Key Actors and Components of a Modern Merchant Payment Ecosystem

18 July, 2025 14 min read

- Key actors in the payment value chain

- How does the payment ecosystem work

- The payment processing cycle

- Partner with Boxopay to support your business on any level

Table of contents:

The modern merchant payment ecosystem is complex and dynamic, involving multiple parties with different responsibilities. Issuers, acquirers, card networks, payment processors – these are only the tip of the iceberg. In this article, you’ll learn about all the main actors of the payment ecosystem, how they interact, and how they can empower each other.

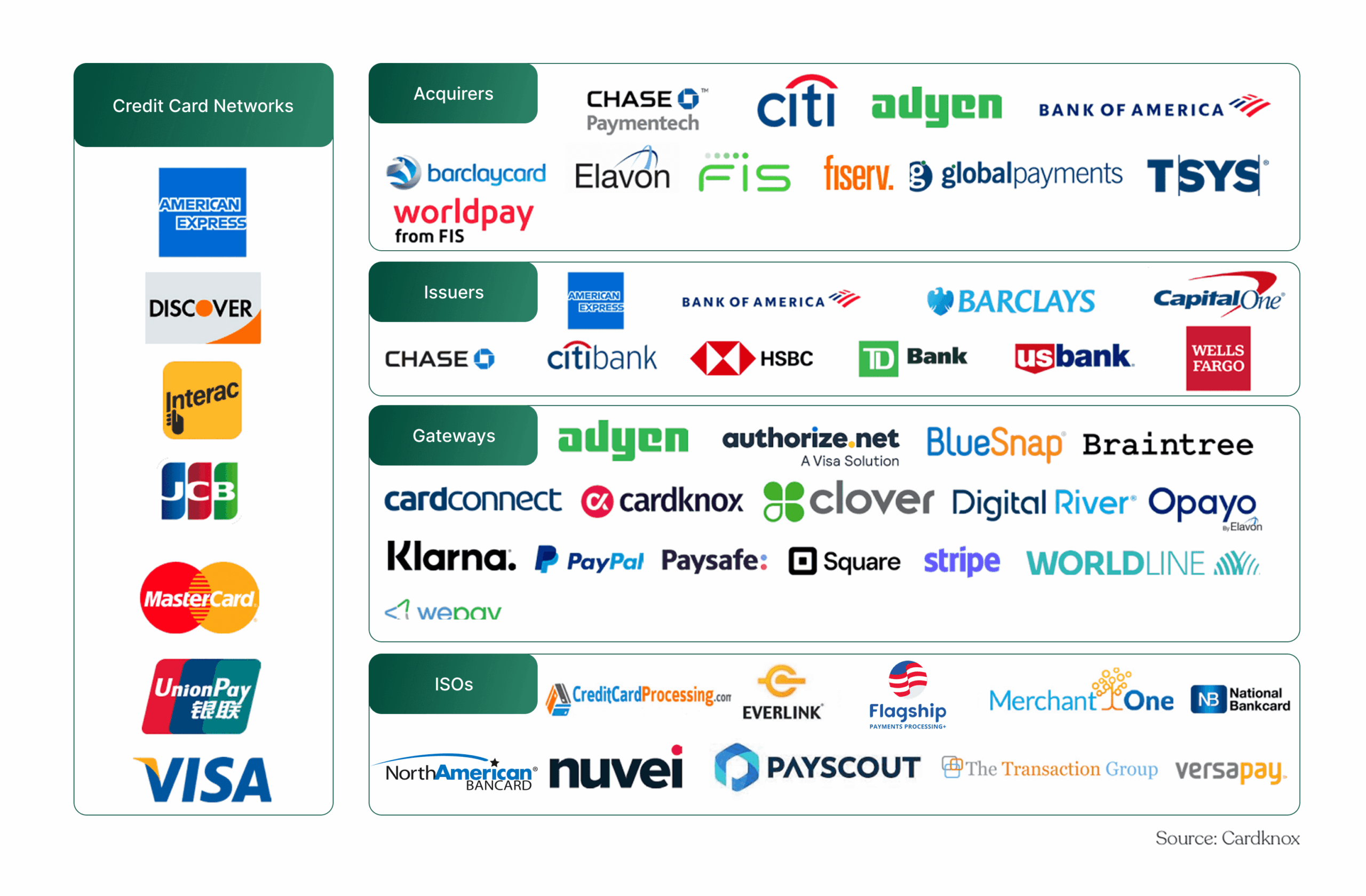

Key actors in the payment value chain

The payment ecosystem for online merchants and acquirers consists of several key players which ensure the whole workflow works as planned. Let’s check out the roles and responsibilities of each actor.

1. Merchants

Merchants represent any companies that allow users to buy products and services via credit/debit cards. Their top priorities are maximising approval rates, shrinking scheme fees, and turning payment data into revenue insights.

With Boxopay’s payment gateway you can deploy a fully‑featured in‑house PSP on your own cloud or an on‑prem cluster with:

- Direct acquiring integrations. Choose the acquiring partners and blended fees that suit your volumes instead of accepting a gateway’s default set‑up.

- Vendor‑free routing & cascading. Move from an expensive orchestrator to zero per‑transaction gateway mark‑ups.

- Platform‑as‑a‑service upside. Expose your new rails to subsidiary brands, marketplace sellers, and other merchants to earn a PSP margin of your own.

- Flexible hosting. Run the gateway on your infrastructure for maximum control or let Boxopay host it in our PCI‑DSS Level 1 cloud.

- Specialized merchant features: omnichannel payments, cross-border transactions, merchant portal with detailed analytics, and many others.

You’ll get all these features and many others to fully cover merchant needs and expectations.

2. PSP (payment gateways)

Payment gateway APIs are the technical layer that collects payment data and transfers it to a relevant endpoint. Depending on their capabilities, PSPs may be divided into two segments.

| PSP segment | Core focus | How Boxopay helps |

|---|---|---|

| Merchant‑centric PSPs | Fast onboarding, vast APM catalogue, smart routing, and orchestration | Boxopay provides a white-label PSP solution that can provide custom & private connectors, A/B routing, and instant KYB pipelines. |

| Acquirer‑centric PSPs | Processing & settlement for a handful of acquiring banks. Often store merchant funds and aim to obtain their own principal status. | Boxopay’s turnkey PSP solution gives scheme‑level control, token vaults, and settlement APIs so these PSPs can evolve into full acquirers. |

Regardless of segment, every serious PSP needs advanced payment infrastructure for merchants and integration with acquirers. Boxopay’s modular stack means you can start with orchestration, add issuing, and grow into a full-stack financial service without changing gateways and vendors.

3. Acquirers

Acquirers hold scheme licenses, manage settlement risk, and now face fierce competition from cloud‑native PSPs. Boxopay’s white‑label acquirer platform provides all must-have back-office features:

- Deep financial reporting on interchange buckets, scheme assessments, and FX spreads;

- Real‑time limit & anti‑fraud engine that unifies rule‑based, AI, and network‑token signals;

- Integrated due diligence (KYB/KYC) and fast merchant onboarding workflows;

- Multi‑currency treasury and intraday payout scheduler that beats legacy batch funding.

You’ll also get powerful features like omnichannel payments, real-time analytics, A/B testing, fast onboarding, and everything else needed for a powerful merchant portal.

With Boxopay, you’ll be able to match PSP agility while keeping your processes in-house. This increases security and reduces reliance on third-party services.

4. Payment processors

A payment processor is a technology provider that securely transmits card data between merchants, acquiring banks, and card networks. Processors do a lot more than “move files.”

They keep a 24 /7 line to every card scheme, convert ISO 8583 in real time, log authorizations, and produce settlement files that match each network’s ever‑changing rulebook. Building that muscle in‑house can burn several million euros and two to three years in certification rounds before the first live transaction.

Our white‑label payment processor solution lets new entrants launch a certified processor business in months, not years. You can get both a pre-built software stack and turnkey business solutions. This includes:

- Card‑scheme gateway core: headless engine that talks Visa, Mastercard, and multiple domestic networks out of the box. ISO 8583 packets travel in simple JSON wrappers, cutting integration time.

- Processor business platform: back‑office layer with acquirer‑friendly reports, merchant and terminal management, automated settlement & batch tools, and built‑in Interchange Rate Designator (IRD) resolver for Mastercard files.

- End‑to‑end option: Boxopay guides you through VisaNet and Mastercard MSP certification, builds PCI DSS L1 infrastructure, and hands over a processor ready to serve its first acquirer.

- On‑prem control: keep full control of tech and data by hosting the software in your own data center.

- Built‑in observability: Prometheus + Grafana dashboards stream live authorization and health metrics. CSV/PDF converters turn raw scheme files into human‑readable finance packs.

- Rapid go‑live: modern RESTful APIs, ready‑made test cases for certification labs, and dynamic mandate handling mean new network rule updates deploy with zero downtime.

That’s only part of the features included in Boxopay’s white-label solution. You’ll be sure to get everything required to support your business on a single platform.

5. Payment networks

Payment networks are solutions like Visa, Mastercard, American Express, UnionPay, and dozens of domestic schemes. They act as the rail system that carries every card transaction between the acquiring and issuing banks. Payment networks set operating rules, define interchange fees, enforce security mandates, and certify every participant before a single live transaction can run.

Connecting to these networks directly is costly and time-consuming – even indirect access requires ongoing scheme audits, mandate upgrades, and fee-table maintenance. Boxopay’s card scheme gateway can help you cut these costs and connect directly with multiple networks:

- Headless core: deploy a lightweight gateway without UI dependencies, enabling flexible integration and horizontal scaling.

- Multi-scheme connectivity: direct links to Visa, Mastercard, and UnionPay networks eliminate intermediaries and reduce go-live time.

- API-first design: a unified REST API with plain JSON payloads supports both e-commerce and POS acquiring workflows.

- Detailed reporting: produce human- and machine-readable reports for authorizations, settlements, and compliance audits out of the box.

6. Issuers

Issuing banks provide customers with credit/debit cards that are used for payments. Building an issuing stack means constantly working with BIN sponsorships, PCI-DSS audits, and mobile development. And that’s all before the first card even ships.

Boxopay’s white-label issuer & BaaS platform removes that friction, giving licensed institutions a turnkey path from licence to live transactions in a matter of weeks. You’ll get:

- API‑first card factory: issue virtual, physical, and token‑only prepaid and debit cards via a unified REST/JSON interface. Apple Pay, Google Pay, and network‑token rails are included out of the box.

- Multi‑tenant fintech management: onboard multiple brands and fintech partners under one licence. Set custom pricing, limits, and AML rules per tenant from a single back‑office.

- Headless or ready‑made: build your own apps on the API or go live instantly with Boxopay’s white‑label neobank suite (web + mobile) and start earning interchange.

- On‑prem or cloud independence: host the software in your own data centre to keep full control of data, or let Boxopay maintain a PCI DSS L1‑certified cloud with bi‑monthly updates while you focus on growth.

- Compliance & certification built in: PSD2, 3‑D Secure 2.0, GDPR, and Visa/Mastercard program-fee engines are all pre‑configured. Our team guides you through every audit.

Looking for the right solution for your business?

Talk to Boxopay’s experts to see how we can help

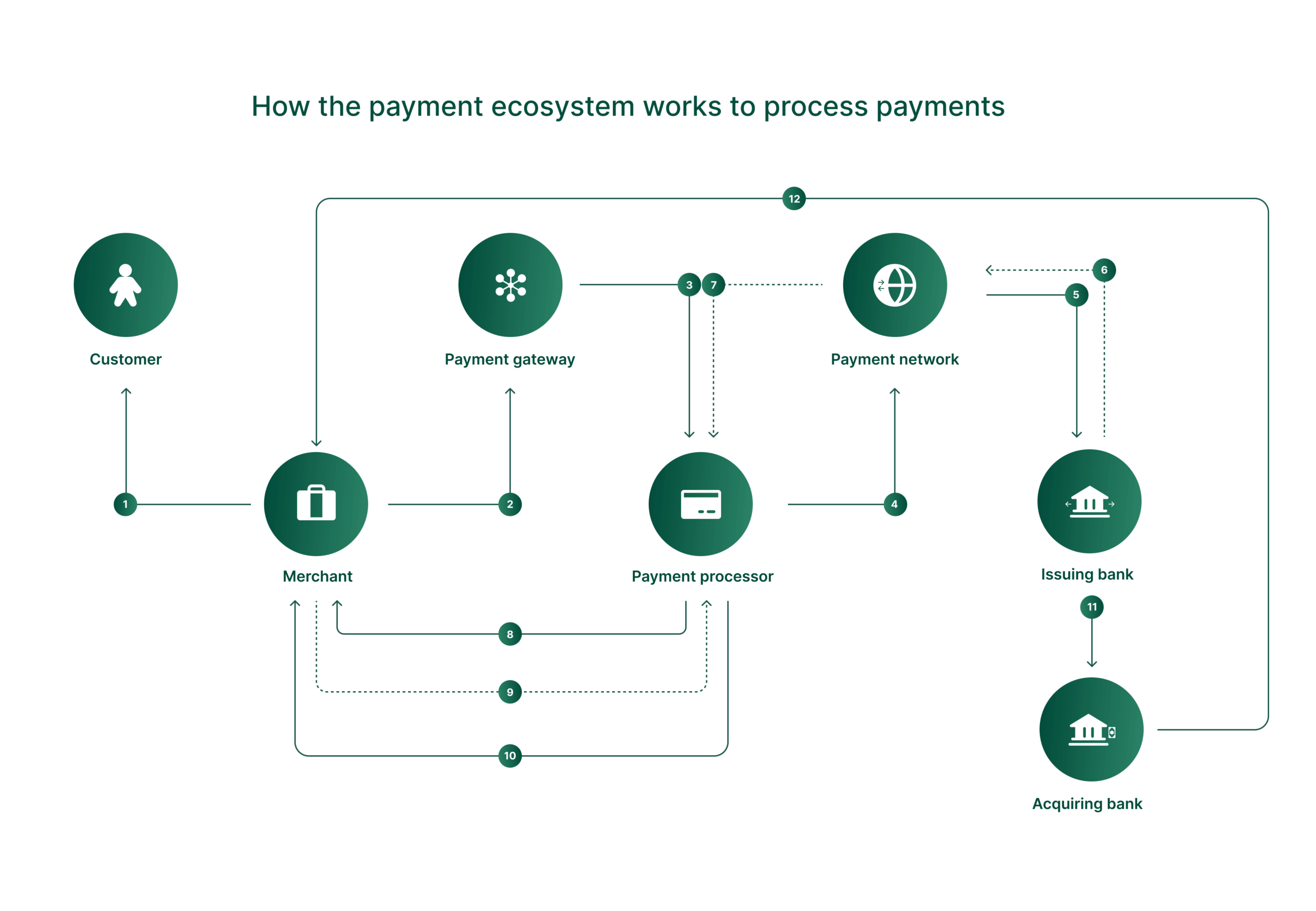

How does the payment ecosystem work

Most consumers expect payments to be instant, invisible, and omnichannel. Meeting that benchmark means stitching together various components of merchant payment systems: merchants, PSPs, acquirers, payment processors, and issuers. They are supposed to work together across various stages of the payment flow.

Let’s take a look at the key steps within the payment flow.

| Step | Key Actor(s) | What Happens |

|---|---|---|

| 1 | Customer | A shopper initiates a purchase, choosing to pay with a credit card, debit card, or digital wallet. |

| 2 | Customer → Merchant → PSP | The buyer presents their payment method at checkout. The merchant captures the card or wallet details and hands them off to the payment service provider (PSP). |

| 3 | Payment Gateway / PSP | Acting as a secure conduit, the gateway transmits the encrypted payment data to the designated payment processor. |

| 4 | Payment Processor | The processor screens for fraud, enforces 3-D Secure when required, and routes the request to the correct card network (Visa, Mastercard, etc.). |

| 5 | Payment Network | The card network receives the packet and forwards it to the cardholder’s issuing bank for authorization. |

| 6 | Issuing Bank | The issuer validates the account, checks available balance, and decides to approve or decline the transaction. |

| 7 | Payment Network | The network relays the bank’s verdict—approved or declined—back to the payment processor. |

| 8 | Payment Processor → Merchant | The processor delivers the decision to the merchant (directly or via the PSP), completing the authorisation cycle. |

| 9 | Merchant | If approved, the merchant fulfils the order and tags the transaction for end-of-day settlement. |

| 10 | Merchant → Processor → Network | At the daily cut-off, the merchant submits its batch of approved transactions. The processor channels each charge through the network to the respective issuers for clearing. |

| 11 | Issuing Bank → Acquiring Bank → Merchant | Issuers transfer settled funds to the acquiring bank, which credits the merchant’s account—minus interchange and processing fees—within one to three business days. |

Components of the Merchant Infrastructure

Merchant and consumer touchpoints

This is where buyers first get in touch with any brand: web checkouts, mobile apps, self-service kiosks, etc. At this stage, the goal is to remove friction and provide payment methods trusted by each customer. Loyalty, cashback, and other promotions are included as well.

Boxopay ships a payment-linked loyalty program that lets acquirers and PSPs embed points, tiers, and card‑linked offers into any merchant’s checkout or wallet. This significantly boosts retention without extra effort. It can be easily integrated into the merchant payment ecosystem for your convenience.

Acceptance and routing

Acceptance represents the payment methods accepted by the merchant. These may include Visa/Mastercard, Apple Pay, Google Pay, and all other methods. The more methods a business accepts, the easier it is for customers to buy.

Routing is the process behind the scenes after the customer clicks the “Buy” button. The payment information has to travel through different networks to reach the right bank for approval. Choosing the fastest, cheapest, and most reliable path is called routing. Good routing means the payment gets approved quickly and costs the merchant less in fees.

Merchants need a smart-routing layer to monitor:

- Issuer location;

- Transaction amount;

- 3-D Secure status;

- Real-time provider uptime.

Boxopay’s payment orchestration platform provides an on-premise SaaS gateway that gives you full control over connectors, rules, chargebacks, and more. You’ll get everything needed without experiencing a vendor lock-in – and with reduced fees.

Acquiring and Processing

Acquiring is the banking layer of card payments. Your typical acquirer:

- Opens and maintains the merchant account;

- Shoulders KYC/AML and chargeback risk;

- Connects to Visa/Mastercard and domestic networks;

- Deposits cleared funds into the merchant’s bank.

Merchants often contract a single acquirer, but scaling businesses may seek their own license to cut third-party markups, control risk rules end-to-end, and negotiate direct scheme fees.

Processing is the tech engine that moves the data. A payment processor:

- Receives checkout information in real time;

- Formats and encrypts it to card-scheme standards;

- Runs fraud and 3-D Secure checks;

- Routes authorizations to the right issuer;

- Batches approved transactions for settlement;

- Produces reconciliation reports.

Unlike the acquirer, the processor never touches the merchant’s money. It just ensures every bit and byte reaches its destination quickly and compliantly. Boxopay’s white-label payment processing can help you get control of these processes if you intend to become an acquirer yourself.

Back-office & merchant portal

After a transaction settles, someone still has to reconcile scheme files, calculate residuals, manage chargebacks, and feed ERP systems. Delays and data gaps here trigger payout disputes and serious regulatory headaches. That’s not something we want.

A merchant portal centralizes all post-payment tasks into one secure dashboard, allowing merchants to get the following benefits:

- Real-time transaction dashboard: filter and search authorizations, captures, refunds and reversals with live status updates;

- Automated reconciliation: import scheme files (Visa, Mastercard, UnionPay) and compare captures to settlements with one-click CSV/JSON exports;

- Dispute & chargeback management: review chargebacks, upload evidence, and track each case through a unified workflow;

- Settlement reporting & ERP integration: generate scheduled or on-demand reports and push them into your ERP, accounting, and BI systems;

- User & permission controls: create sub-accounts, assign strict access rights, and audit every action with a full activity log.

Loyalty tools

Loyalty tools integrate rewards and engagement features directly into the payment flow, helping merchants build stronger customer relationships. This includes multiple features:

- Points and tiers: allow customers to earn and unlock rewards based on spending patterns and frequency;

- Card-linked offers: trigger cashback and discounts automatically when customers use enrolled payment methods;

- Omnichannel engagement: sync rewards across web, mobile, and in-store channels for seamless loyalty experiences.

The payment processing cycle

When a shopper clicks “Pay”, a whole lot of encrypted messages flies through at least four institutions before funds finally reach the merchant. This whole process can be generally divided into two sections:

- Authorization – the real-time check that confirms the cardholder has sufficient funds (and isn’t flagged for fraud), placing a temporary hold on the purchase amount;

- Settlement – the batch process (usually end-of-day) that captures those held funds and moves the money from the issuing bank into the merchant’s account.

Let’s take a closer look at both options below.

Authorization process

When a customer starts a payment, this launches the following process:

| Step | What happens |

|---|---|

| 1. Customer → store | Shopper submits an order online or taps to pay in‑app. |

| 2. Store → PSP | Checkout hands the encrypted payload to the gateway. |

| 3. PSP → acquirer/card network | Orchestrator forwards to the optimal acquiring endpoint via Visa/Mastercard rails. |

| 4. Issuer ↔ network ↔ acquirer | Issuer approves or declines; the response cascades back through the network. |

| 5. Acquirer → merchant | Funds move (except for interchange and fees) into the merchant account. |

Settlement process

If authorization gives the green light, settlement moves the cash. The whole flow may cover 2-3 banking days and includes the following steps:

| Step | What happens |

|---|---|

| 1. Merchant → Processor → Acquirer | At day‑end (or per transaction for e‑commerce) the merchant “closes out” sales and the payment processor packages each auth‑ID, amount, and currency and forwards them to the acquiring bank. |

| 2. Acquirer → Card Network → Issuer | The acquiring bank routes the batch to Visa/Mastercard (or a domestic scheme), which in turn sends every approved transaction to the correct issuing bank. |

| 3. Issuer → Acquirer | The issuing bank releases funds for each transaction into the acquirer’s settlement account. |

| 4. Acquirer → Merchant Bank | The acquirer credits the merchant for the gross amount, considering the merchant‑discount rate (MDR) and any acquirer markup. |

| 5. Issuer → Cardholder | The issuing bank places the charge on the cardholder’s statement and bills it in the next cycle. |

Partner with Boxopay to support your business on any level

Boxopay’s solutions can support all actors in the payment ecosystem: merchants, PSPs, acquirers, payment processors, payment networks, and issuers. You’ll get a scalable infrastructure with detailed reporting and expert guidance for your business.

Here are some of the solutions provided by Boxopay’s team:

- Payment gateway software;

- Card issuing / BaaS platform;

- White-label merchant app;

- End-to-end processor software;

- Card scheme gateway;

- Loyalty program platform;

- KYC onboarding software;

- Custom fintech development;

- Business success services, and others.

Contact us today to learn more about our offer and see how we can help your business grow!