why it’s necessary to understand your approach.

E-commerce acquiring allows digital merchants to accept online payments through credit and debit cards, digital wallets, and bank transfers. That’s where Boxopay can help. In-store acquiring payments typically require PoS terminals as the main payment processing method.

Here are some of the key differences between e-commerce and in-store acquiring.

| E-commerce | In-store |

|---|---|

| Designed for online transactions | Designed for physical transactions |

| Use white-label payment gateways like Boxopay | Uses traditional POS systems, Kiosk POS, and SoftPOS. Boxopay supports SoftPOS solutions |

| Merchants integrate their platforms with the acquirer’s gateway to handle payments | Merchants need to install the POS software on their devices and integrate it with their business software, if applicable |

| Implement advanced fraud detection systems to avoid fraudulent activities | Employs measures such as EMV chip authentication to reduce fraud risks in physical transactions |

| Focuses on a seamless and responsive checkout experience, including one-click payments and saved payment methods | Focuses on smooth in-person interactions, resolving customer issues on the spot if needed |

| Can integrate with in-store systems to enable omnichannel payment solutions | Can connect with online systems to provide a unified experience for omnichannel transactions |

White-label software — the optimal choice for launching an acquirer business

Partnering with a white-label vendor like Boxopay saves time, resources, and development costs while delivering a proven, market-ready solution. Instead of investing heavily in creating a gateway from scratch, you can rely on our expertise to quickly launch and scale your acquiring business.

As a white-label software provider for acquirers, Boxopay delivers a comprehensive suite of features tailored specifically to meet your needs and enhance your competitive edge. Our solution was designed with the unique demands of acquirers in mind, ensuring seamless integration into your business processes while empowering you to rival cutting-edge PSPs and orchestrators.

With us, you’ll gain access to a wide range of capabilities, including support for alternative payment methods, QR codes, payment links, e-invoices, and more. For your merchants, we offer a robust Merchant Portal, RESTful API, and fully customizable payment page with A/B testing for maximum conversions, and tools designed to enhance their payment experience.

To optimize your back and middle office operations, we provide smart routing, anti-fraud and limits engine, multi-currency support, process automation, and detailed financial analytics. Our gateway is built to handle payments online, in-store, and for merchants of any size, ensuring you have the tools needed to succeed in any environment.

Contact our top experts

to pick products and services that fit your business needs

Schedule a meeting

5 key steps to become an acquirer

1. Get an EMI license

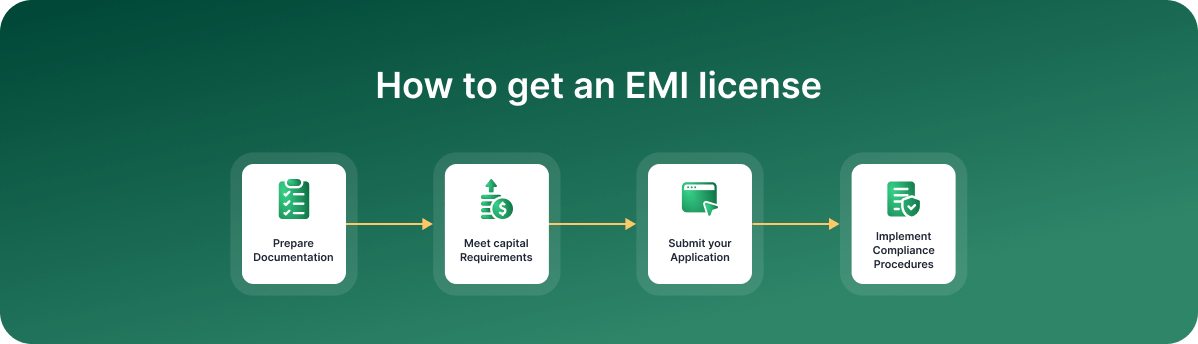

If you want to start an acquiring bank or business, the first step is to obtain an Electronic Money Institution license. This will let you store and manage customer funds legally.

Depending on your target market, you’ll have to follow these steps:

- Prepare documentation. Collect all necessary documents: your business plan, risk management policies, and AML/KYC procedures. These documents are needed for regulatory compliance.

- Meet capital requirements. European laws require a registered capital of at least €350,000 and this sum may vary depending on specific countries.

- Submit your application. Apply for an EMI license through the appropriate regulatory body in your jurisdiction, such as the FCA in the UK or the ECB in the EU. The application process involves a thorough review of your business and compliance practices.

- Implement compliance procedures. Develop systems for anti-money laundering and Know Your Customer protocols to protect yourself against fraudulent activity. Compliance is critical for maintaining your license.

Learn more about becoming an electronic money institution in our detailed guide with all essential steps.

2. Set up IT infrastructure & integrate with Visa and Mastercard

The next step in launching your payment acquirer business is where the Boxopay team steps in to take the lead. We provide a turnkey IT infrastructure setup, with a dedicated team handling every aspect of the process for you. While the setup shares similarities with PSP infrastructure setup, it incorporates unique features tailored to the needs of acquirers.

Here’s how our team will establish your acquirer infrastructure:

- Understanding needs and expectations. All projects start with a discovery phase, which involves a detailed assessment of your business requirements, payment flow expectations, and overall goals. This is also where we draft a detailed work plan with scheduled tasks and milestones for all processes.

- Acquirer infrastructure setup. We build a robust multi-product infrastructure compliant with PCI DSS Level 1, choosing the best-fit solution between cloud and dedicated servers.

- Deployment of acquirer software. We ensure it is fully optimized for payment processing and configure the necessary system components for seamless operation. We also establish separate infrastructures for testing and production, with limited administrative access to ensure security. Then we configure DNS, repositories, application servers, and a database management system while balancing traffic and ensuring stability.

- PCI DSS Level 1 certification. After completing stress tests and audits, we organize the certification process with an independent auditor.

- Software branding. During this stage, we customize the software with the client’s branding. To ensure a smooth launch, we conduct training sessions for the client’s team.

The final step is choosing your payment scheme integration approach:

- Third-party processor integration.

This is an excellent option for businesses that want to avoid the technical complexities of payment processing. You can focus on your core business operations by outsourcing these aspects to professionals. If you choose Boxopay as your software vendor, we handle the integration with the processors you select.

It’s a fast solution, typically taking 2–6 months to implement, and ensures a quick market entry. Although a third-party processor will charge a commission from each transaction, you won’t have to spend your budget on the certification process.

- API-based integration (VisaNet Connect and Mastercard Cloud Edge).

If you’re looking for more control, API-based integration is a modern and efficient alternative. This method eliminates intermediaries, allowing you to interact directly with payment schemes. It uses a standard API integration process, making certification easier and removing the need for additional hardware.

This approach ensures you have complete control over operations without paying third-party fees. Additionally, Boxopay’s unified interface simplifies your management of both merchant interactions and payment scheme connections. The setup time for this method is typically 3–4 months, offering a balance between simplicity and technical independence.

- Direct ISO8583 integration.

Direct ISO8583 integration is the best option for businesses that want maximum autonomy. This traditional method requires additional hardware and a longer setup time of around 12 months. But it gives you complete control over managing transactions and lets you work without any middlemen.

While it demands significant technical expertise and investment, this method is a great ideal for businesses that prioritize complete control over their payment operations.

The choice for your acquiring business depends directly on your needs, expectations, and budget. Boxopay’s experts will help you get the best option based on your requirements, providing full support from assessment to deployment. Contact our experts to get an estimate.

3. Complete the licensing process (Visa/Mastercard)

The final step in establishing your acquirer business is obtaining licensing with Visa and Mastercard. This process requires adherence to strict security and functionality standards. Before proceeding with licensing, it’s crucial to understand the difference between principal and affiliate membership.

| Principal member | Affiliate/associate member |

| Principal members have the authority to issue cards, acquire merchants, and directly settle transactions with the payment schemes.

This status grants greater control over operations but comes with increased obligations, including direct compliance with all network rules and settlement responsibilities. |

Affiliate members operate under the sponsorship of a principal member. They can perform many of the same functions but do so under the oversight and liability of their sponsoring principal.

This arrangement can be beneficial for entities seeking to enter the market with reduced direct responsibilities. |

You can find detailed information regarding the terms for both models on the official websites:

The detailed licensing process for Visa and Mastercard depends on which payment scheme you choose, but it’s generally followed by the same procedure:

- Preliminary assessment.

- Review Visa and Mastercard guidelines to ensure you meet the basic requirements;

- Ensure you comply with the PCI DSS.

- Documentation preparation.

- Prepare your regulatory credentials, banking license, audited financial statements, etc.;

- Depending on your country, you might have to fill in an AML form, a client licensing agreement, and a sponsorship agreement (for associates).

- Application submission.

- Send your application with all the documents and required details.

- Technical integration.

- After approval, you can start the implementation activities.

Read more about the Visa/Mastercard certification process in our dedicated guide.

4. Build an in-house team

If you’re planning for long-term success, you’ll have to build an in-house team to ensure smooth operations. This requires you to get several departments:

- Risk management and AML;

- Sales team;

- Merchant support;

- Accounting;

- IT;

- Business analytics.

Learn more about hiring your in-house team and how Boxopay’s solutions can help you save resources in our guide.

5. Create a go-to-market strategy

Marketing and positioning are also key elements for your acquirer business’s success. You’ll have to create a detailed strategy to differentiate your solution from competitors and attract merchants. This process consists of nine steps:

- Set your target market and analyze it.

- Research your competitors.

- Analyze your strengths and weaknesses.

- Define your target customers.

- Set your brand positioning.

- Clearly outline your product’s solutions.

- Develop a powerful brand identity.

- Choose a competitive strategy.

- Implement new elements and grow.

You can find out more about creating a go-to-market strategy in Boxopay’s detailed guide created by our team’s marketers and founders.

How can Boxopay help you launch an acquirer?

Boxopay provides a turnkey launch solution tailored for acquirers and their complex business processes. You’ll get all the features for merchants and your team in our go-to-market platform with the perfect pricing.

Some other benefits that you’ll get include:

- On-premises infrastructure deployment to maintain complete control over data and operations while meeting PCI DSS Level 1 certification requirements;

- Turnkey setup, payment system integrations, and full certification support to cover all technical aspects for your acquirer business to launch with ease.

If you’re looking forward to launching your business quickly and getting a reliable tech partner, Boxopay is your go-to choice for all PayTech needs. Book a call with our experts to get a detailed estimate.

FAQ

How to start a bank acquirer?

You must obtain an EMI license, set up PCI DSS Level 1 certified IT infrastructure, integrate with payment schemes, and complete Visa/Mastercard licensing. Boxopay team offers turnkey solutions for each step.

How do acquirers make money?

Acquirers earn revenue through transaction fees, processing charges, and service fees paid by merchants for managing and settling payments securely.

Who can be an acquirer?

Financial institutions, banks, and licensed EMIs with the necessary regulatory approvals and PCI DSS compliance can operate as acquirers, managing payment processing for merchants.

Contact our top experts

to pick products and services that fit your business needs

Schedule a meeting